EUR/AUD drops on trade worries, Australia’s data up next

- Eurozone’s thin economic docket and German bond yield dip contribute to EUR’s decline.

- Upcoming Aussie data includes Westpac Consumer Confidence and NAB Business Confidence.

- EUR/AUD technicals suggest potential further downside with key support near 1.6100.

The Euro began the week on a lower note against the Australian Dollar, drops over 0.45% late during the North American session. A risk-off mood trade in the currency market, keept investors worried about possible tariffs by the upcoming Trump’s administration. The EUR/AUD trades at 1.6207, after reaching a daily high of 1.6284.

EUR/AUD falls as traders eye potential tariffs under Trump and await key Australian data

A scarce economic docket in the Eurozone and Australia, left traders adrift to sentiment linked to the newly elected US President Donald Trump. However, European Central Bank (ECB) members Yannis Stoumaras commented ECB rates will hit 2% goal in September of 2025.

Another reason behind the Euro’s fall was the drop of the 10-year German Bund yield, down two basis points to 2.33%.

In the meantime, the Aussie’s economic docket will feature on Tuesday the release of the Westpac Consumer Confidence for November. October’s reading was 89.8, and any measure below that level, would indicate that Australians are feeling less optimistic on the economy.

Later, the Aussie’s NAB Business Confidence for October, would be revealed. September came at -2.

On the Eurozone area, the schedule will feature German’s inflation rate, which is expected to edge up 0.4% MoM, exceeding September’s 0%. On a yearly basis, October’s inflation is expected to rise to 2%, from 1.6%.

EUR/AUD Price Forecast: Technical outlook

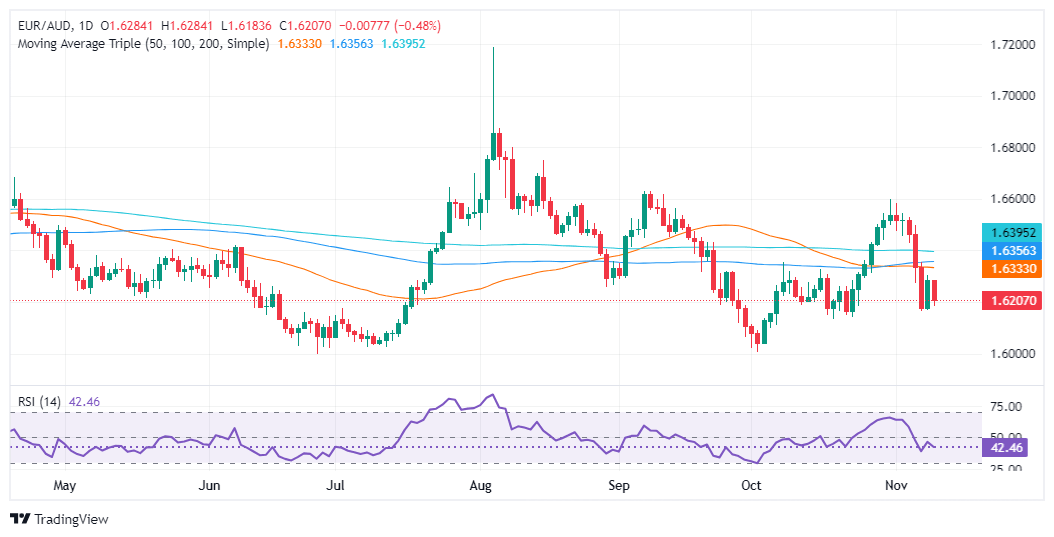

The EUR/AUD remains consolidates, as shown in the daily chart. However, it’s slightly tilted to the downside, as the exchange rate persists below the confluence of the 20, 50 and 100-day Simple Moving Averages (SMAs). This and the Relative Strengt Index (RSI) falling deeper, hints the cross could crack the 1.6200 in the short term.

In that event, the first support would be the 1.6100 psychological level, followed by major support at 1.6005, October 2 swing low. On the other hand, if buyers reclaim 1,6300, the next resistance area would be the confluence of daily SMAs at around 1.6327/1.6332.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| AUD | EUR | GBP | JPY | CAD | USD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| AUD | 0.04% | 0.04% | 0.08% | 0.07% | 0.06% | -0.00% | 0.02% | |

| EUR | -0.04% | -0.01% | 0.05% | 0.03% | 0.00% | -0.05% | -0.01% | |

| GBP | -0.04% | 0.00% | 0.08% | 0.05% | 0.03% | -0.05% | -0.00% | |

| JPY | -0.08% | -0.05% | -0.08% | -0.02% | -0.04% | -0.10% | -0.03% | |

| CAD | -0.07% | -0.03% | -0.05% | 0.02% | -0.01% | -0.08% | -0.04% | |

| USD | -0.06% | -0.01% | -0.03% | 0.04% | 0.00% | -0.06% | -0.03% | |

| NZD | 0.00% | 0.05% | 0.05% | 0.10% | 0.08% | 0.06% | 0.03% | |

| CHF | -0.02% | 0.01% | 0.00% | 0.03% | 0.04% | 0.03% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.