- The US dollar is testing a critical level of support and it could be a turning point.

- EM-FX meets resistance and ASEAN currencies have been battered in recent times.

The US dollar has been under pressure as risk appetite returned to a beaten-up stock market on Wall Street. However, from a technical standpoint, there are now signs that the tide could be turning.

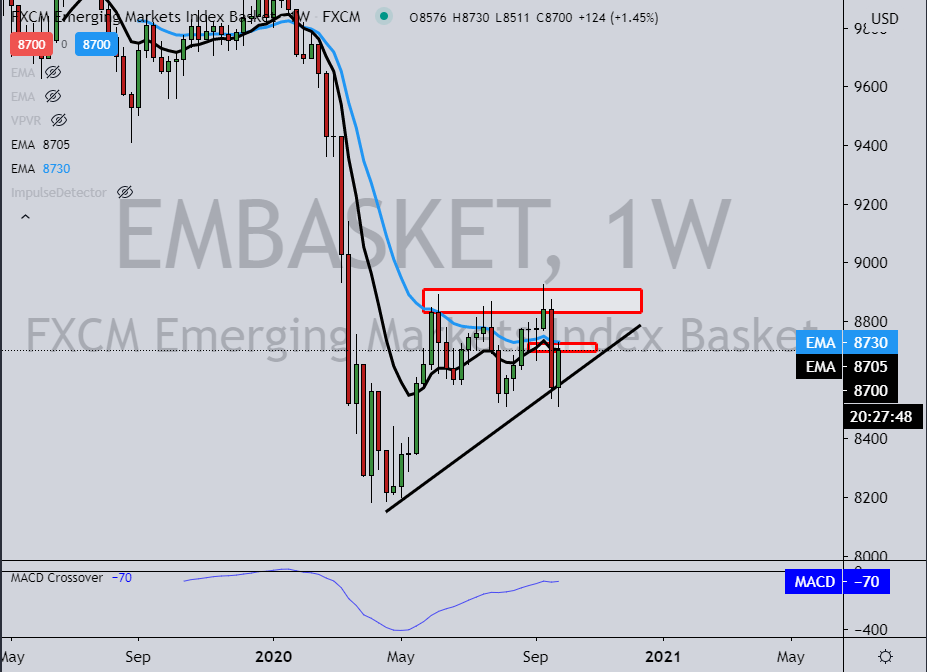

When looking to the EMBasket, which is an Emerging Markets benchmark, designed to reflect the change in the value of the USD against the Chinese renminbi, Mexican peso, South African rand, and Turkish lira, it meets a significant weekly resistance.

The index is expected to falter and possibly break the support of an ascending triangle's support within the steep 2020 downtrend:

Meanwhile, the US dollar recently took the ASEAN currencies to the cleaners according to data collected by Bloomberg.

The data shows that the SGD was down vs USD by 1.3%, IDR by 0.94%, MYR by 1.34%, PHP by 0.17%, INR by 0.22% and leaving the ASEAN-Based USD Index up by 1.33% for the week of 21/9/2020.

This would leave one to presume that capital is leaving emerging markets and developing economies due to rising concerns around the global growth outlook and it could be a sign that the dollar is on the verge of a U-turn.

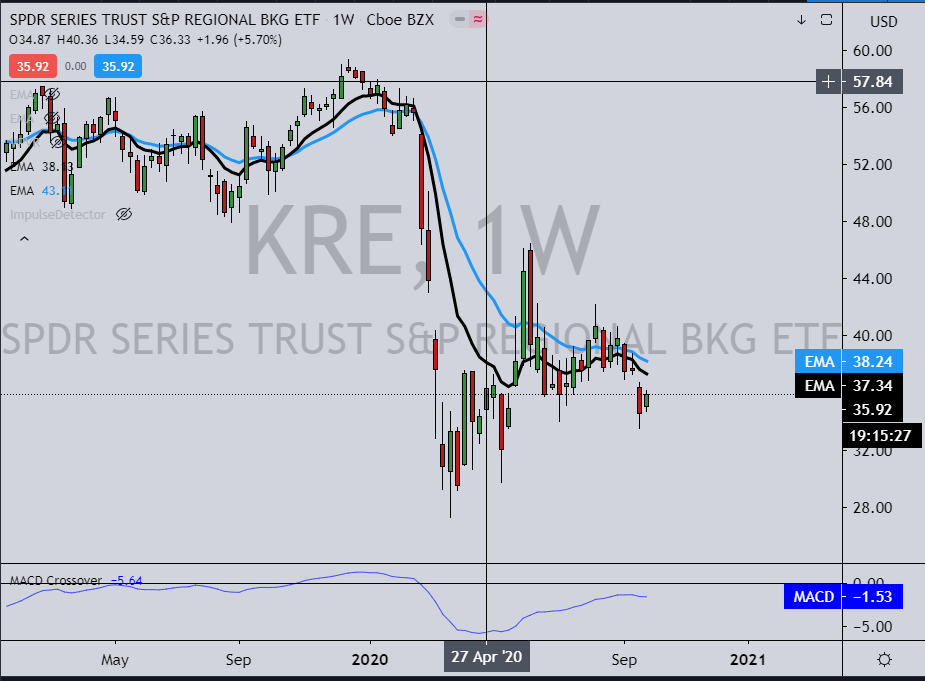

The banks are also under pressure according to the KRE index falling to the lowest levels since May leaving a sizeable gap on the charts.

If there are problems in the banks, the dollar swap lines will come under great demand again.

Meanwhile, DXY's weekly reverse head and shoulders bullish pattern is also compelling:

The euro is also meeting a strong level of resistance:

The DXY has met the 93.50's and could now be on the verge of entering a bullish Wave-5:

The hourly time frame is also printing the potential for a reverse head and shoulders pattern:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD maintains its constructive tone near 1.1400

EUR/USD remains well bid in the proximity of the 1.1400 hurdle on Thursday, deriving support from the renewed selling pressure in the US Dollar as investors continue to assess the ongoing absence of further progress in the US-China trade conflict.

GBP/USD appears sidelined around 1.3300, USD remains offered

GBP/USD holds its ground near the 1.3300 mark on Thursday amid a strong rebound in the broader risk-linked universe, all against tha backdrop of renewed weakness around the Greenback and steady uncertainty over US–China trade relations.

Gold eases from tops, back near $3,300

Gold manages to regain composure and reverses two daily drops in a row, currently approaching the $3,300 mark per troy ounce following the earlier bull run to the boundaries of $3,370. Furthermore, XAU/USD attracted safe-haven flows amid renewed concerns of a US-China trade flare-up.

Bitcoin Price corrects as increased profit-taking offsets positive market sentiment

Bitcoin (BTC) is facing a slight correction, trading around $92,000 at the time of writing on Thursday after rallying 8.55% so far this week. Institutional demand remained strong as US spot Exchange Traded Funds (ETFs) recorded an inflow of $916.91 million on Wednesday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637371934656351952.png)

-637371935528988305.png)

-637371936307037411.png)

-637371932904460964.png)