Elliott Wave intraday analysis expects DAX to turn higher soon [Video]

![Elliott Wave intraday analysis expects DAX to turn higher soon [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DAX/dax-macro-concept-57844002_XtraLarge.jpg)

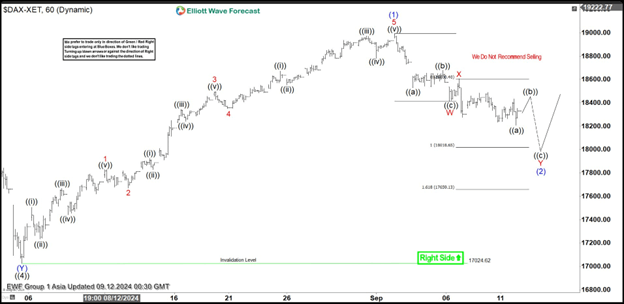

Short Term Elliott Wave view on DAX suggests that the Index is correcting cycle from 8.5.2024 low in 3, 7, or 11 swing before it resumes higher. The pullback on 8.5.2024 towards 17024.6 ended wave ((4)). The Index has turned higher in wave ((5)) with internal subdivision as an impulse Elliott Wave structure. Up from wave ((4)), wave ((i)) ended at 17505.23 and wave ((ii)) pullback ended at 17233.07. Wave ((iii)) higher ended at 17666.82 and pullback in wave ((iv)) ended at 17439.87. Wave ((v)) higher ended at 18920.1 which completed wave 1 in higher degree. Dips in wave 2 ended at 17669.64.

Up from wave 2, wave ((i)) ended at 17921.99 and wave ((ii)) ended at 17827.08. Wave ((iii)) higher ended at 18344.22 and wave ((iv)) ended at 18240.17. Wave ((v)) higher ended at 18495.28 which completed wave 3 in higher degree. Pullback in wave 4 ended at 18349.98. Final leg wave 5 ended at 18990.78 which completed wave (1) in higher degree. Wave (2) pullback is in progress to correct cycle from 8.5.2024 low as a double three Elliott Wave structure. Down from wave (1), wave W ended at 18414.13 and wave X ended at 18607.79. Expect wave Y to extend lower to correct cycle from 8.5.2024 low in 7 swing towards 17659.1 – 18018.6 area before it turns higher. As far as pivot at 17024.62 low stays intact, expect pullback to find support in 3, 7, 11 swing for more upside.

DAX 60 minutes Elliott Wave chart

DAX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com