EUR/CHF Price Forecast: Triangle pattern completing, breakout to follow

- EUR/CHF has formed a Triangle pattern which looks poised to breakout

- A downside break is marginally more probable given the longer-term trend is bearish.

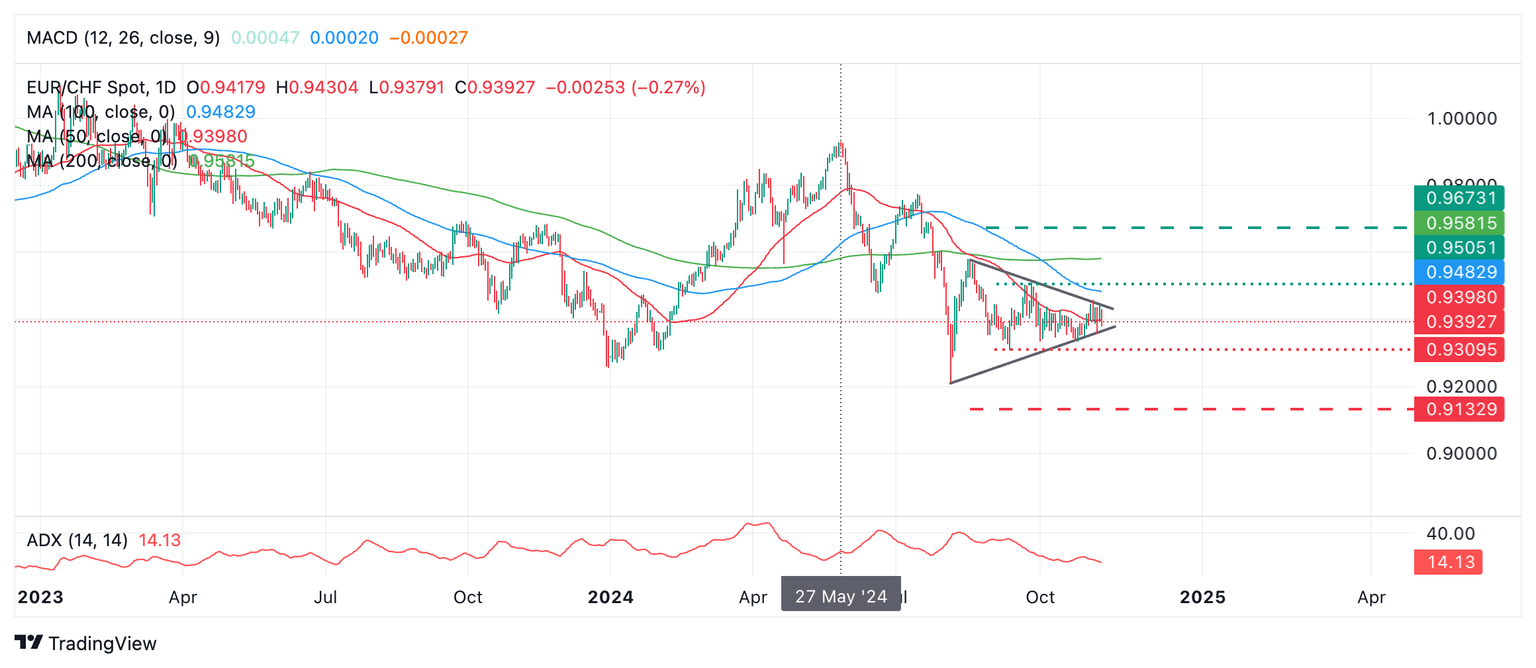

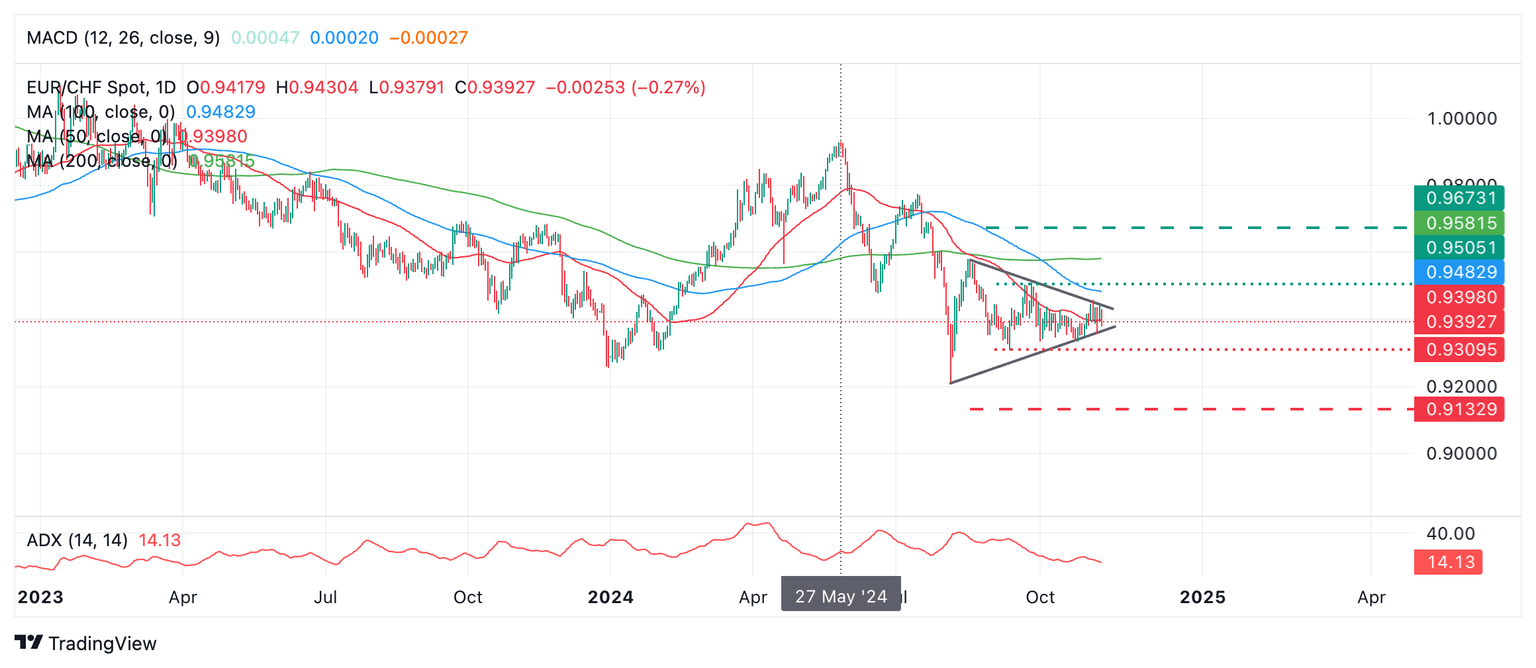

EUR/CHF has formed a Triangle pattern over the last three months which looks like it is on the verge of completing as it tapers to a tip at around 0.9400. A breakout should soon follow.

EUR/CHF Daily Chart

Since the market activity prior to the formation of the Triangle (Since May 27) was bearish and the longer-term trend is probably also down, the odds slightly favor a downside breakout.

If EUR/CHF pierces below the lower boundary line of the Triangle and falls below the 0.9307 level (September 11 lows) it will probably confirm an authentic breakout. The next target to the downside would lie at 0.9132, the 61.8% Fibonacci extrapolation of the height of the Triangle lower.

An upside breakout – though less likely – is possible. A move above the 0.9508 high of September 25 would probably confirm a bullish breakout and extend to the 0.9581 Fibonacci 61.8% target for the Triangle higher.

The Average Directional Index (ADX) measures how strong the price is trending. At 14.13 it is currently relatively low, suggesting it will soon start rising again as price begins its next directional phase of development.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.