Major US stock market indexes and in particular, the NASDAQ 100 and S&P 500 appear to be moving in an upwards fashion for the week. Yet, the decline of the Dow Jones 30 for a third week in a row is of some concern. Today we have a look at the fundamentals by analysing the release of the Fed’s interest rate decision later on today and the US Core PCE rate on Friday. For a rounder view we are to conclude the report with a technical analysis of S&P 500’s daily chart.

Fed decision day

We make a start with the Fed’s interest rate decision which is set to take place during today’s American session. This will be the last interest rate decision by the Fed for the year and thus may garner greater attention than usual. Essentially, market participants are eagerly awaiting the Fed’s decision, despite the majority of them currently anticipating the bank to cut by 25 basis points, with Fed Fund Futures currently implying a 96% probability for such a scenario to materialize. Hence, we turn our attention to the bank’s accompanying statement, in which should it be perceived that the bank may opt to resume its monetary easing cycle, it could aid the US Equities markets. On the flip side, should policymakers showcase a hesitancy to cut interest rates with the new year, or imply that the bank may remain on hold for a longer period of time, it could weigh on the US Equities markets. In our view, we would not be surprised to see the bank’s accompanying statement imply that the Fed may opt for a more gradual approach to its rate-cutting cycle, which in turn could be perceived as slightly hawkish in nature.

US inflation data to end the year with a bang

Moreover, we would also like to point out the US Core PCE rates for November which are due out on Friday. The Core PCE rate on a year-on-year level for November is expected by economists to come in at 2.9% which would be higher than the prior rate of 2.8%. Such a scenario could imply an acceleration of inflationary pressures in the US economy, which could increase pressure on the Fed to remain on hold for a prolonged period of time in order to gain more confidence that the inflation beast has been tamed. Hence, should the Core PCE rate come in as expected or higher, it could imply that the financial conditions surrounding the US economy, may remain tight and thus could weigh on the US Equities markets. On the other hand, should the Core PCE rate come in lower than expected, it may have the opposite effect. In conclusion, the Fed’s interest rate decision today may send shockwaves across the US Equities markets, with a secondary shock potentially occurring on Friday with the release of the Core PCE rate for November.

US-China tech standoff continues

The tit-for-tat exchanges between the US and China appear to be continuing. In particular, we would like to note the report by Bloomberg yesterday. In the report published by Bloomberg, it is stated that the outgoing Biden administration is set to “initiate a trade investigation into Chinese semiconductors in the coming days” with the probe potentially resulting in “tariffs or other measures to restrict imports on older-model semiconductors and the products containing them”. In our opinion, we are seeing the stage being set for next year, between the USA and China imposing measures on one another, in order to garner leverage for future negotiations. Nonetheless, in our view, the possible response by China could target high-profile companies in the US in order to increase pressure on the incoming administration, which could predominantly impact tech-orientated companies that are included in the NASDAQ 100 index.

Technical analysis

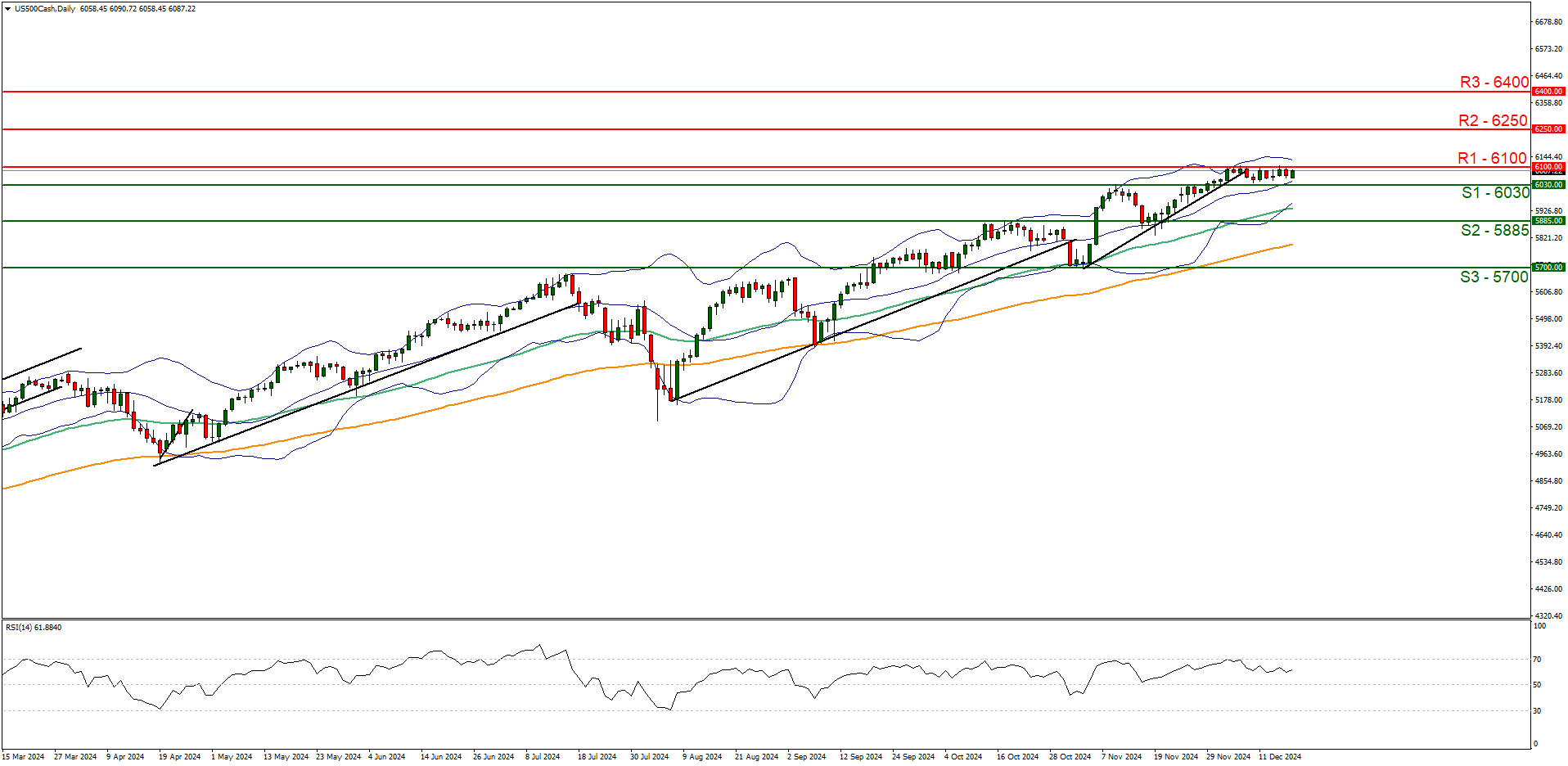

US500 daily chart

Support: 6030 (S1), 5885 (S2), 5700 (S3).

Resistance: 6100 (R1), 6250 (R2), 6400 (R3).

The S&P 500 appears to be moving in a tight-range sideways fashion. We opt for a sideways bias for the index and supporting our case is the index’s failure to break above the 6100 (R1) resistance line and the failure to break below the 6030 (S1) support level. Yet we must stress that the Fed’s interest rate decision and the release of the Core PCE rate on Friday could easily alter the index’s direction. Moreover, the RSI indicator below our chart currently registers a figure near 60, which tends to imply bullish market tendencies. Nonetheless, for our sideways bias to continue we would require the index to remain confined between the 6030 (S1) support level and the 6100 (R1) resistance line. On the flip side we would immediately abandon our sideways bias in favour of a bullish outlook, in the event of a clear break above the 6100 (R1) resistance line, with the next possible target for the bulls being the 6250 (R2) resistance level. Lastly, for a bearish outlook, we would require a break below the 6030 (S1) support level ,with the next possible target for the bears being the 5885 (S2) support base.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our Risk Disclosure. IronFX is a trade name of Notesco Limited. Notesco Limited is registered in Bermuda with registration number 51491 and registered address of Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda. The group also includes CIFOI Limited with registered office at 28 Irish Town, GX11 1AA, Gibraltar.

Recommended content

Editors’ Picks

AUD/USD holds the bounce near 0.6400 amid signs of easing US-China trade tensions

AUD/USD attracts some dip-buyers to hold near 0.6400 in the Asian session on Wednesday. Hopes for a possible de-escalation in the US-China trade war boost investors' appetite for riskier assets and support the Aussie. Further, the pause in the US Dollar rebound also aids the pair's upside.

USD/JPY regains 142.00 as US Dollar finds its feet

USD/JPY has picked up fresh bids to regain 142.00, reversing the dip to near 141.50 in the Asian session on Wednesday. Signs of easing US-China trade tensions led to a sharp recovery in the risk sentiment, lifting the US Dollar broadly despite doubts over Trump's veracity.

Gold price is down but not out ahead of US PMI data

Gold price is heading back toward $3,400, stalling Tuesday's correction from the $3,500 mark, The US Dollar recovery fixxles, allowing Gold price to regain footing as investors remain wary about US President Trump's intentions. Trump said on Tuesday that he hopes for US-China trade war de-escalation and doesnt intend to fire Fed's Powell.

Why is the crypto market up today?

Bitcoin rallied above $93,000 on Tuesday alongside the broader financial market following Treasury Secretary Scott Bessent's statement at a closed-door meeting that the trade feud between the US and China is unsustainable.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.