EUR/AUD weakens on combo of ECB rate cut and Aussie employment data

- EUR/AUD declines sharply on a “combo” of the ECB deciding to cut interest rates and robust Australian employment data.

- The Euro weakened after the ECB decided to salami slice another 0.25% off its policy rates due to disinflation and weaker activity.

- The Australian Dollar was bolstered by employment data showing 64.1K people joined the workforce in September.

EUR/AUD falls by almost three-quarters of a percent to the 1.6180s on Thursday after a combination of stronger-than-expected Australian labor market data boosted the Australian Dollar (AUD) whilst the Euro (EUR) depreciated ahead of the European Central Bank’s (ECB) decision to cut interest rates, and remained under pressure as the bank telegraphed a mildly negative economic outlook for the region going forward.

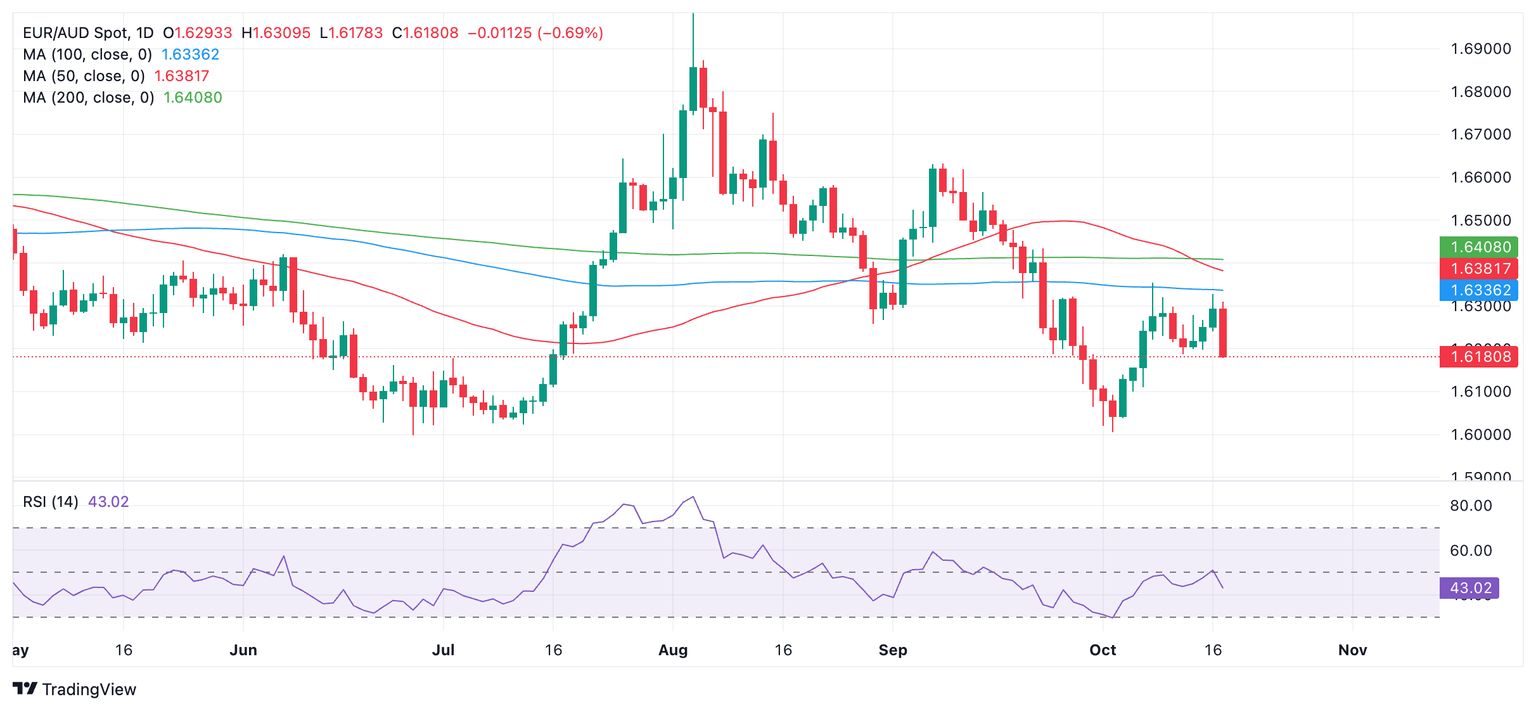

EUR/AUD Daily Chart

The Aussie Dollar strengthened on Thursday, putting downward pressure on EUR/AUD after fresh data showed that the number employed Australians rose by 64,100 in September, which was well above expectations of 25,000 and the downwardly-revised 42,600 of the previous month. Of these, full-time employees made up the majority with 51,600, whilst the remaining 12,500 were employed part-time, acording to data from Australian Bureau of Statistics.

The Unemployment Rate, which had been expected to creep higher to 4.2%, actually remained the same as in August at 4.1%.

The data overall painted a picture of a robust labor market and reduced the chances that the Reserve Bank of Australia (RBA) will have to cut interest rates in the coming months, since high levels of employment are associated with higher levels of spending and inflation. This, in turn, supports AUD since relatively higher interest rates strengthen a currency by attracting more foreign capital inflows.

EUR/AUD declined further in the run up to the ECB meeting policy decision as investors expected the ECB Governing Council to take a dovish line (in favor of lower interest rates) due to recent data showing a marked slowdown of economic activity in the Eurozone.

Further, the second estimate of Eurozone Harmonized Index of Consumer Prices (HICP) released just before the ECB meeting revealed a downward revision in the headline HICP to 1.7% in September from the preliminary estimate of 1.8%, which itself was well below the 2.2% in August. The 1.7% revision plotted inflation well below the ECB’s 2.0% target.

The ECB policy statement indicated the governing council’s decision to cut the ECB’s three main interest rates, including the benchmark Deposit Facility Rate by 0.25% to 3.25% was taken because the “disinflationary process is well on track” and recent data showed “ downside surprises in indicators of economic activity.”

However, the statement gave no hint of whether the ECB was planning any further reductions in future meetings, retaining a “data-dependent and meeting-by-meeting” approach to monetary policy.

In her press conference after the decision, ECB President Christine Lagarde said that “Incoming data suggest that activity is weaker than expected," and pointed to “slowing employment growth.” Yet, she also spoke of labor market resilience and said she expected the economy “to strengthen over time.”

Lagarde further added that the decision to cut rates had been “unanimous” and added “all information since the September meeting was heading lower."

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.