EUR/CAD Price Prediction: Decisively breaks out of top of pattern

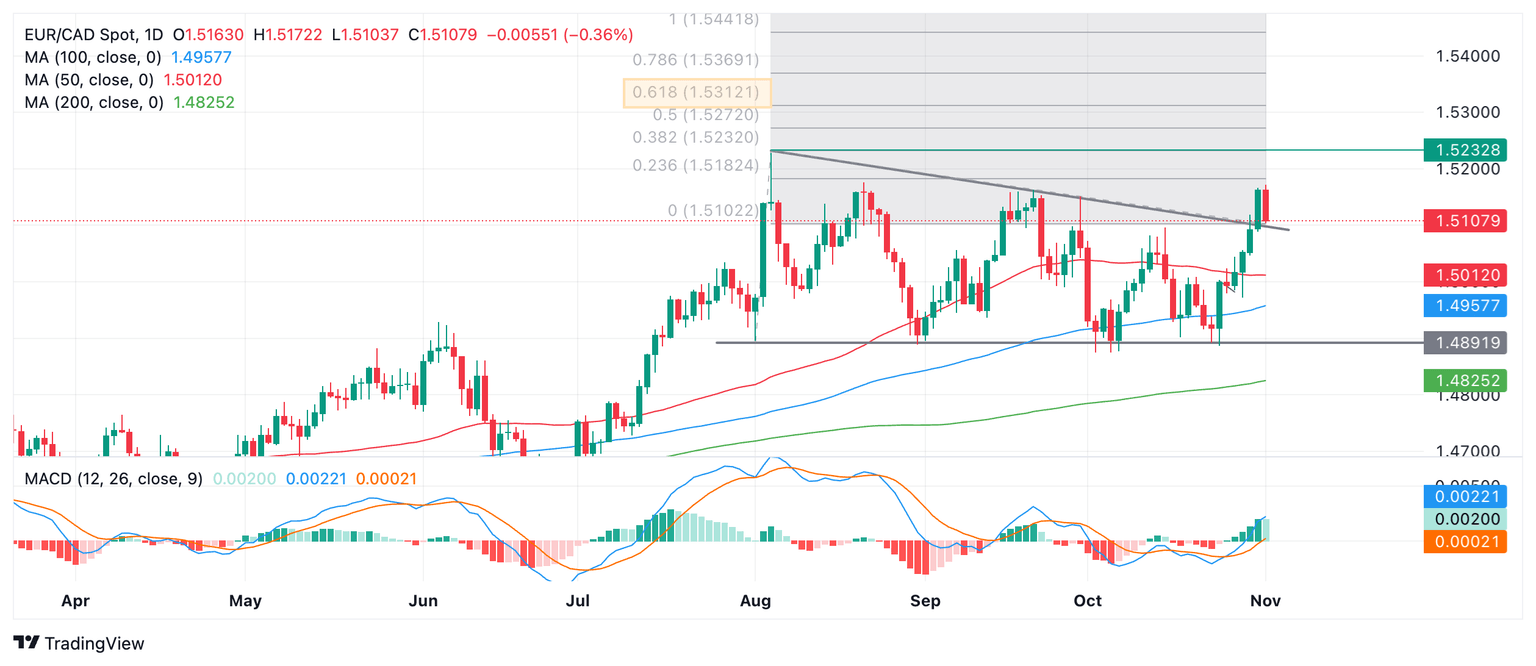

- EUR/CAD has decisively broken out of a multi-month price pattern.

- If it can follow through higher it will probably confirm the start of a strong move higher.

EUR/CAD rallies and pierces decisively above the slanting roof of the price pattern it had been trading in since the beginning of August. This is a bullish sign and if price follows through higher it could make a significant advance.

EUR/CAD Daily Chart

A break above 151.72 (November 1 high) might confirm a continuation higher, probably to an initial target at 152.28, the August 5 high, followed by 1.5312, the 61.8% Fibonnacci price projection of the height of the pattern at its widest part, from the breakout point higher.

The Moving Average Convergence Divergence (MACD) momentum indicator has risen above the zero line and is currently supportive of the bullish outlook.

A bearish close on Friday, however, would also form a two-bar reversal pattern, which occurs after a rally when a long green up day is followed by a long red down day of a similar length. This is a bearish short-term reversal pattern and could indicate a deeper correction temporarily clouds the outlook.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.