Elliott Wave intraday view: S&P 500 futures (ES) Wave five in progress [Video]

![Elliott Wave intraday view: S&P 500 futures (ES) Wave five in progress [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

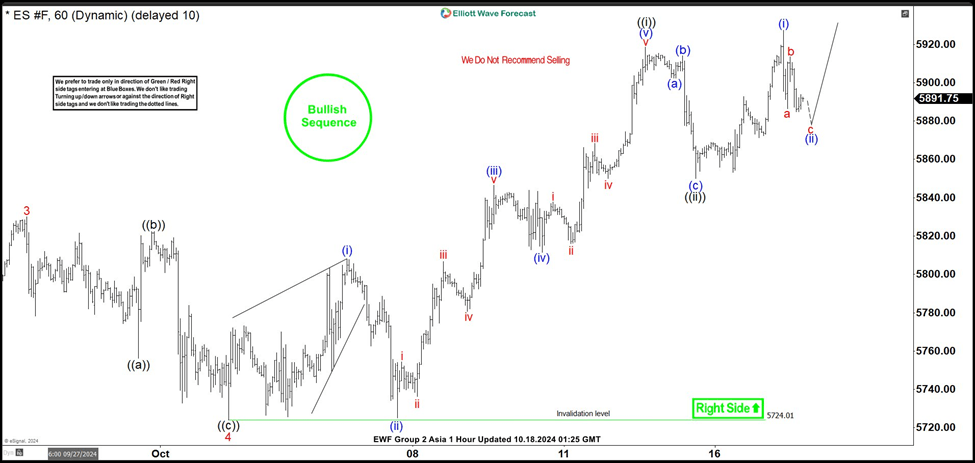

Short Term Elliott Wave View in S&P 500 Futures (ES) suggests that cycle from 8.5.2024 low is in progress as a 5 waves impulse. Up from 8.5.2024 low, wave 1 ended at 5669.75 and dips in wave 2 ended at 5394. The Index extends higher in wave 3 towards 5830 and pullback in wave 4 ended at 5724. Internal subdivision of wave 4 unfolded as a zigzag structure. Down from wave 3, wave ((a)) ended at 5756.2 and wave ((b)) ended at 5822.50. Wave ((c)) lower ended at 5724 which completed wave 4 in higher degree.

S&P 500 futures (ES) 60 minutes Elliott Wave chart

The Index has resumed higher in wave 5. Up from wave 4, wave (i) ended at 5808 and pullback in wave (ii) ended at 5725.25. Wave (iii) higher ended at 5846.50 and pullback in wave (iv) ended at 5811.50. Final leg wave (v) ended at 5918.50 which completed wave ((i)) in higher degree. Correction in wave ((ii)) is proposed complete at 5850 with internal subdivision as a zigzag structure. The Index then resumed higher in wave ((iii)). Up from wave ((ii)), wave (i) ended at 5927.25. Near term, as far as pivot at 5724.01 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

ES_F Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com