Equities report: Google in trouble

US stock markets appear to be uneasy with the Dow Jones 30 moving lower for the week, whilst the NASDAQ 100 and S&P500 appear to be relatively unchanged when compared to last week’s closing figures. Today we are to focus mainly on fundamental issues that could affect US stock markets including the recent announcement from the DOJ that they are considering breaking up Google, the upcoming US CPI rates on Thursday and the continued woes faced by Boeing. For a rounder view conclude the report with a technical analysis of US 500’s daily chart.

Google (#GOOG) to be broken up?

The US Department of Justice is considering requesting a Judge to break up Google, after it was found guilty on the 5th of August, of maintaining a monopoly in US general search services and US general search text advertising. The DOJ in its court filing has stated that they are considering remedies to address four categories of harms related to Google’s search distribution and revenue sharing, generation and display of search results, advertising scale and monetisation, and accumulation and use of data. The DOJ goes on to state that they are considering structural remedies that would prevent Google from using products such as Chrome, Play and Android, which may be interpreted as a break up of Google in order to “resolve the serious competition issues that have plagued the relevant markets for more than a decade”. The potential move by the DOJ to break up Google (#GOOG), could significantly weigh on the company’s stock price, as a splitting of its business could reduce overall revenue for the company. However, we should note that a further refined proposed final judgement will be presented in November and a revised proposed final judgement in March, which may see changes to the proposals and could provide a clearer picture of the remedies sought by the DOJ and might not include a breaking up of Google in the final proposal. In our view, we would not be surprised to see a hefty fine being imposed against Google, with potential structural changes that could facilitate increased competition in the search engine business.

US CPI rates for August in sight

As for financial releases we note that the US CPI rate is anticipated to showcase easing inflationary pressures in the US economy. In particular, the headline rate on a year-on-year basis is expected to slow down from 2.5% to 2.3%, which may further amplify the soft-landing scenario for the US economy. Hence, should the CPI rates for September come in as expected or lower it may validate the Fed’s rate-cutting path and may provide the Fed with some leeway should they continue on their monetary easing path. In turn, the implications of easing financial conditions and a soft-landing scenario in the US economy may provide support for the US Equities markets as the possibility of a recession may further decrease. However, should the CPI rates unexpectedly accelerate and come in higher than expected, it may re-ignite concerns about a recession in the US economy, which in turn may weigh on the US stock markets.

Boeing(#BA) continues its battle with its labour union

Boeing announced yesterday that it has withdrawn its pay offer to 33,000 US factory workers after talks collapsed with the labour union, with Boeing stating the union’s demands were “non-negotiable”. As a reminder, the striking union of the company’s West Coast factory workers is requesting a 40% pay rise over four years and the restoration of a defined-benefit pension plan that was taken away a decade ago. The company’s latest offer included a 30% raise and a restoration of a performance bonus which has since been struck down by the union representatives and has effectively been withdrawn from the table by Boeing. The strike appears to be poised to continue, as no agreement appears to be in sight and thus should it continue next week, it would mark the 5th consecutive week that workers have been on strike. Overall, should the strikes continue, it may weigh on the company’s stock price, as further delays and increased costs may deter investors and paint an even more dire picture for the company’s financials, with S&P Global Ratings considering a downgrade on Boeing’s rating to junk status per Reuters

Earnings Season returns

Earnings season makes a return this week, with Wells Fargo (#WFC) and JP Morgan (#JPM set to release their earnings on Friday. Whereas next week we would like to note Johnson&Johnson (#JNJ), Citigroup (#C), Goldman Sachs (#GS) and Morgan Stanley (#MS) amongst others.

Technical analysis

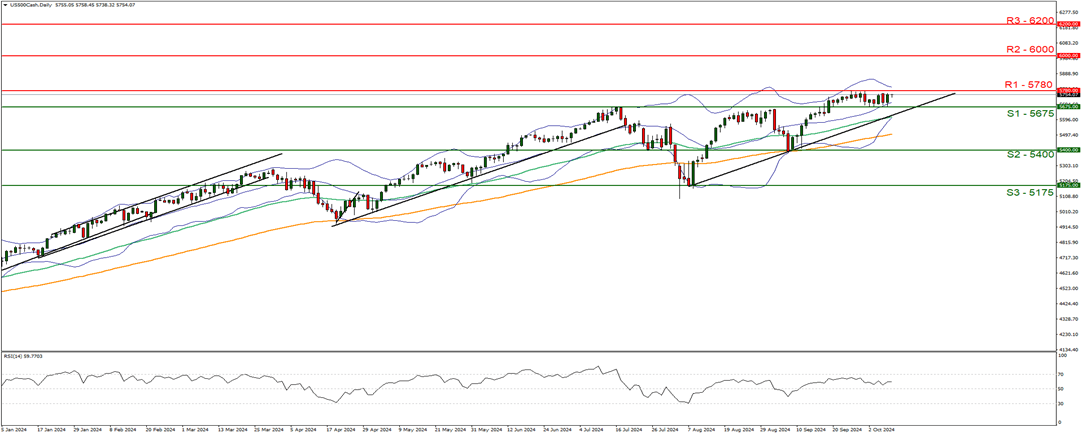

US500 cash daily chart

-

Support: 5675 (S1), 5400 (S2), 5175 (S3).

-

Resistance: 5780 (R1), 6000 (R2), 6200 (R3).

The S&P500 has remained in a relatively tight sideways motion over the past week, having failed to break above its all-time high figure of 5780 and having failed to break below our 5765 (S1) support level. We would like to point out that despite the index moving in an apparent sideways fashion, the upwards-moving trendline which was incepted on the 8th of August remains intact, in addition, the RSI indicator below our chart which remains close to the figure of 60, which may imply a slight bullish market sentiment. Nonetheless, for our sideways bias to continue we would require the index to remain confined between our 5675 (S1) support level and the 5780 (R1) resistance line. On the flip side, we would immediately switch our sideways bias in favour of a bullish outlook in the event of a clear break above the 5780 (R1) resistance line, with the next possible target for the bulls being the 6000 (R2) resistance level. Lastly, for a bearish outlook, we would require a clear break below the 5675 (S1) support level, with the next possible target for the bears being the 5400 (S2) support line.

Author

Phaedros Pantelides

IronFX

Mr Pantelides has graduated from the University of Reading with a degree in BSc Business Economics, where he discovered his passion for trading and analyzing global geopolitics.