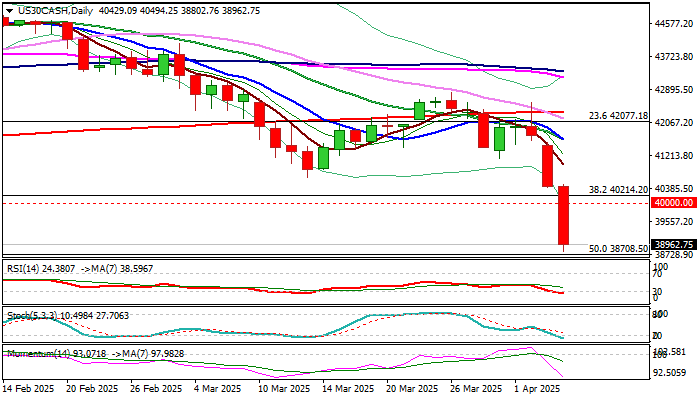

Dow was down 4.8% in past two days, strongly pressured by risk aversion as markets fear of deeper crisis that US tariffs and counter measures could cause on global economy.

From the technical point of view, daily studies are in full bearish setup, while weekly studies are weakening and contribute to negative outlook.

Break of important supports at 40214 and 40000 (Fibo 38.2% of 32328/45088 / psychological) and attempts to register weekly close below these levels, would generate strong bearish signal for deeper drop.

Completion of a double-top pattern on weekly chart has been confirmed by the latest weakness that adds to downside risk.

Immediate target lays at 38708 (50% retracement) with break here to expose 37624 (weekly Ichimoku cloud base) and 37202 (Fibo 61.8% retracement).

Strong resistances at 40000/40700 zone (broken supports / former low of Mar 13) should ideally cap upticks.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after downbeat Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY fades the rebound to 142.85 amid US-Japan trade optimism

USD/JPY fades the impressive rebound from seven-month lows of 141.61, falling back toward 142.00 in the Asian session on Thursday. The pair tracks the US Dollar price action, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery supports the pair.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.