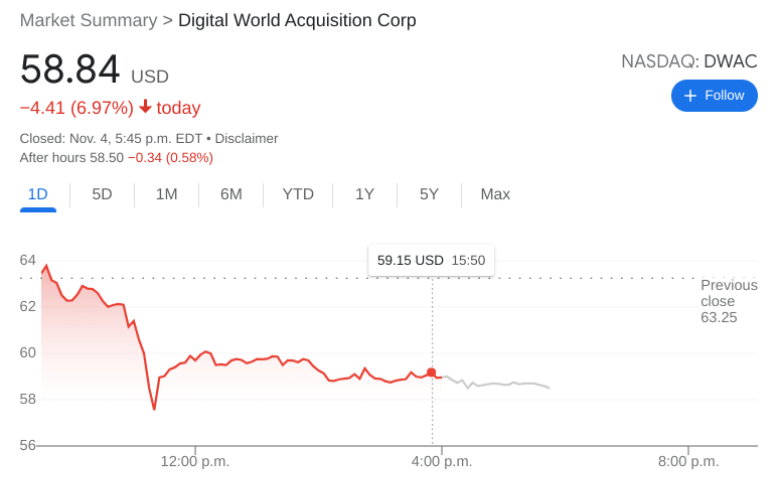

DWAC Stock Price: Digital World Acquisition slips as Trump Presidential odds are boosted

- NASDAQ:DWAC fell by 6.97% during Thursday’s session.

- Former President Trump could be using Truth Social as a way to launch another presidential campaign.

- Meme stocks pull back on Thursday after a hot start to November.

NASDAQ:DWAC extended its recent downward trajectory on Thursday as the SPAC stock continues to fall back down to Earth. Shares of DWAC fell by a further 6.97% on Thursday, and closed the trading day at $58.84. The stock has now fallen over 16% this week, despite the three major US indices hitting new all-time highs during nearly every session. On Thursday, the NASDAQ and S&P 500 continued higher, while the Dow Jones finally took a day off and fell slightly by 0.09%. The markets have shown strength after the Federal Reserve announced that the long awaited bond tapering policy would kick in later this month.

Stay up to speed with hot stocks' news!

There is rising sentiment that former President Trump is preparing for another run as the Republican Presidential candidate in 2024. His upcoming social media company that is merging with DWAC, Truth Social, could be a way of promoting his campaign since he is still banned from Facebook, Twitter, and YouTube. Odds at online sportsbooks, which are usually a sharp way of gauging the market, have current President Biden and Trump as neck and neck for the most likely President following the 2024 election.

DWAC stock forecast

DWAC fell alongside its meme stock brethren on Thursday, as the sector pulled back after a hot start to the month of November. Shares of legacy meme stocks AMC (NYSE:AMC) and GameStop (NYSE:GME) fell by 1.91% and 0.27% respectively. Other meme stocks that closed Thursday in the red include ContextLogic (NASDAQ:WISH), Vinco Ventures (NASDAQ:BBIG), Phunware, Inc (NASDAQ:PHUN), and Camber Energy (NYSEAMERICAN:CEI).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet