Elliott Wave intraday analysis on DAX looking for support soon [Video]

![Elliott Wave intraday analysis on DAX looking for support soon [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DAX/dax-macro-concept-57844002_XtraLarge.jpg)

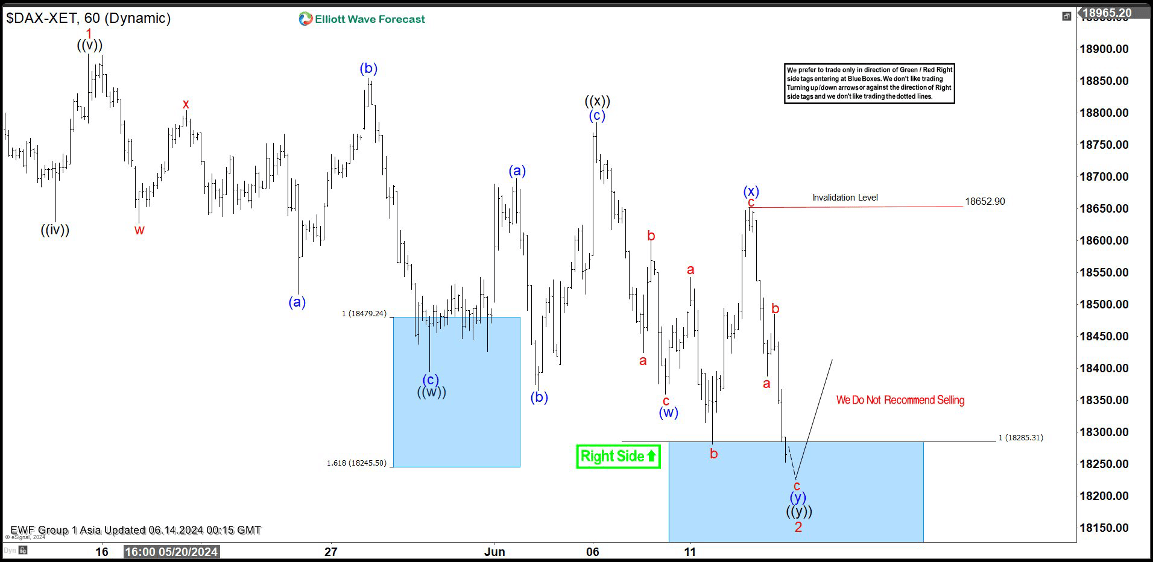

Short term Elliott Wave in DAX suggests the Index is correcting cycle from 4.19.2024 low. The rally from 4.19.2024 low ended wave 1 at 18892.92. Wave 2 pullback is currently in progress as a double three Elliott Wave structure. Down from wave 1, wave (a) ended at 18515.84 and wave (b) ended at 18855.05. Wave (c) lower ended at 18394.43 which completed wave ((w)) in higher degree. Wave ((x)) unfolded as an expanded flat Elliott Wave structure. Up from wave ((w)), wave (a) ended at 18697.09 and wave (b) ended at 18365.53. Wave (c) higher ended at 18784.65 which completed wave ((x)) in higher degree.

The Index has resumed lower in wave ((y)). Down from wave ((x)), wave (w) ended at 18359.42 and wave (x) rally ended at 18652.90. Wave (y) lower is now in progress to complete wave ((y)) of 2 in higher degree. The Index has reached the extreme area from wave 1 peak. This area of support is at 100% – 161.8% Fibonacci extension of wave ((w)), which comes at 17981 – 18287.2. From this area, the Index should turn and resume higher or at minimum rally in 3 waves.

DAX 60 minutes Elliott Wave chart

DAX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com