ETF review: December flows so far fail to keep pace with November

ETFs are experiencing a quieter December compared with November. Although we are half-way through the month, ETFs have registered flows of $90bn so far this month, this means that they are not on track to meet November’s huge inflows into global ETFs of $220bn, according to Bloomberg’s ETF Flow data. November saw the highest fund flows for the year, as the election of Donald Trump triggered a stock market rally.

US funds are still the King of ETF world

While flows could be lower in December, the regional diversification theme remains the same with the US attracting by far the largest flows. For example, so far in December, flows into US funds are $65bn, more than two thirds of the total. This compares with outflows for Europe and very low level of inflows into Asia.

The US exceptionalism story is dominating as we move into year end. US markets are the path of least resistance for investors right now, but it dashes hopes of a broadening out of the stock market rally as we move towards Q1 2025.

How long will US exceptionalism continue?

The question for investors is, will this outperformance continue? With envious growth expectations and a Fed that is expected to cut rates slowly but surely, along with strong corporate earnings, especially from the tech sector, it is clear to see why US stocks are attracting huge inflows and this is a tough tide to swim against. In Europe, the political and growth pictures are both inferior to the US. Added to this, the AI theme is continuing to drive gains into stocks. For example, Broadcom, the semiconductor company, reported soaring AI revenues of 220% YoY, and gave a strong outlook when they reported results on Monday. The company reached a market cap of $1 trillion for the first time. It’s stock price surged by 11% on Monday, although it is expected to experience a mild pullback at the open on Tuesday.

The US stock market rally narrows further

While it may seem like the rally in US stocks will continue forever, it’s worth noting two things. Firstly, most investors will have only made positive returns in US stocks if they had been invested in the US indices, compared with individual stocks. Only 100 companies have posted a positive return on the S&P 500 so far this month, led by Broadcom and Tesla. This means that 80% of S&P 500 companies have not risen so far this month, which highlights the concentration risk, with only 1 in 5 US listed companies performing well in December. Only 80 companies listed on the S&P 500 have registered a gain that is greater than 1% so far this month.

Secondly, the price of out of the money puts on the S&P 500 index is rising, which is a sign that the market is hedging their exposure to US indices, and some are expecting large declines in the future.

How far can tech rally?

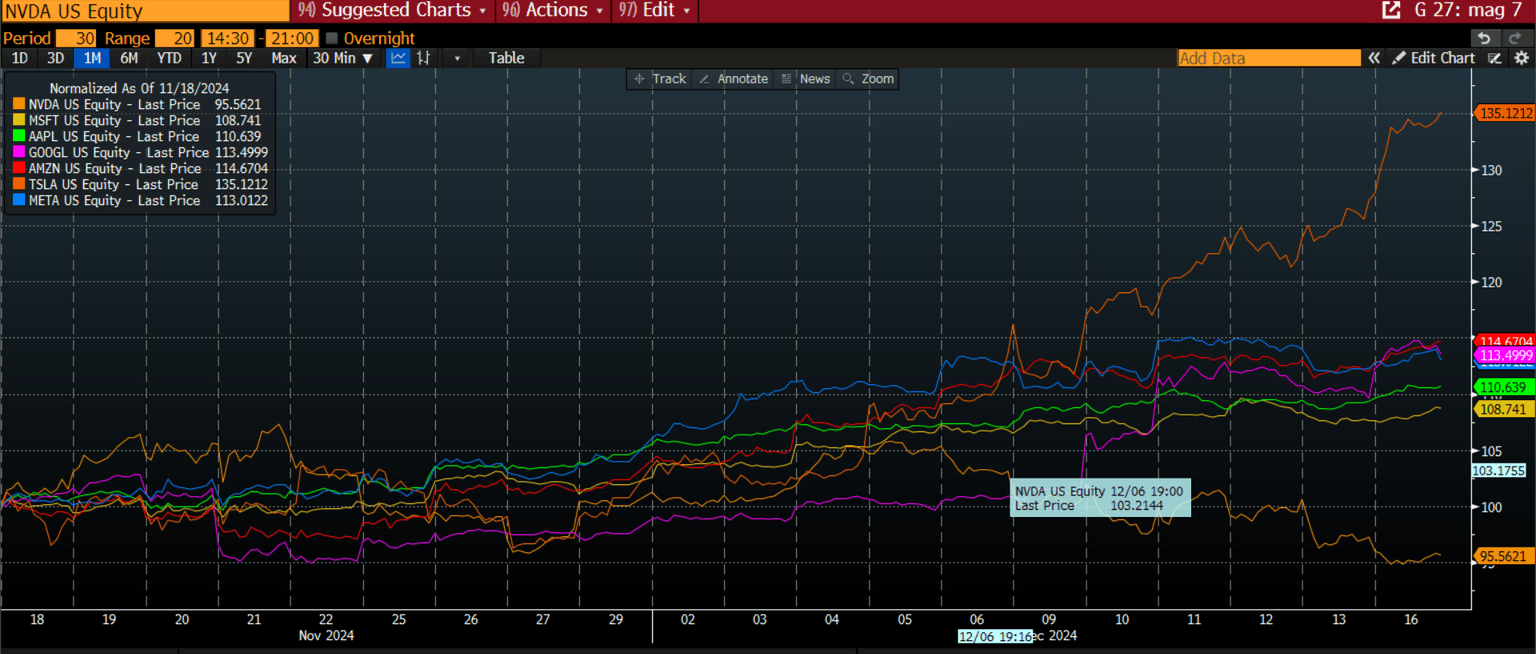

Thus, 2024 has failed to answer the question ‘how far can tech rally?’. We still don’t know. However, the tech rally is going through a change of leadership. The chart below shows the Magnificent 7. In the past month, Tesla has surged, as it continues to benefit from the autonomous driving future that President Trump is expected to fast track as well as slashing regulation for this sector, which will make launching self-driving cars easier. In contrast, Nvidia has slipped, and is the weakest performer in the Magnificent 7 in the past month, after a stunning rally of more than 166% so far this year.

Chart 1: Magnificent 7, monthly chart normalized to show how they move together.

Source: XTB and Bloomberg

As we end the year, concentration risk is increasing, and US stocks are getting harder to trade as some key names seem to defy gravity.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.