Electric vehicles: A high voltage market

Rather like smartphones, electric vehicles are emblematic products of a complex, globalised supply chain, and their national affiliations are far from straightforward. If the country of assembly served as a passport, then a famous American company with a fruity logo would actually be Chinese; another, also American, but taking its name from the Serbian engineer and pioneer of alternating current, would call Shanghai home.

Whether one likes it or not, China has a key role in the “green” industrial revolution that will take economy to climate neutrality. In the transition to all-electric, particularly as it is happening in Europe, it is even strengthening its positions. The planned ban on the sale of new petrol and diesel cars will bring the end of a technological barrier that has thus far allowed European manufacturers to excel, whilst keeping Chinese-made vehicles away from their markets.

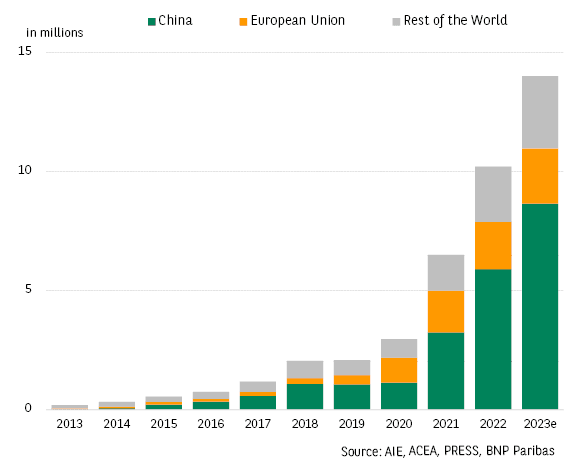

The opposite is now the case. With a fifteen-year head start over its rivals, a particularly aggressive commercial policy and strong upstream control over the battery supply chain – starting from the extraction of the critical metals - Beijing is the epicentre of the earthquake that is shaking up the automotive market. Of the 14 million or so electric vehicles registered worldwide in 2023, nearly 9 million will have been produced in China (chart). Granted, sales in this segment are still a minority (16% of the total), but growth is exponential and China is capturing two thirds of it.

For Asia’s superpower, it is not only a question of supplying its immense domestic market, but also of exporting, including under its own flag. A relatively new fact, Chinese marques, which had long been invisible, have seen a remarkable breakthrough in Europe, where they already have an 8% market share. The trend is such that the European Commission has recently explored ways of putting the brakes on, launching an investigation on subsidies China offers its car firms. In response to this (and also to the protectionism of America’s Inflation Reduction Act) the Beijing authorities have announced restrictions on exports of graphite (used for battery anodes), over which they have considerable control.

In the globalised EV market, the sometimes idealised notion of “economic sovereignty” needs to be treated with caution; and in the interplay of interdependent trade that shapes it, China has a say.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.