Trump’s tariffs delivered a hit on US equities markets on Monday, yet overall US stockmarkets seem to have weathered the storm. Today we are to take a look at the evolving trade war between China and the US, the upcoming financial releases, upcoming earnings reports and the situation revolving around Alphabet. For a rounder we will be providing a technical analysis of S&P 500’s daily chart.

The evolving and consequences of Trump’s tariffs

On Monday, the US government avoided at the last minute to impose tariffs on US imports from Mexico and Canada, by postponing it. The postponement is to last for 30 days and tended to ease market worries somewhat. Yet that was not the case with the additional 10% tariffs across all Chinese imports in the US, which are now in effect. The Chinese replied practically immediately, by imposing tariffs of 15% tariffs on U.S. coal and LNG and 10% for crude oil, farm equipment and some autos according to Reuters. Also, China is now reported stating that it will start an antimonopoly investigation in Alphabet’s Google and at the same time, included in its “unreliable entities list” some US companies. China is also imposing export controls over some rare earths and metals that are critical for hi-tech gadgets and the clean energy transition. The issue is expected to be maintained and on a fundamental level, should the frictions in the US-Sino relationships be enhanced, we may see them weighing on US stockmarkets as business opportunities may shrink. Overall the risk factor has been elevated and the market’s uncertainty seems to intensify, which could also be a deeper fundamental reason not allowing US stock markets to rise at their full swing.

The release of January’s US employment data

We also note the release of the US employment report for January as the next big test for US Equities. The non-farm payrolls is expected to drop to 170k if compared to December’s 256k, the unemployment rate to remain unchanged at 4.1% and the average earnings growth rate to slow down slightly. Should the actual rates and figures meet their respective forecasts, we may see them providing some support for US equity markets as it may imply a relative easing of the US employment market, which in turn may ease the Fed’s doubts for further rate cuts. Yet the actual data tend to differ from prognosis, hence the element of surprise for stock markets is quite probable and hence may lead to an asymmetric reaction of the market. Should the actual rates and figures show an unexpected tightening of the US employment market, we may see US stock markets retreating as the Fed’s decisiveness to keep rates unchanged may be enhanced.

Alphabet’s earnings and investments

We allready mentioned how China in response to Trump’s tariffs is about to open an antimonopoly investigation on Alphabet’s (#GOOG) Google. The antitrust probe is expected to focus on the company’s Android operating system affecting Chinese phone makers like Xiaomi. The news did not seem to hit the company’s share price, yet as the probe progresses we may see the issue weighing on the share’s price. Furthermore the company’s earnings release was a bit lukewarm, as the EPS figure surpassed expectations a bit, while the revenue figure undershoot its target, maybe causing a bit of disappointment maybe focusing mostly on the cloud segment of the business. Yet the sensation was Alphabet’s announcement yesterday that it will invest US$75 billion on Artificial Intelligence a substantially higher number than what some analysts have mentioned around US$58 billion ,as per Reuters and US$52.5 billion in 2024. The increased amount scheduled to be invested in AI may have raised some eyebrows of doubt, given the appearance of DeepSeek, yet seems to have been embraced by market participants with enthusiasm and could provide some support for the share’s price.

Upcoming earnings reports

In the coming days we get a slew of earnings reports, yet some stand apart. We would note the release of the earnings reports of Amazon (#AMZN) as a key release for the US tech sector, tomorrow Wednesday in the after closing hours. Also on Friday we note the release of Canopy Growth (#CGC) while on Monday the 10th of February we get McDonalds (#MCD) figures and on Tuesday the release of Coca Cola’s (#KO) earnings report.

Technical analysis

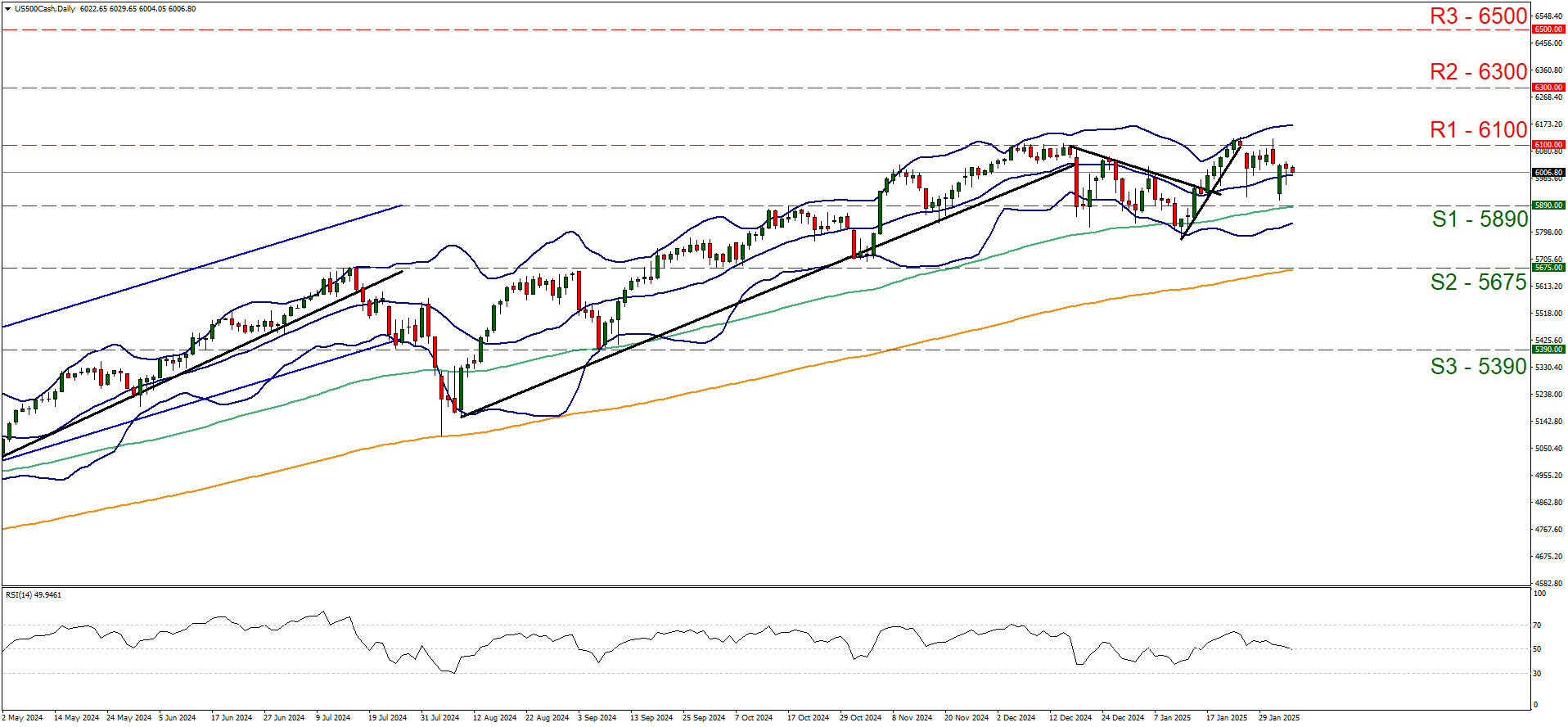

US500Cash daily chart

Support: 5900 (S1), 5675 (S2), 5390 (S3).

Resistance: 6120 (R1), 6300 (R2), 6500 (R3).

The S&P 500 maintained a choppy sideways motion between the 6120 (R1) resistance line and the 5900 (S1) support level since our last report. We tend to maintain a bias for the sideways motion to continue as long as the price action of the index continues to respect the prementioned levels. Furthermore we note that the RSI indicator lowered to reach the reading of 50, implying a relative indecisive market, regarding the index’s direction. Should the bulls take over ,we may see the index entering unchartered waters by breaking the 6120 (R1) resistance level, which is a record high level. We set as the next possible target for the bulls the 6300 (R2) resistance level. Should the bears take over, we may see the index breaking the 5900 (S1) support line, a level that was aimed for on Monday and if so we may see the index approaching the 5675 (S2) support line, a level that provided support for the index’s price action in the early days of October and resistance on the 16th of July.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our Risk Disclosure. IronFX is a trade name of Notesco Limited. Notesco Limited is registered in Bermuda with registration number 51491 and registered address of Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda. The group also includes CIFOI Limited with registered office at 28 Irish Town, GX11 1AA, Gibraltar.

Recommended content

Editors’ Picks

AUD/USD: A challenge of the 2025 peaks looms closer

AUD/USD rose further, coming closer to the key resistance zone around 0.6400 despite the strong rebound in the Greenback and the mixed performance in the risk-associated universe. The pair’s solid price action was also propped up by a firm jobs report in Oz.

EUR/USD gathers strength above 1.1350, ECB cuts interest rates by 25 bps

The EUR/USD pair attracts some buyers to near 1.1370 during the early Asian session on Friday. The concerns over the economic impact of tariffs continue to drag the US Dollar lower against the Euro.

Gold bounces off daily lows, back near $3,320

The prevailing risk-on mood among traders challenges the metal’s recent gains and prompts a modest knee-jerk in its prices on Thursday. After bottoming out near the $3,280 zone per troy ounce, Gold prices are now reclaiming the $3,320 area in spite of the stronger Greenback.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.