- EUR/GBP is off its best levels and back below the 0.9200 level again, though still trading with significant gains on the day.

- The German Foreign Minister hinted that Brexit talks could continue past the Sunday deadline, but hopes for a deal remain low.

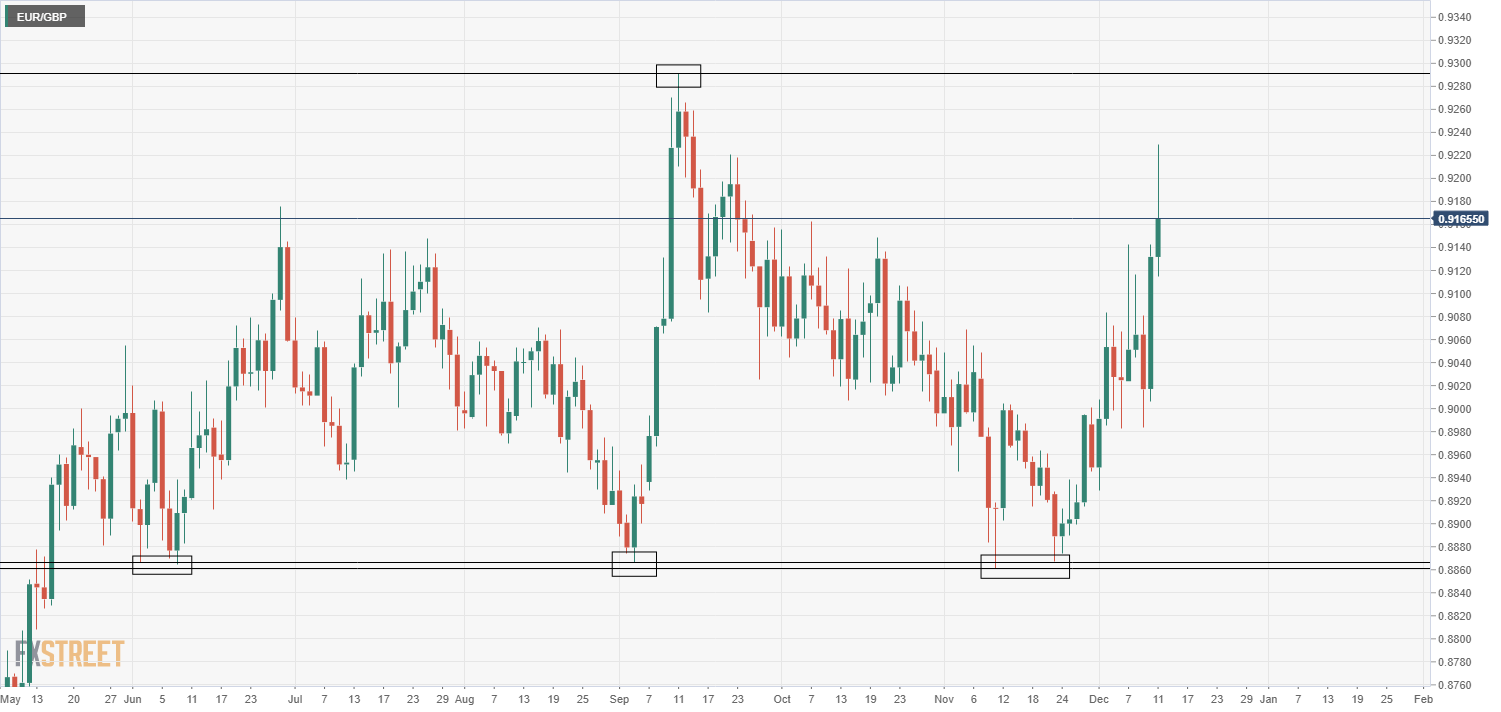

Prior to the start of US trading hours on Friday, EUR/GBP rallied as high as the 0.9230s amid an increasingly pessimistic mood regarding the state of Brexit negotiations and the chances that a deal can be reached and ratified prior to the end of the year when the UK’s transition period to exit the EU single market comes to an end. Over the past few hours, in a move that seems to have primarily been driven by profit-taking, the pair has dropped back from highs and beneath the 0.9200 level again and currently trades in the 0.9160s. Still, on the day the pair is up some 40 pips or 0.4%.

Talks to continue past Sunday?

Earlier in the week, UK PM Boris Johnson and EU Commission President von der Leyen agreed to continue negotiations until Sunday, when a firm decision would be made about the future of talks. Amid the increasingly pessimistic mood regarding the two sides' abilities to bridge gaps on the issues of level playing field, state aid and fisheries, markets initially seemed to take this deadline as “make or break” for talks. Indeed, the way Johnson and von der Leyen put it, either the two sides would have needed to have made significant progress towards a deal in order to justify a continuation of talks or talks would effectively end, with efforts instead being aimed at preparing for trading on WTO terms from 1 January.

But German Foreign Minister Heiko Mass was out with some comments earlier on in the day where he hinted that talks could continue past Sunday; “discussions on Brexit will not fail due to the fact that we might need a few days more beyond Sunday”, said Mass. How many previous EU/UK negotiating deadlines have been ignored? If this is the EU’s way of teaing the public up for further kicking of the can down the road, then this should hardly come as a surprise.

Brexit will continue to be the main factor driving the EUR/GBP cross, and next Monday’s Asia session open, which will follow the alleged next Brexit deadline on Sunday should be interesting; if the can is kicked down the road, as now seems likely given what the German Foreign Minister Mass said, then the GBP reaction will likely be muted, albeit a negative bias will likely be in play given the clock continues to tick down towards the 31 December deadline for a deal.

If the UK and EU decide to suspend talks, then EUR/GBP could see a sizeable gap to the upside. Conversely, in the seemingly at this point unlikely event that major progress towards a deal is made, then EUR/GBP might see an even more sizeable gap to the downside, given how markets seem at this point to be pricing a higher probability of a no-deal than a deal.

EUR/GBP could go either way

In the event that major progress towards a deal is made by Sunday, EUR/GBP is likely to see an extensive move to the downside, perhaps even as low as the September and November lows in the 0.8860s. Conversely, if talks do collapse, then a move towards September highs just ahead of the 0.9300 level are likely.

EUR/GBP daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.