Elliott Wave view: Dow Futures (YM) looking for double correction [Video]

![Elliott Wave view: Dow Futures (YM) looking for double correction [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/bloomberg-app-on-iphone-4-with-market-data-17118657_XtraLarge.jpg)

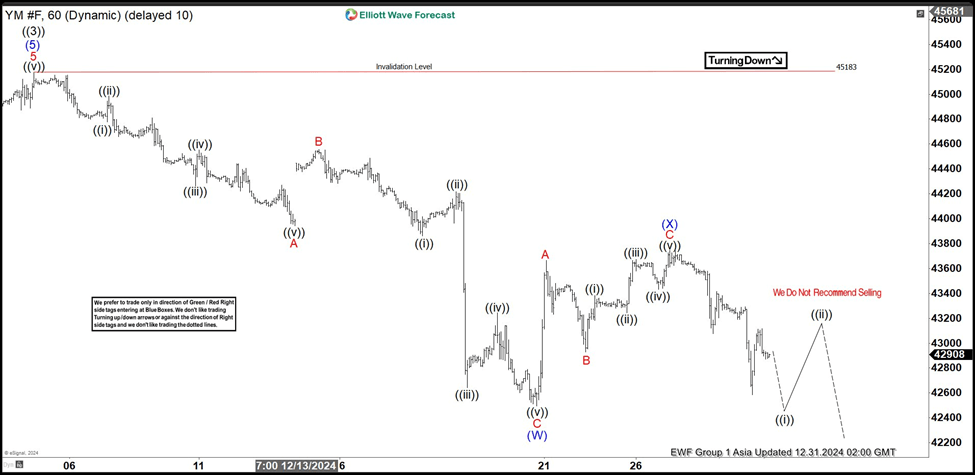

Short Term Elliott Wave view of Dow Futures (YM) is looking for a larger degree correction against cycle from 3.15.2023 low in 3, 7, or 11 swing. Rally to 45183 ended cycle from 3.15.2023 low as wave ((3)) per 1 hour chart below. Wave ((4)) pullback is now in progress to correct that cycle. Internal subdivision of wave ((4)) is unfolding as a double three Elliott Wave structure. Down from wave ((3)), wave A ended at 43941 and wave B rally ended at 44556. Wave C lower ended at 42496 which completed wave (W) in higher degree.

Rally in wave (X) unfolded as a zigzag Elliott Wave structure. Up from wave (W), wave A ended at 43663 and wave B ended at 42928. Wave C higher ended at 43746 which completed wave (X). The Index has turned lower in wave (Y), but it still needs to break below wave (W) at 42496 to validate this view. Near term, as far as pivot at 45183 high stays intact, expect the Index to extend lower. Potential target for wave (Y) lower is 100% – 161.8% Fibonacci extension of wave (W). This area comes at 39403 – 41060 area where buyers can appear for more upside or 3 waves rally at least.

Dow Futures (YM) 60 minutes Elliott Wave chart

Dow Futures (YM) Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com