- The FOMC meets next Wednesday at 18.00 GMT.

- DXY potential bull breakout but need to close above 91.00.

The US dollar index is trading at around 90.21 up 0.07% after the bulls made a nice recovery as prices plunged sub-90 in the EU session.

The Fed will decide on monetary policy next Wednesday. Most investors believe a rate hike is a done deal as they will seek for clues of the FOMC increasing its 2018 and 2019 end-of-year targets for fed funds rate. At least four of the twelve members who projected the fed funds rate to be 2.125% or less at the end of the year would then need to revise their projection upward.

Earlier in the week on Tuesday, we saw the US CPI dataset which came mainly in line with expectations. PPI on Wednesday also came in line. On Thursday, initial jobless claims, NY empire state manufacturing and import price index came above expectation while the Philly Fed manufacturing survey disappointed. As the week ended on Friday, Industrial production JOLTS and the Michigan consumer sentiment index also came above expectation.

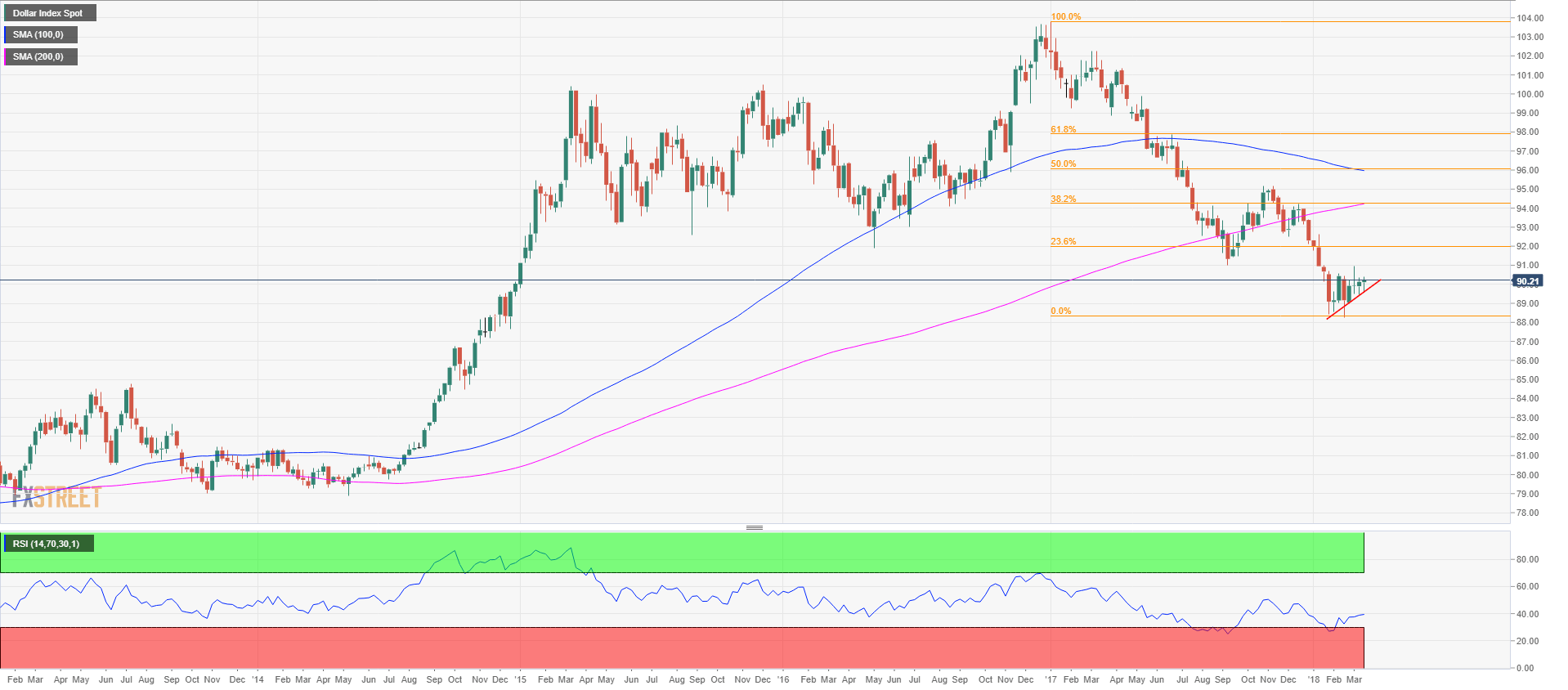

DXY weekly chart

The technical picture on the DXY looks quite similar to the USD/JPY price action since the start of the year 2018. Essentially, a bear leg followed by a consolidation. Those last two weeks the dollar bulls managed to close the bar in the upper third part and have managed to form a small triangle compression pattern in the process. Resistance is seen at the 91.00 figure followed by the 92.00 figure and Fibonacci retracement 23.6% from the December 2017-February 2018 downtrend. To the downside 89 and 88 figure are support.

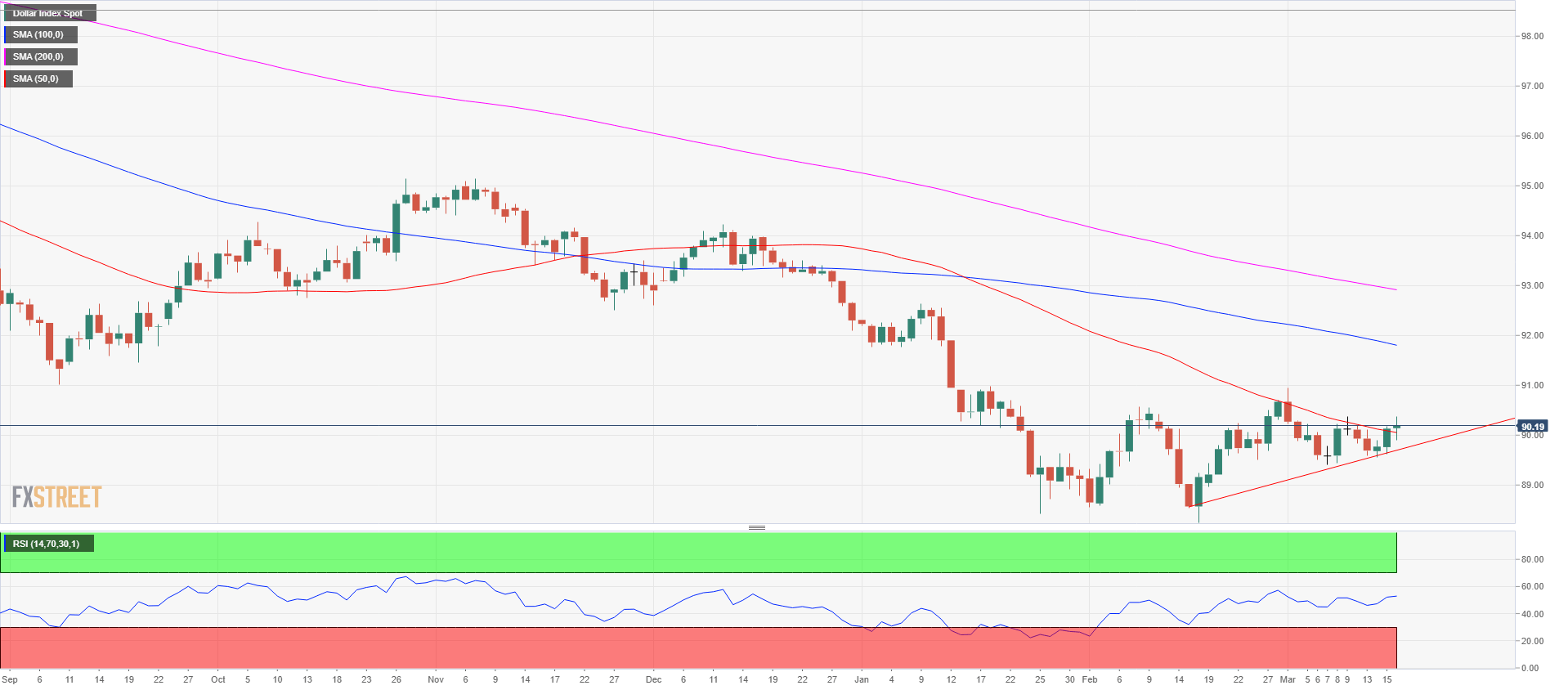

DXY daily chart

On Thursday the dollar broke above the 50-period SMA and the bullish pressure continued on Thursday as it was anticipated. The bulls are building momentum but the bull breakout will be confirmed when they can break above 91.00 (last significant swing) and start putting in higher highs. Stay tuned as next week will most likely provide an answer as to which direction the dollar will be headed in the near future.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.