Elliott Wave view: Apple (AAPL) looking to end wave five [Video]

![Elliott Wave view: Apple (AAPL) looking to end wave five [Video]](https://editorial.fxstreet.com/images/Markets/Equities/close-up-of-stock-certificate-7978488_XtraLarge.jpg)

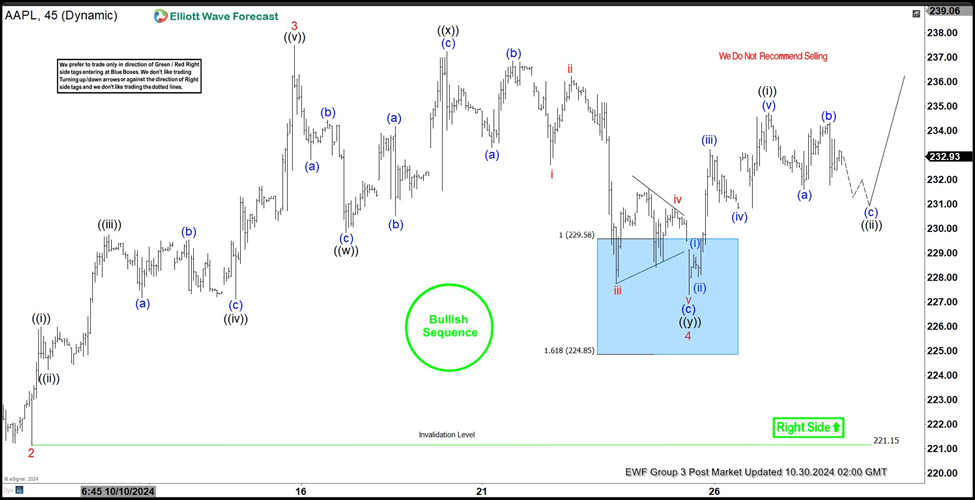

Short Term Elliott Wave View in Apple (AAPL) shows a 5 swing diagonal from 9.16.2024 low. Up from 9.16.2024 low, wave 1 ended at 233.09 and dips in wave 2 ended at 221.15. The stock resumed higher in wave 3. Up from wave 2, wave ((i)) ended at 225.97 and dips in wave ((ii)) ended at 224.22. Stock resumed higher in wave ((iii)) towards 229.75 and pullback in wave ((iv)) ended at 227.12. Final leg wave ((v)) ended at 237.49 which completed wave 3 in higher degree.

Wave 4 pullback unfolded as a double three Elliott Wave structure. Down from wave 3, wave (a) ended at 232.81 and wave (b) ended at 234.44. Wave (c) lower ended at 229.84 which completed wave ((w)). Up from there, wave (a) ended at 234.19 and wave (b) ended at 230.52. Wave (c) higher ended at 237.23 which completed wave ((x)) in higher degree. The stock turned lower in wave ((y)) with internal subdivision as a zigzag. Down from wave ((x)), wave (a) ended at 233.3 and wave (b) ended at 236.85. Wave (c) lower ended at 227.3 which completed wave ((y)) of 4 in higher degree. The stock has turned higher in wave 5. Near term, as far as pivot at 221.1 low stays intact, expect the stock to extend higher.

Apple (AAPL) 45 minutes Elliott Wave chart

AAPL Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com