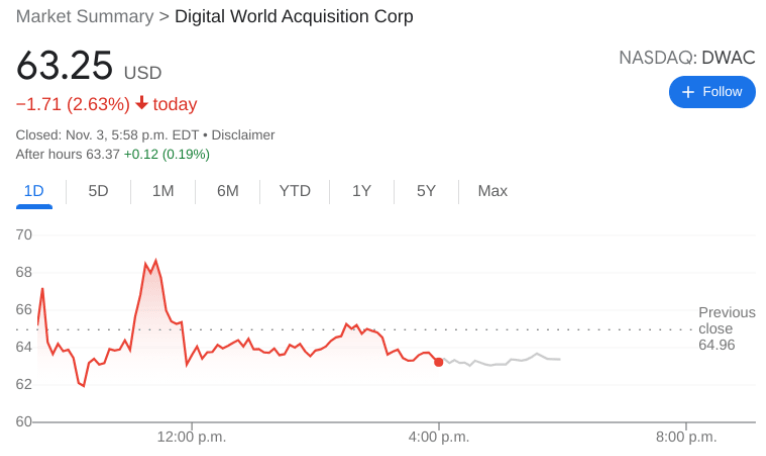

DWAC Stock Price: Digital World Acquisition dips as short interest for the stock mounts

- NASDAQ:DWAC fell by 2.63% during Wednesday’s trading session.

- DWAC now has the highest nominal short interest amongst SPAC stocks.

- GameStop jumps higher again as NFT rumors persist.

NASDAQ:DWAC stumbled on Wednesday after flying higher during the previous session. It was just another bump in the road for the volatile meme SPAC that has taken the focus off of GameStop (NYSE:GME) and AMC (NYSE:AMC) on Reddit forums like r/WallStreetBets. Shares of DWAC fell 2.63% and closed the trading day at $63.25. The stock is still trading at over six times its NAV price of $10, but has pulled back considerably from its recent highs of $175 per share. The stock has been a rallying point for retail investors and has been the top discussed ticker symbol on Reddit for the past couple of weeks.

Stay up to speed with hot stocks' news!

It should then come as no surprise whatsoever that DWAC has the highest nominal short interest out of any SPAC stock in the market right now. It is hard to argue with that as well, considering that the company it is merging with, Truth Social, has yet to even be released to the public. Former President Trump has stated that the platform should be ready at some point in 2022, but the short interest is definitely justified considering how high and how fast the stock has soared.

DWAC stock forecast

While DWAC has been dominating the headlines, legacy meme stock GameStop has quietly risen by nearly 25% over the past five trading sessions. What is causing this resurgence of GameStop’s stock? It has been linked to an NFT project featuring a Loophole cryptocurrency that is based on the Ethereum blockchain. There has been some leaked information from Loophole’s public GitHub space that there is an impending GameStop NFT platform in the works.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet