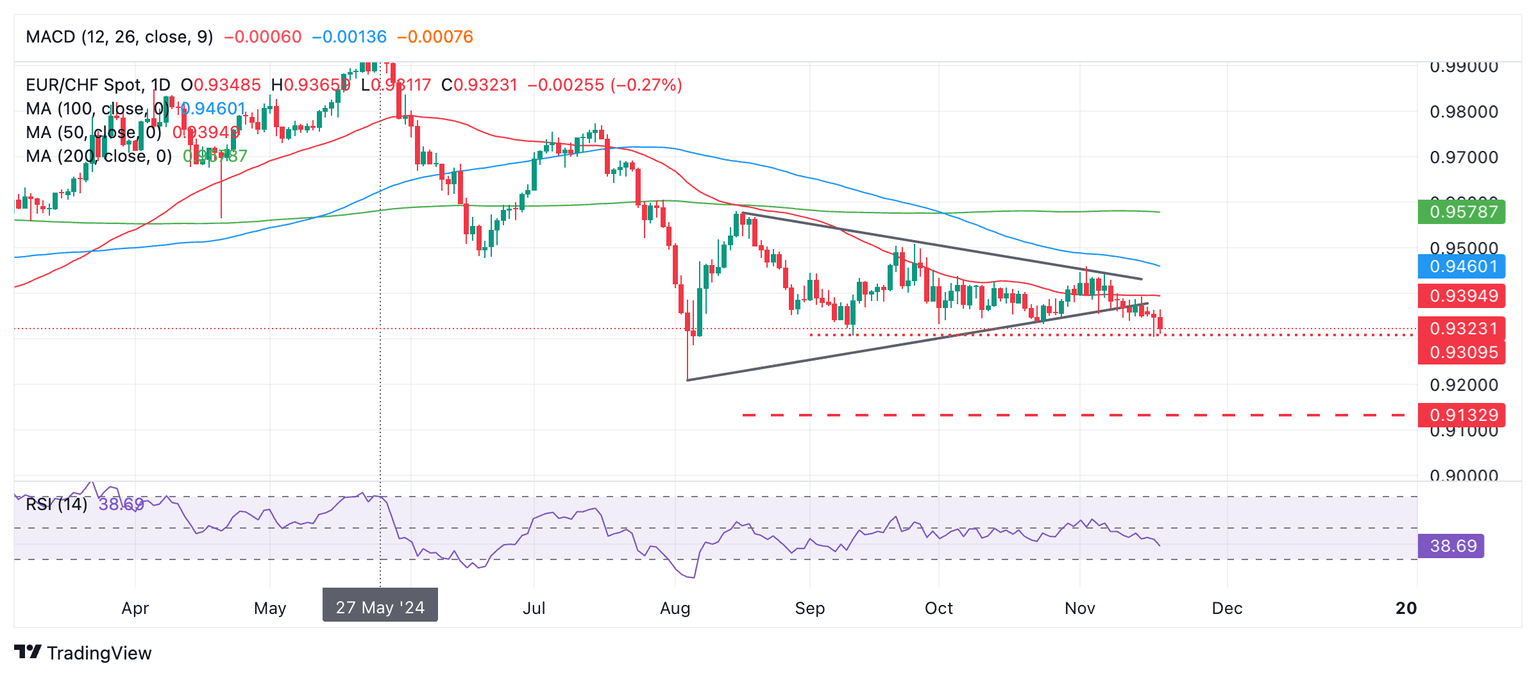

EUR/CHF Price Prediction: Downside breakout from Triangle confirmed

- EUR/CHF confirms its downside breakout from a Triangle pattern.

- It is likely to continue lower, especially given the bearish market action prior to the Triangle’s formation.

EUR/CHF cements its bearish breakout from a Triangle pattern and declines.

It has now fallen below the confirmation level for the pattern at 0.9339, the November 13 low, and will thus probably confirm more weakness down to the next downside target at 0.9132, the 61.8% Fibonacci extrapolation of the height of the Triangle lower.

EUR/CHF Daily Chart

EUR/CHF has found support at the 0.9307 September 11 lows (red dotted line). A break below the low of Tuesday at 0.9304 would confirm more downside to the aforementioned target (red dashed line).

The bearish trend prior to the formation of the Triangle (Since May 27) further tips the odds in favor of a downside evolution.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.