Economy down, tech up – The new world?

Well this is very interesting. Meta leapt 15% in one day on a better than dire expectations result. A relief to be sure, but 15%?

Microsoft, a company with moderate single digits growth is now trading at 30 times earnings?

Amazon has also beaten low expectations.

In all of these cases the results are definitely better than expected, but as I keenly remind people every reporting season, it is in the interest of mature companies to low-ball their forward guidance. In the first instance this keeps the board safe from litigation. With the then argument of providing an emotional ‘look we are doing better’ outcome highly probable. Each and every reporting season.

There is also the argument that big tech has magically morphed into the safe-haven buying category?

Well, it certainly looks that way, as they leap higher in the midst of disastrous US GDP data. Yet, they may be having one of those last gasp rallies that happen so often in this sector. Tech is always more spectacular than other sectors. At the moment, the earnings results of a few big techs are being highly exaggerated in their response stock price movements and may be truly topping out from a long term valuations relative new higher interest rates settings perspective.

For the moment they have dragged the broad market higher too. It was a one way street higher for the SP500 for instance. All day long in what really looked to be an abnormal overtly simplistic price action structure. Which makes one wonder, just how much impact, read distortion, large fund momentum computer models, combined with the now 40% of daily SP500 turnover one day retail option structures are having.

If such forces had a major role to play on the day, then this may be a rally that only has another 24 hours or so left to run.

For the broader market the Main Street economy is where the juice is.

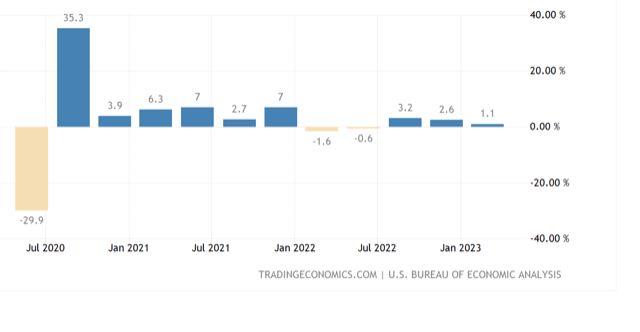

Here, US GDP more than halved from Q2 to Q1. Dropping sharply from 2.6% annualised growth to just 1.1%. Even this performance was largely supported by that moment of strong retail sales and consumer behaviour at the very start of the year. After those end of year severe storms, and the post-Season sales run. Since then, consumer activity has died away significantly. Q2 growth is very likely to be weaker again. One anecdotal note is that children’s toy sales are now plummeting. A sure sign of consumer behaviour, as seen elsewhere, shifting to essentials only.

US economy: Lacklustre to vulnerable

The US economy is in a continued phase of moderation and perhaps risks serious decline. While inflation remains firm and the Federal Reserve will hike another 1-2 times to then be maintaining rates at these much higher levels with no rate cuts in sight at all. And the market has a party?

The global environment also continues to deteriorate. Though it was enough for a few big tech companies to be doing OK, to get everyone buying most everything on the day?

It could be a case of the largesse of the Biden Administration and the printing of money and bank rescues, having added so much money to the system, it continues to find its way into speculation.

This is certainly to some degree the case, but for how long can such speculation avoid the gravity of a declining economy and permanently higher rates?

Also on the data front on the day, the Kansas Fed Manufacturing Index collapsed into Covid-lockdown style territory, Pending Home Sales crashed, and New Jobless Claims moderated thereby assuring further Fed rate hikes. The stock market paid no attention. Such is the meme social style of current investment practices.

What is most likely out of this is that volatility will again be on the increase. The great roller-coaster of prices seen so far this year may only just be beginning.

Author

ACY Securities Team

ACY Securities

ACY Securities is one of Australia's fastest growing multi-asset online trading providers, offering ultra-low-cost trading, rock-solid execution, technologically superior account management and premium market analysis. The key pi