EUR/CHF climbs over 0.9500 as the Euro catches a much-needed relief bid against the Swiss Franc

- The Euro sees a bid against the Swiss Franc for Monday.

- EU Consumer Confidence improved in October, PMI figures still ahead.

- The late week sees another ECB rate statement.

The EUR/CHF climbed 0.6% on Monday, with the Euro (EUR) finding some market bids against the Swiss Franc (CHF) following a better-than-expected Consumer Confidence reading to kick off the trading week, though investors will be keeping an eye out for upcoming EU Purchasing Manager Index (PMI) data on Tuesday followed by Wednesday's European Central Bank (ECB) rate call and ensuing press conference.

The European Consumer Confidence survey for October beat market expectations to print at -17.9, better than the expected -18.3 but still a minor downtick from August's -17.8.

Tuesday sees the EU-wide PMI figures for October, with the composite component expected to improve slightly from 47.2 to 47.4. Traders will also want to keep an eye out for a speech from ECB President Christine Lagarde, who is due to give a speech Wednesday while attending a functionary dinner at the central bank of Greece.

Thursday's late-week showing for the ECB brings another rate call, where markets are broadly anticipating a hold on the central bank's main refinancing rate at 4.5%, though dovish comments from ECB officials of late could certainly cause some froth in market reactions on release.

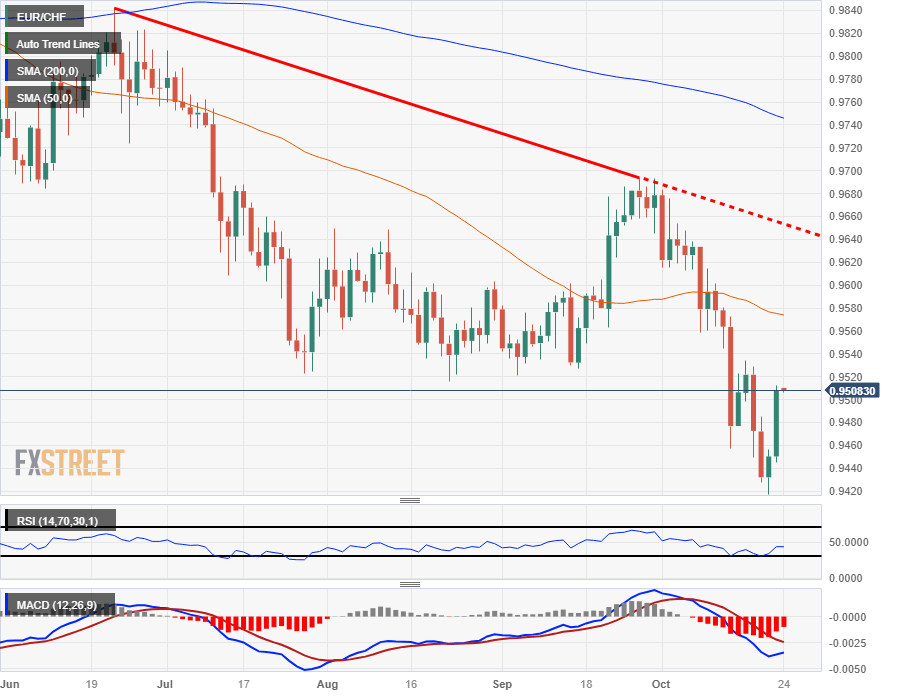

EUR/CHF Technical Outlook

Despite Monday's rebound, The Euro remains firmly lower against the Franc, with last week's bottom at 0.9417 setting a fresh twelve-month low for the pair and marking in a near low-water mark for 2023.

Despite reclaiming the 0.9500 handle in Monday's bid, the EUR/CHF remains buried deep in bear country, with the 50-day Simple Moving Average (SMA) well above current price action, near 0.9575, with the 200-day SMA acting as a ceiling on medium-term price movements from 0.9750.

EUR/CHF Daily Chart

EUR/CHF Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.