EUR/GBP back over 0.8720 as Euro gains against Pound Sterling on Wednesday

- The EUR/GBP is seeing a topside push into recent highs as the Pound Sterling swoons against the Euro.

- Mixed data for both the EU and the UK leave markets forced to pick a winner.

- Up Next: ECB rate call, Monetary Policy Statement in the pipe for Thursday.

The EUR/GBP is testing back into near-term highs above the 0.8700 handle, with the Euro (EUR) tipping into an intraday peak against the Pound Sterling (GBP) above 0.8725 rounding the corner into the Thursday market session.

The Euro is recovering from a downside stall against the Pound Sterling after Tuesday's Purchasing Managers' Index (PMI) figures for both the EU and the UK left much to be desired, but the Euro is catching some bids to recover ground heading into Thursday's European Central Bank (ECB) Monetary Policy Statement and rate call.

ECB Preview: Forecasts from 11 major banks, good moment to pause

The ECB is broadly expected to hold its main refinancing operations rate at 4.5%, and investors will be looking to the following ECB press conference for any hints about the ECB's path forward on their rate cycle outlook.

The ECB is caught between a rock and a hard place, as inflationary pressures remain elevated despite drastic and rapid rate changes from the central bank, but further rate hikes risk sending a cold shot through the European economy, which is already facing cracks around the seams and faltering growth indicators.

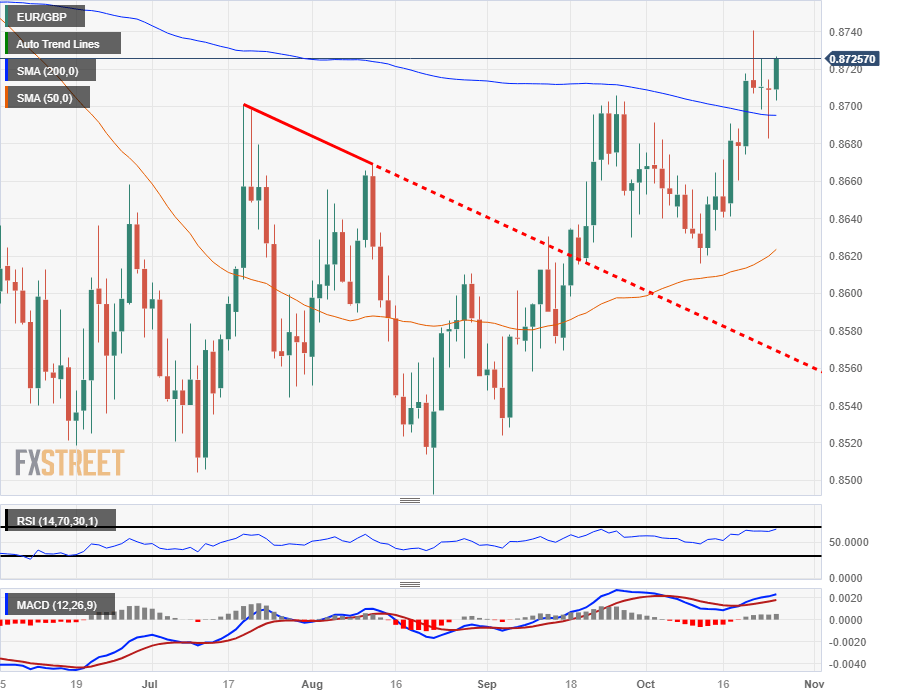

EUR/GBP Technical Outlook

the EUR/GBP's rebound on Wednesday sees the pair pushing further north from the 200-day Simple Moving Average (SMA) currently testing down below 0.8700, and a break above last week's top at 0.8740 will see the EUR/GBP etching in new five-month lows.

On the down side, the EUR/GBP has a floor built in from the last swing low near 0.8620, where there's a confluence of technical support from the 50-day SMA near the same level but tilted bullish.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.