Dow Jones Industrial Average backslides 300 points on bearish Friday

- The Dow Jones fell seven-tenths of a percent on Friday.

- Stocks are paring back recent election-fueled gains.

- US Retail Sales beat forecasts, but still grew by a smaller amount in October.

The Dow Jones Industrial Average (DJIA) trimmed it’s recent bull run, declining over 350 points at its lowest and giving back roughly 0.85% as investors grapple with an increasingly uncertain future. US Retail Sales beat expectations but still eased back from previous figures, and Federal Reserve (Fed) Chair Jerome Powell splashed cold water on rate-cut-hungry investors this week when he reaffirmed that the Fed wasn’t “in a hurry” to cut interest rates further.

The post-election “Trump rally” is set to continue unwinding as the Trump campaign begins to leak potential candidates for key official positions that former President Donald Trump intends to install at the beginning of his second term in January. Pharmaceutical stocks took an unexpected hit on Friday after Trump’s team announced their plans to nominate vaccine skeptic Robert F. Kennedy Jr. to the head of the US Department of Health and Human Services. RFK Jr. has openly discussed his plans to ban several vaccines and other health products outright, a surprisingly hyper-regulatory move that flies in the face of the broader market’s initial exuberance at a Trump election win which was meant to carry further deregulation efforts to the public marketplace.

US Retail Sales grew by 0.4% MoM in October, slightly above the 0.3% forecast but still down from September’s revised print of 0.8%. Core Retail Sales, or Retail Sales excluding automobile purchases, failed to meet expectations, growing by a scant 0.1% compared to the expected 0.3% and even further below the previous month’s 1.0% revised print.

Dow Jones news

Despite steep headline losses in key equities, the Dow Jones is roughly on-balance on Friday, with about half of the major equity board’s listed stocks finding the green for the day. Disney (DIS) rose another 5.3% to $115 per share as the entertainment giant enjoys a firmer rebound in quarterly revenues than many investors anticipated. Meanwhile, Amazon (AMZN) and Amgen (AMGN) both fell around 4.5% on the day to $201 and $282 per share, respectively, as tech stocks and biomed stocks take an end-of-week hit.

Dow Jones price forecast

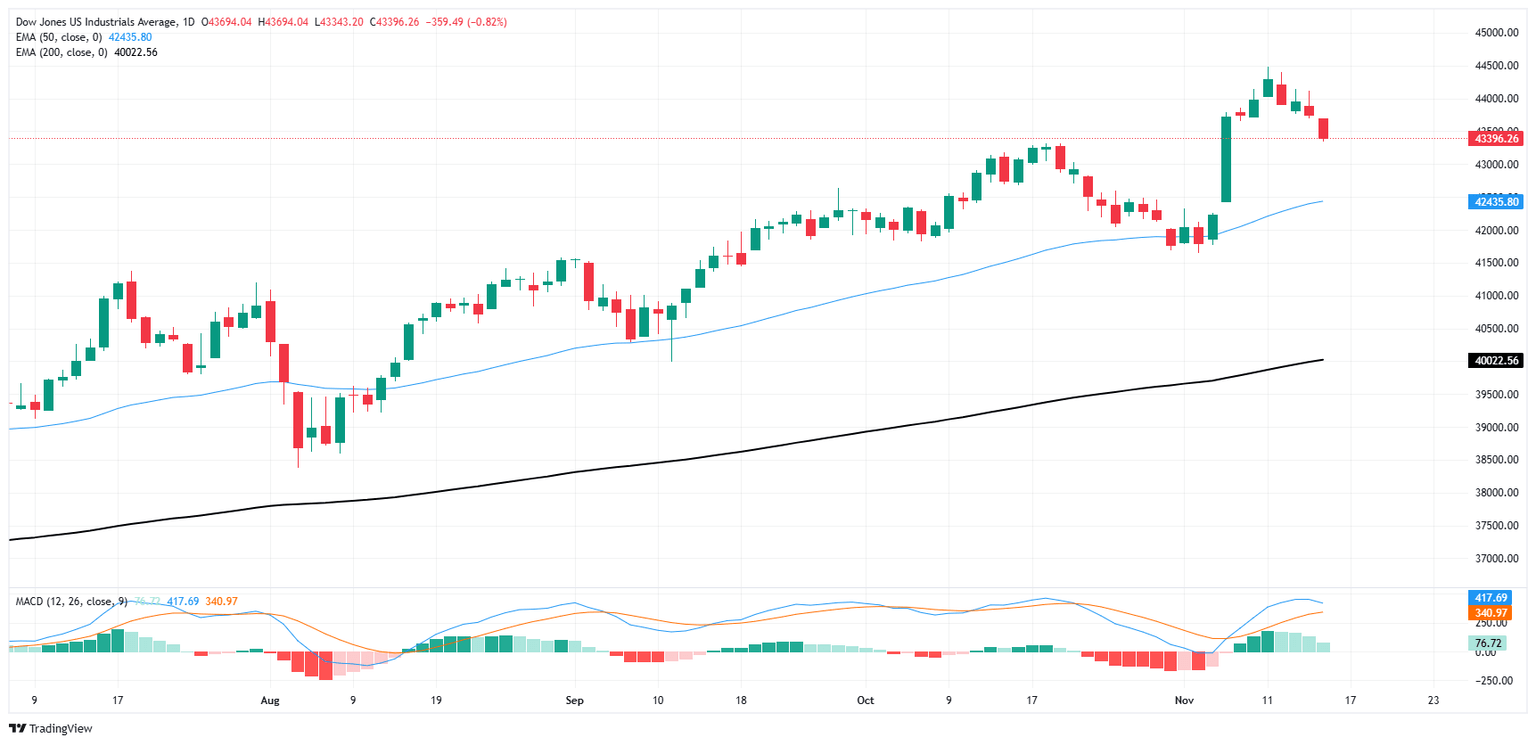

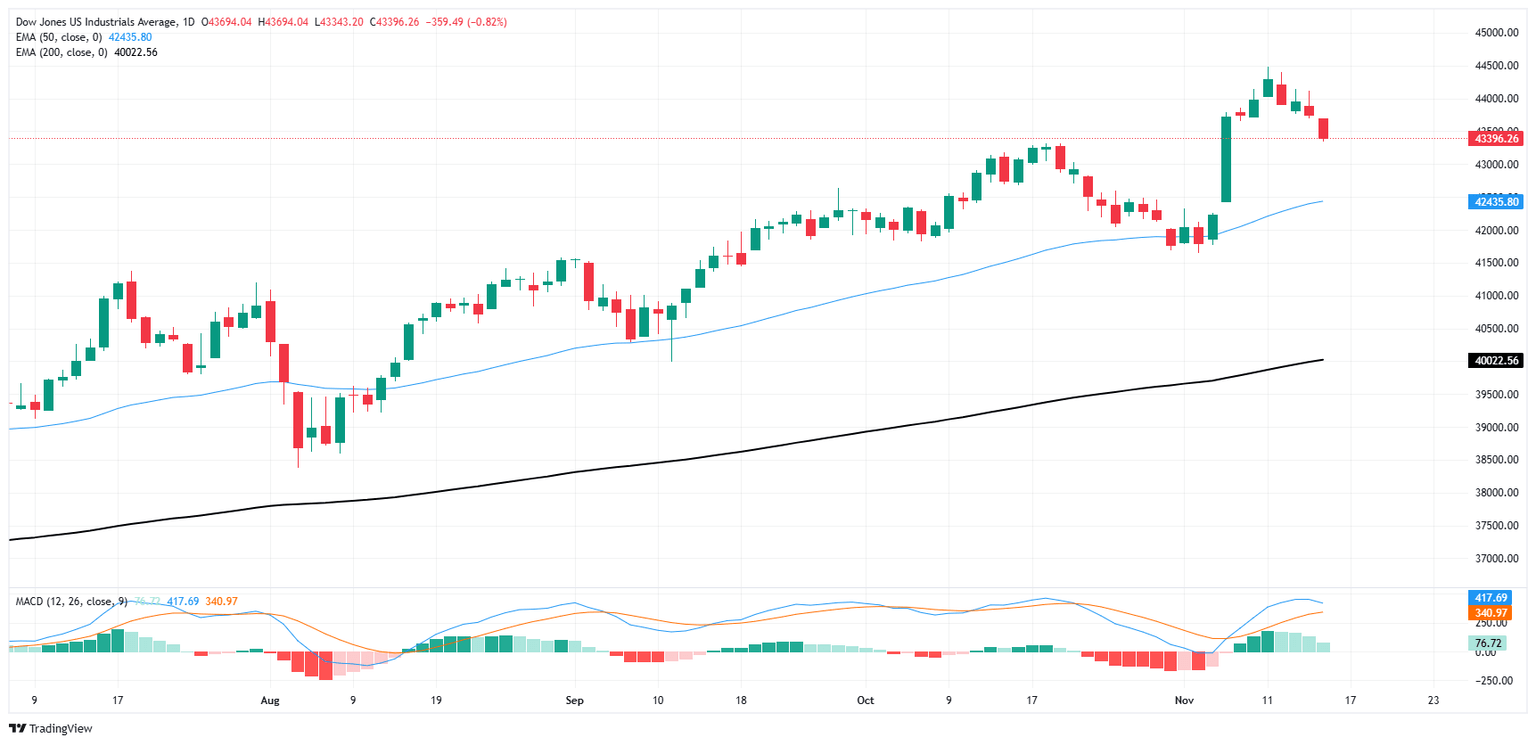

Despite a bearish extension on Friday sending the Dow Jones deeper into the red for the week, there’s still plenty of room to run to the downside before technical warnings begin to emerge. Bullish pressure could also reappear in the charts at anytime as investors remain hopeful to keep a firm grasp on record high territory.

The Dow Jones is poised to end the week lower by 1.3% despite setting an other new all-time high bid earlier this week at 44,485. The nearest technical barrier sits at the 50-day Exponential Moving Average (EMA) near 42,430.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.