EUR/AUD Price Forecast: Stalls below 1.6500 amid EU political turmoil

- EUR/AUD remains flat, with the formation of a 'doji' indicating indecision among traders in the face of Eurozone political challenges.

- RSI suggests a neutral stance, hinting at potential sideways movement in the near term.

- Key resistance and support levels to watch include 1.6574 and 1.6450 respectively, with further downside possibly testing SMA levels at 1.6375 and 1.6359.

The EUR/AUD consolidates below 1.6500 for the second consecutive day and trades at 1.6499, virtually unchanged. The Eurozone is experiencing turbulent moments amid political issues in France and Germany, two of the bloc's largest economies. Although the Euro holds firm, the end of the year keeps traders from opening fresh bets against the shared currency.

EUR/AUD Price Forecast: Technical outlook

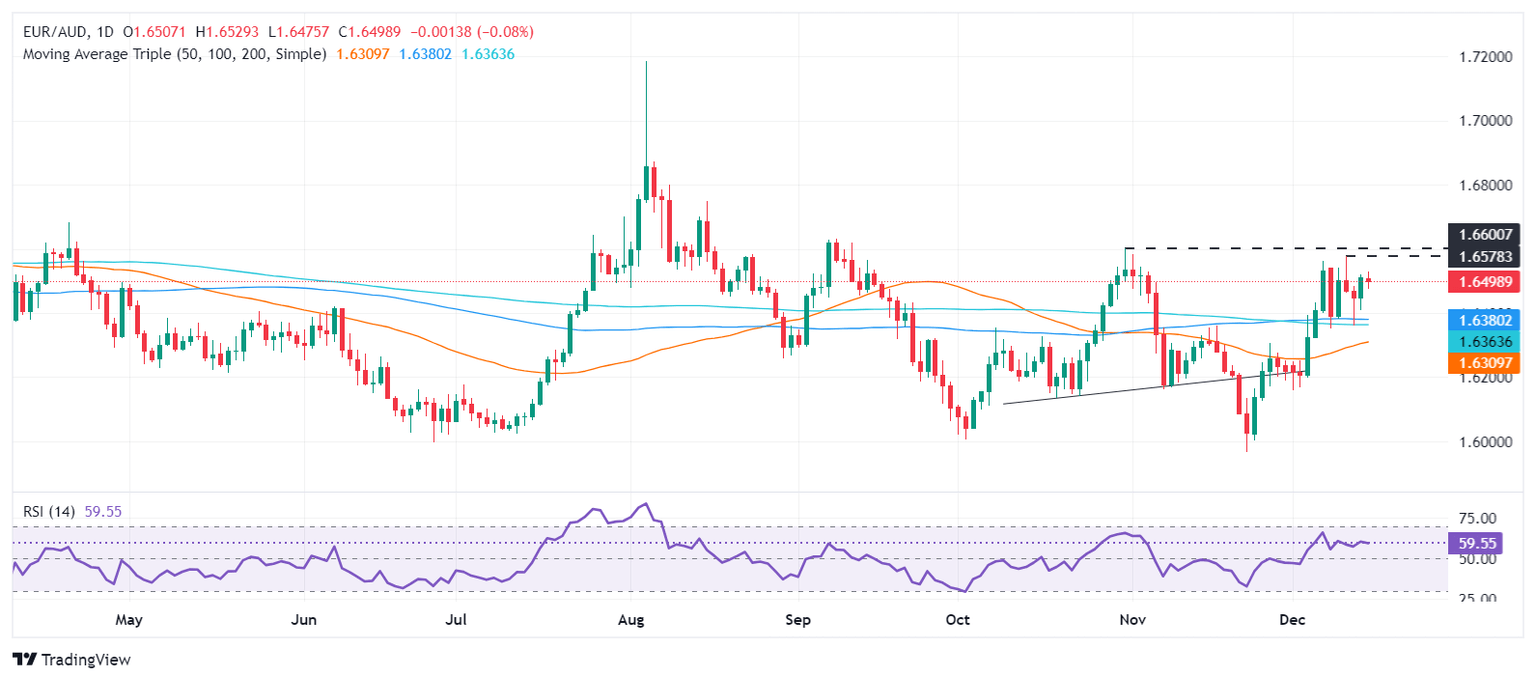

The EUR/AUD consolidates, forming a ‘doji,’ meaning neither buyers nor sellers are in control. The Relative Strength Index (RSI) is bullish, though the slope turned flat, meaning the cross would likely remain sideways.

For a bullish resumption, the EUR/AUD first resistance would be the December 11 high at 1.6574. Once surpassed, the next stop would be the 1.6600 figure. Conversely, if EUR/AUD extends its losses below 1.6450, the next support would be the 100-day Simple Moving Average (SMA) at 1.6375, followed by the 200-day SMA at 1.6359.

EUR/AUD Price Charr – Daily

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day, according to data from the Bank of International Settlements. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.