EARS Stock News: Auris Medical Holding Ltd nearly quintuples on promising coronavirus treatment

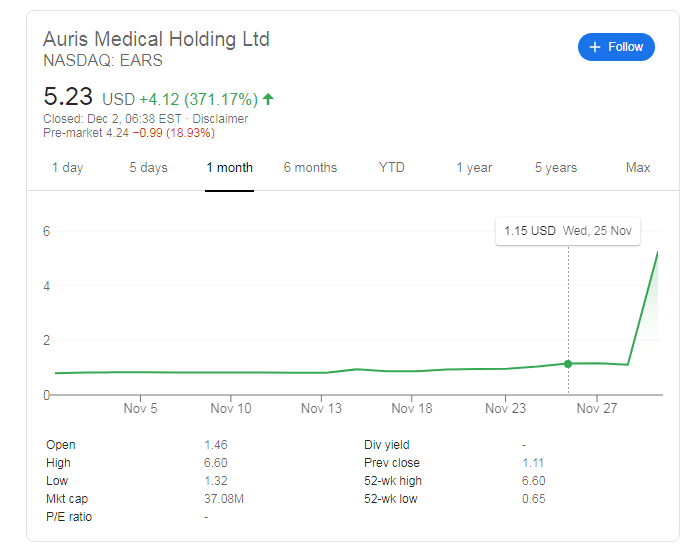

- NASDAQ: EARS has leaped by 370% on Tuesday following promising news.

- Auris Medical Holding reported that its nasal spray could protect against coronavirus.

- A downside correction may make it a buying opportunity.

Investors will likely be all-ears to hear about a coronavirus treatment which is not invasive – Auris Medical Holding Ltd (NASDAQ: EARS) has jumped from $1.11 to close at $5.23 after hitting a high of $6.60 at one point – nearly a sixfold leap – before closing at "only" a 370% gain, nearly quintupling.

With all the buzz about COVID-19 vaccines, markets seem to have forgotten about treatments – and especially prevention. Auris' AM-301 solution is a nasal spray that may protect against pathogens and also allergens that travel via aerosols.

The Zug, Switzerland-based firm has shared results from an in-vitro test, a stage before testing it on animals or humans. Nevertheless, the tests have shown a reduction of the virus by up to 90%, similar to the efficacy rates of the Pfizer/BioNTech and Moderna vaccines.

While the UK gave its green light to Pfizer's jabs, it may take some time until they can be distributed and administered. In the meantime, cheap means of prevention can help in stopping the spread of the disease that grips the world.

EARS stock forecast

NASDAQ: EARS is falling by around 20% in Wednesday's premarket trading, a much-needed correction after the whopping surge. For traders, the question is – will Auris stocks resume their gains? Even if covid disappears by the end of 2021, the company is now on the radar of investors. Allergies are unlikely to go away anytime soon, and nor are other issues that the company addresses.

The small pharma firm – worth a minuscule $37 million – in developing a drug called Sonsuvi which is used to treat sudden deafness. Sonsuvi has already reached Phase 3 trials and may be ready for markets next year.

All in all, there is room for some upside after the recent correction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.