Emini S&P December made a low for the day just 3 points below the buying opportunity at 5745/35 & immediately shot higher to both targets of 5755, 5765.

The low & high for the last session were 5733 - 5822.

Emini Nasdaq December broke lower but made a low for the day at strong support at 19900/800

Last session high & low for the last session were: 19818 - 20331.

Emini Dow Jones December trades mostly sideways for many days.

Last session high & low for the last session were: 42251 - 42656.

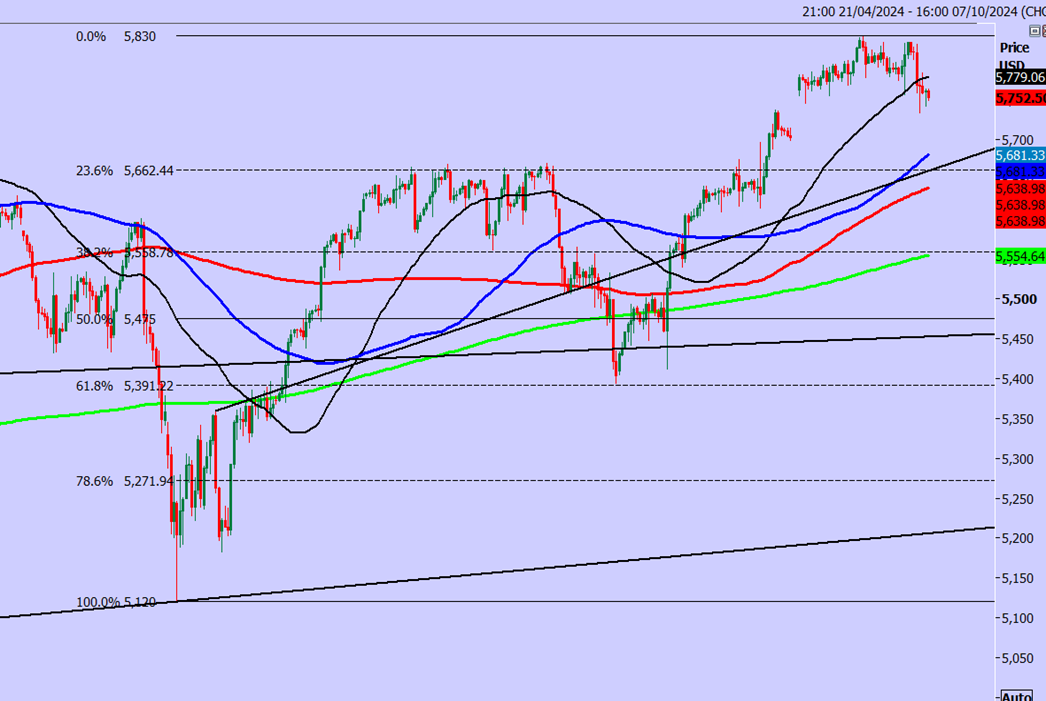

Emini S&P September futures

Emini S&P longs at strong support at 5745/35 worked perfectly as we held above 5730 & shot higher to targets of 5755 & 5765 then as far as 5783.

If we continue higher look for a retest of the all time high of 5820/30.

So we have support again at 5745/35 & longs need stops below 5730.

A break lower this week however could target 5695/90 & even support at 5680/70.

Longs here need stops below 5660.

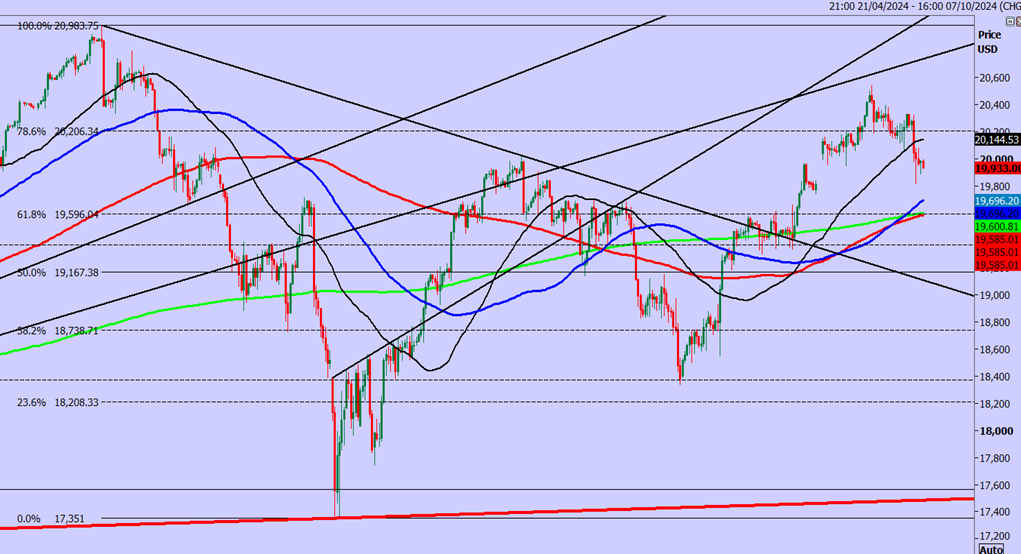

Nasdaq September futures

We broke support at 20250/150 to hit my next downside target & very strong support at 19900/800 with a low for the day exactly here.

We then shot higher to 20081.

If we continue higher look for 20150/200, perhaps as far as 20250/290.

Strong support again at 19900/800 - Longs need stops below 19700.

A break lower today however risks a slide to 19550, perhaps as far as strong support at 19400/300.

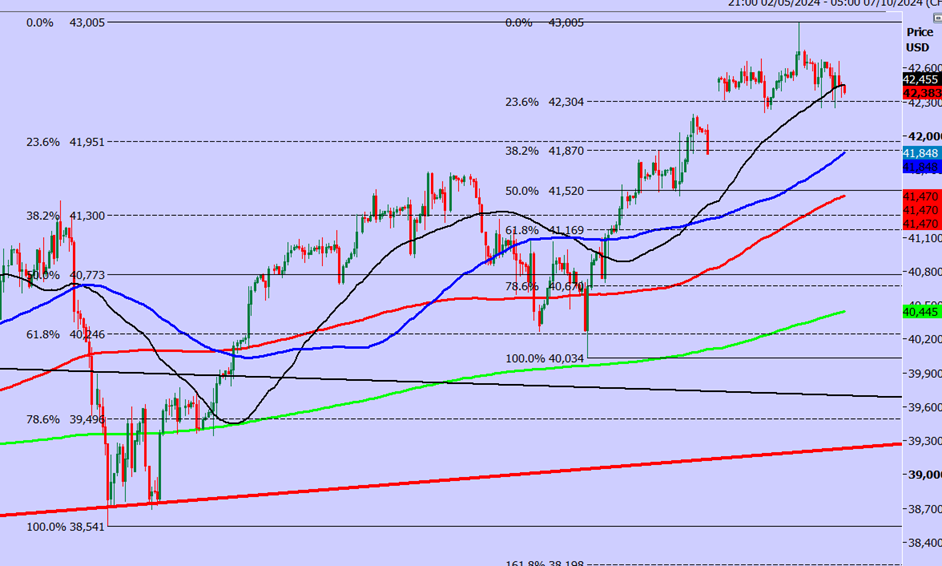

Emini Dow Jones September futures

We wrote: I think gains are likely to be limited in severely overbought conditions but there is definitely no sell signal & I will remain a buyer on any profit taking.

We did dip as far as support at 42350/250 as predicted & this did prove to be an excellent buying opportunity again but longs need stops below 42150 on a retest today.

Targets of 42500 & 42650 were hit immediately, meaning we caught the low & high for the day for the second day in a row.

A break lower this week however risks a slide to 42000/41900 & longs need stops below 41800.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

AUD/USD stays firm near 0.6300 after strong Chinese exports data

AUD/USD is trading well bid near 0.6300 in Asian trades on Monday, opening the week on the front foot. Risk sentiment remains in a sweeter spot following the weekend's news of lower US tariffs on Chinese electronic supply chain and strong Chinese exports data for March. Tariffs talks will remain on the radar.

USD/JPY recovers to 143.00 amid volatile trading

USD/JPY is trimming losses to retake 143\.00 in Monday's Asian trading. The US Dollar pauses its latest leg down, with traders digesting Trump's tariff news from the weekend. However, the Fed-BoJ policy divergence expectations underpin the Japanese Yen, keeping the weight intact on the pair.

Gold retreats from record highs of $3,245 as US Dollar finds its feet

Gold is rereating from record highs of $3,245 early Monday, extending Friday's late pullback. Reducded demand for safe-havens and a broad US Dollar rebound undermine the yellow metal amid the news of not-so-steep US tariffs on China's semiconductors and electronics.

Bitcoin is on the verge of a breakout while Ethereum and Ripple stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.