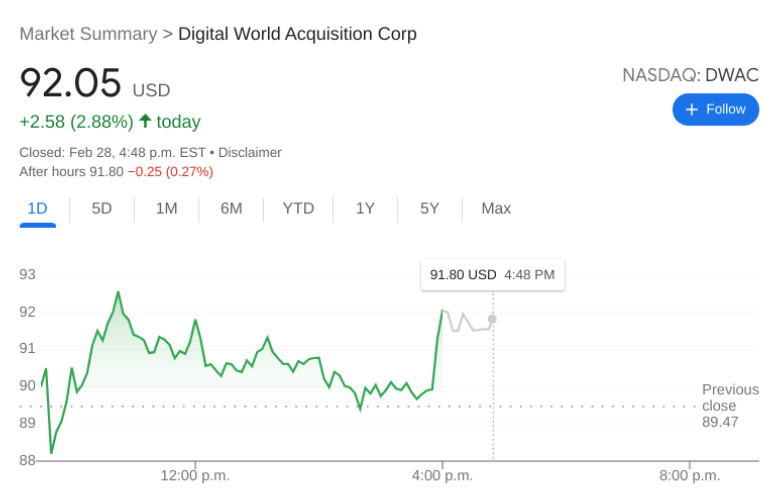

DWAC Stock Price: Digital World Acquisition jumps higher into the closing bell

- NASDAQ: DWAC gained 2.88% during Monday’s trading session.

- Truth Social is off to a rocky start as it has already censored some of its users.

- The platform is verifying some controversial figures and using bots for others.

NASDAQ: DWAC closed out the month of February on a high note as the pre-merger SPAC stock saw a late-day surge into the closing bell. Shares of DWAC gained 2.88% and closed the trading session at $92.05. The stock has been unaffected by the recent growth stock correction and has managed to gain 10.6% during the month of February and a whopping 78.1% so far in 2022. While an official merger date with Truth Social has yet to be determined, we should be seeing one imminently as the platform went live on the internet back on February 21st.

Stay up to speed with hot stocks' news!

While the platform has soared to the top of the Apple App store download list, there is a long line of users who are frustrated with the delay. There are apparently over 500,000 users on the waiting list, with no sign of any progress on freeing up more spaces inside the app. On top of that, Truth Social has already censored some of the existing users for content they have posted or usernames they have selected, which goes against the ‘free speech’ mantra that the platform has been preaching.

DWAC stock forecast

On top of the rocky start for the app, the platform is also making headlines by verifying known far right wing activists like Nick Fuentes. Some of Fuentes’ content has been so controversial, that other social media sites like Twitter and Gettr have banned the activist from their sites. In addition to this, Truth Social is apparently creating branded pages for companies like the NFL, without the league’s consent. It is utilizing bots to repost what the NFL is posting on its other social media channels to make it look like a legitimate profile.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet