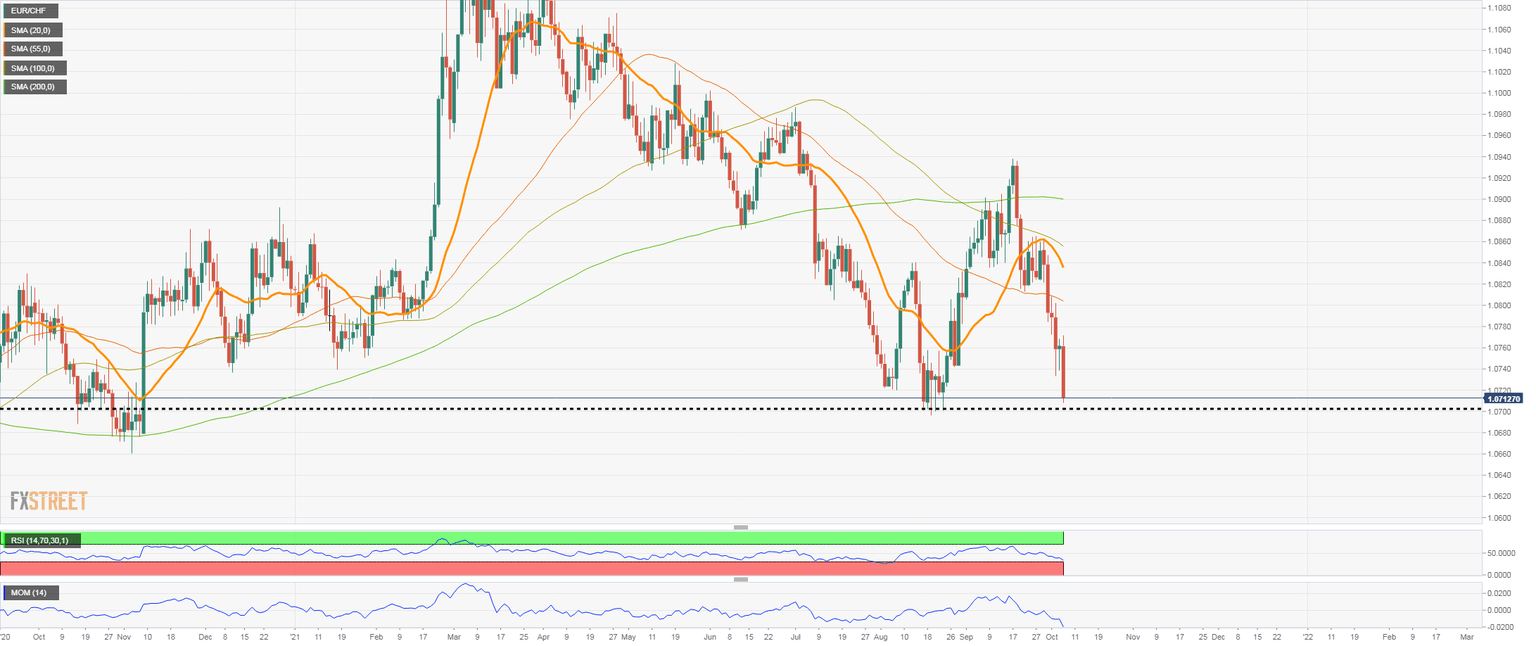

EUR/CHF extends slide and challenges the critical 1.0700 area

- Risk aversion, soaring energy prices across Europe and supply bottlenecks weighs on EUR/CHF.

- Swiss franc among top performers on Wednesday.

- Break under 1.0700 in EUR/CHF targets 1.0660 initially.

After a pause on Tuesday, EUR/CHF resumed the decline and fell to 1.0706, hitting the lowest intraday level in a month. The euro has been unable to move off lows, and continues to look at the 1.0700 area, a critical support.

A break and a confirmation under 1.0700 should clear the way to more losses for EUR/CHF with an initial target at 1.0660. If the euro manages to remain above 1.0700 it could start setting up a rebound.

The European energy crisis and the global risk aversion wave boosted the Swiss franc that together with the yen and the US dollar are among the top performers on Wednesday. European stock indices finish in red with losses on average of 1.25%, off lows. Comments from Russian President Puttin about gas supply eased the pressure on gas prices. An improvement in market sentiment could help EUR/CHF remain above 1.0700.

Analysts at Commerzbank hold a negative perspective on EUR/CHF. “We look for losses to the mid-October low at 1.0700/1.0689. Further down sits the 1.0629 November low and there is also the 78.6% retracement at 1.0643. We look for the market to hold in this vicinity.”

EUR/CHF daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.