Elliott Wave view: NVDA bullish momentum looking for more upside [Video]

![Elliott Wave view: NVDA bullish momentum looking for more upside [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/market-analyze-44097788_XtraLarge.jpg)

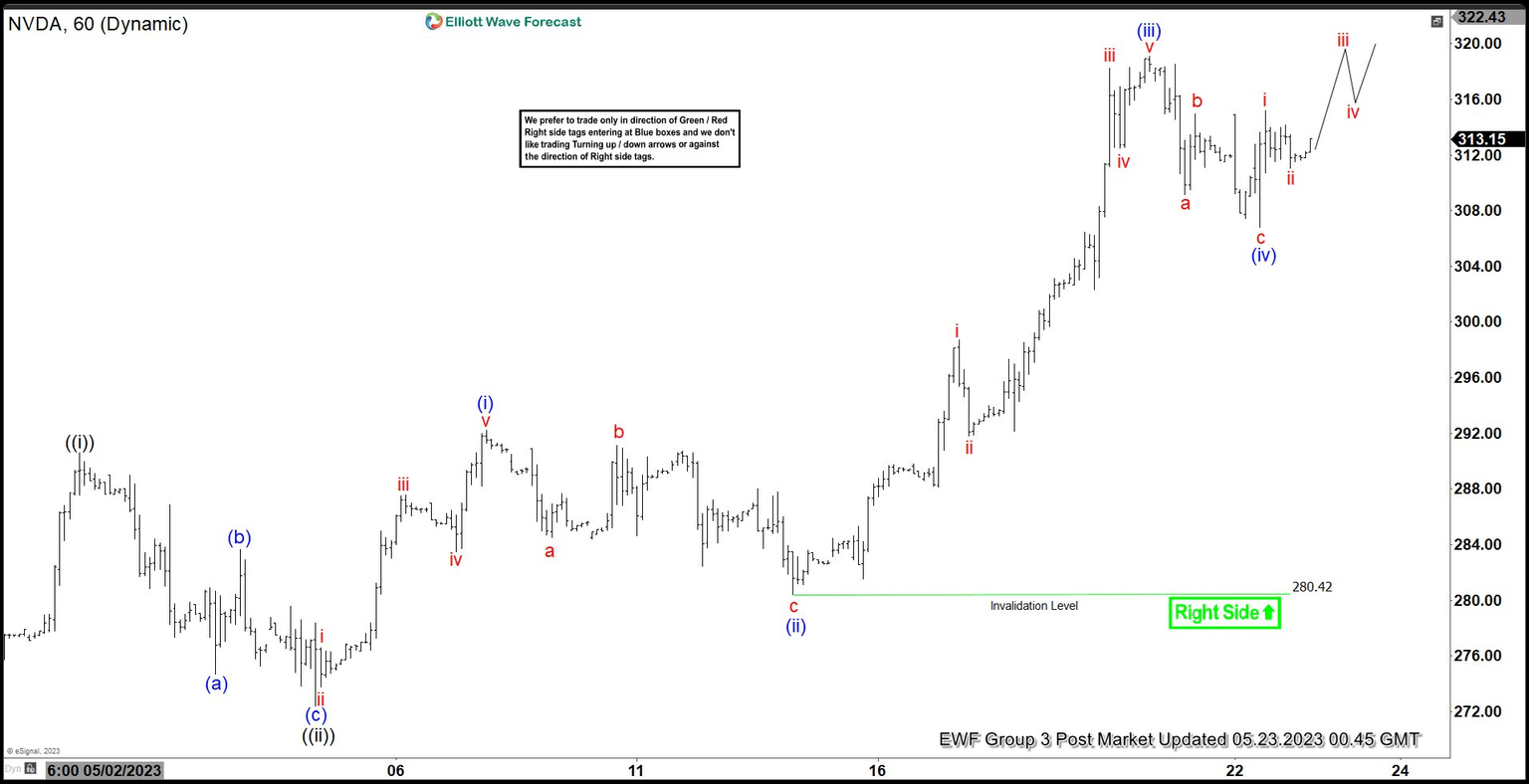

Short term Elliott Wave View in Nvidia Corporation (ticker: NVDA) suggests that rally from 4.26.2023 low is unfolding as a 5 waves impulse Elliott Wave structure with extension. Up from 4.26.2023 low, wave ((i)) ended at 290.58 and dips in wave ((ii)) ended at 272.40. Stock has resumed higher in wave ((iii)) which subdivides into another 5 waves in lesser degree. Up from wave ((ii)), wave i ended at 276.6 and wave ii ended at 273.80. Wave iii ended at 287.55, pullback in wave iv ended at 283.50, and final leg wave v ended at 292.20 which completed wave (i).

NVDA 60 minutes Elliott Wave chart

Pullback in wave (ii) ended at 280.42 with internal subdivision as a zigzag structure. Down from wave (i), wave a ended at 284.5, wave b ended at 291.13, and wave c ended at 280.42. This completed wave (ii). The stock has resumed higher in wave (iii). Up from wave (ii), wave i ended at 298.70 and pullback in wave ii ended at 291.84. Wave iii ended at 318.24, pullback in wave iv ended at 312.50, and wave v higher ended at 319.08 which completed wave (iii). Pullback in wave (iv) ended at 306.80 with internal subdivision as a zigzag. Near term, while above 306.80, and more importantly above 280.42, expect stock to extend higher.

NVDA Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com