Elliott Wave view on DAX looking for larger degree correction [Video]

![Elliott Wave view on DAX looking for larger degree correction [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DAX/dax-macro-concept-57844002_XtraLarge.jpg)

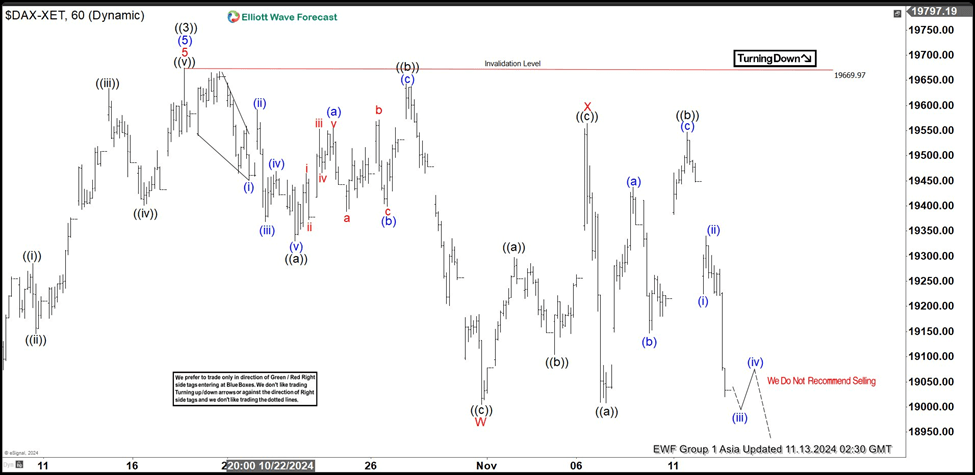

Short Term Elliott Wave View in DAX suggests rally to 19670 ended wave ((3)). Wave ((4)) pullback is currently in progress as a double three Elliott Wave structure. Down from wave ((3)), wave (i) ended at 19451.7 and rally in wave (ii) ended at 19591.5. Wave (iii) lower ended at 19368.69 and wave (iv) rally ended at 19468.6. Final wave (v) lower ended at 19330.1 which completed wave ((a)). Rally in wave ((b)) ended at 19643.12 with internal subdivision as a zigzag. Up from wave ((a)), wave (a) ended at 19555.45 and wave (b) ended at 19399.16. Wave (c) higher ended at 19643.12 which completed wave ((b)) in higher degree.

Wave ((c)) lower ended at 19004.97 which completed wave W in higher degree. Up from wave W, wave ((a)) rally ended at 19297.6 and wave ((b)) ended at 19104.59. Wave ((c)) higher ended at 19563.97 which completed wave X in higher degree. Index has turned lower in wave Y with internal subdivision as a zigzag structure. Down from wave X, wave ((a)) ended at 19007.88. Wave ((b)) rally ended at 19456.9 and Index has turned lower. Near term, as far as pivot at 19669.9 high stays intact, expect Index to extend lower.

DAX 60 minutes Elliott Wave chart

DAX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com