-

Emini S&P March shorts at first resistance at 6055/6060 worked perfectly as we collapsed from 6067 to 5995 The low & high for the last session were 5995 - 6067.

-

(To compare the spread to the contract you trade).

-

Emini Nasdaq March made a high for the day exactly at first resistance at 21800/900 before prices collapsed to 21408. Last session high & low for the last session were: 21408 - 21813.

-

Emini Dow Jones March made a high for the day exactly at first resistance at 43750/850 before prices collapsed again to 43420. Last session high & low for the last session were: 43420 - 43825.

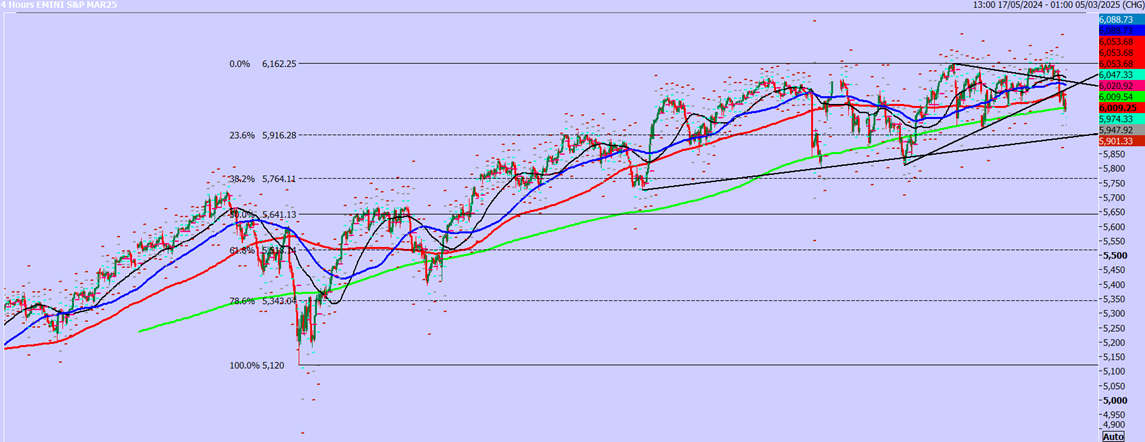

Emini S&P March futures

-

Emini S&P recovered to the sell opportunity at 6055/6060 & shorts worked perfectly as we collapsed to 5994.

-

The break below 6010 did not work the first time yesterday but we are now likely to head for the 100 day moving average at 5978/74.

-

A low for the day is possible here as we become oversold but longs need stops below 5965.

-

A break lower targets 5940/35 & even a test of strong support at 5920/10 is possible.

-

Longs need stops below 5900.

-

Again, gains are likely to be limited with first resistance at 6030/40. Shorts need stops above 6045. Targets: 6015, 5995.

-

Strong resistance at 6055/65 & shorts need stops above 6075.

- Targets: 6040, 6020.

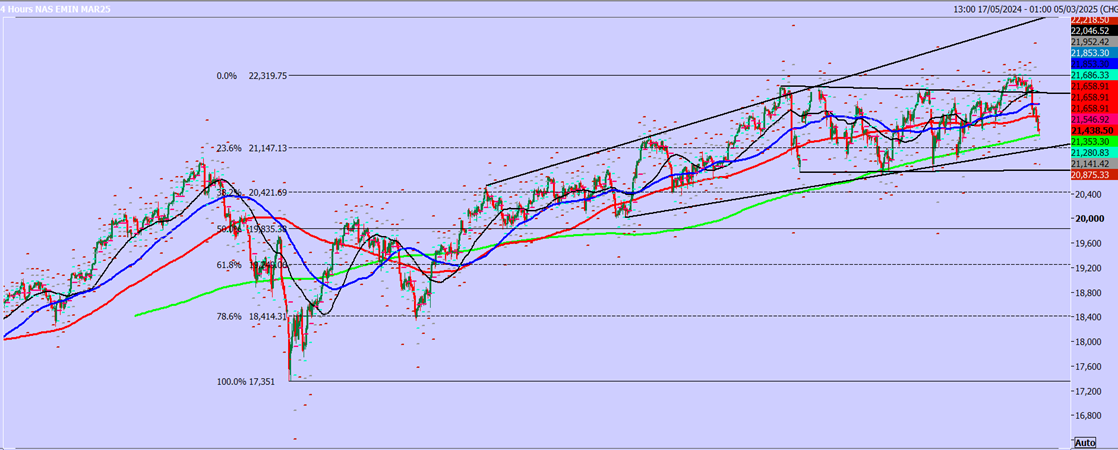

Nasdaq March futures

-

Emini Nasdaq we wrote: Further losses are expected targeting 21550. Target was hit.

-

However eventually this week we could fall as far as a buying opportunity at 21200/100. Longs need stops below 20950.

-

Targets:

-

Gains are likely to be limited with first resistance at 21700/800 & shorts need stops above 21900.

-

Targets: 21500, 21400, 21300.

Emini Dow Jones March futures

-

Further losses are expected to the 16 month ascending trend line at 43100/43000.

-

A bounce from here is possible but longs need stops below 42850.

-

Gains are likely to be limited with first resistance again at 43750/850 & shorts need stops above 44000.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.