Dow Jones Industrial Average waffles after US CPI print matches expectations

- The Dow Jones spun in a tight circle on Wednesday near 44,200.

- Market expectations for US CPI inflation were met, keeping rate cut hopes on-balance.

- The tech sector rose on Wednesday, offsetting declines in health services.

The Dow Jones Industrial Average (DJIA) spun in a tight circle on Wednesday, keeping close tabs on the 44,200 level after US Consumer Price Index (CPI) inflation broadly met market expectations. Despite an uptick in annualized CPI inflation figures, investors remained confident that the Federal Reserve (Fed) is on pace to deliver one last quarter-point rate cut before the end of the year.

US CPI inflation rose slightly for the year ended in November with headline CPI inflation ticking up to 2.7% YoY from 2.6%, while core CPI inflation held steady at 3.3% YoY. Monthly headline CPI inflation also rose in November, climbing to 0.3% MoM from October’s 0.2%. Despite the overall upswing in main inflation figures, Wednesday’s CPI print was broadly in line with forecasts, keeping investor sentiment tepid.

According to the CME’s FedWatch Tool, rate traders are now pricing in 95% odds of a 25 bps rate cut when the Fed convenes for its last rate call on December 18. Despite the near-term uptick in CPI inflation, investors have decided that the wiggle in reported figures isn’t enough to push the Fed away from delivering one last quarter-point cut to wrap up 2024.

Dow Jones news

The Dow Jones struck a middling note on Wednesday with gains in tech and communications stocks getting weighed down by losses in health services. Nvidia (NVDA) rose over 3.3% to test $140 per share as the AI rally continues on the back of rate cut expectations, while Unitedhealth Group (UNH) shed nearly 5% to fall below $540 per share after the US Senate took up a bill to force health insurers to exit the pharmacy management industry.

Dow Jones price forecast

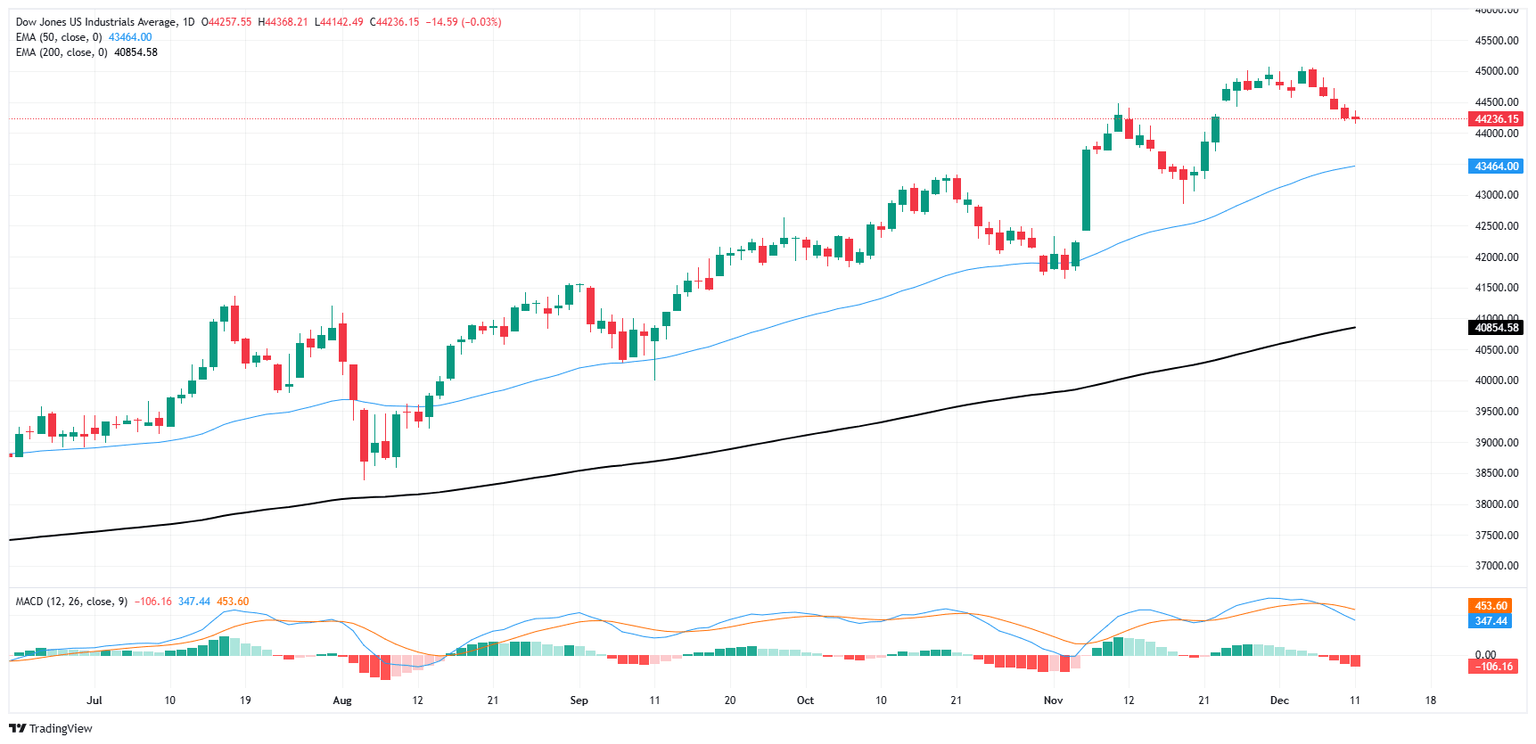

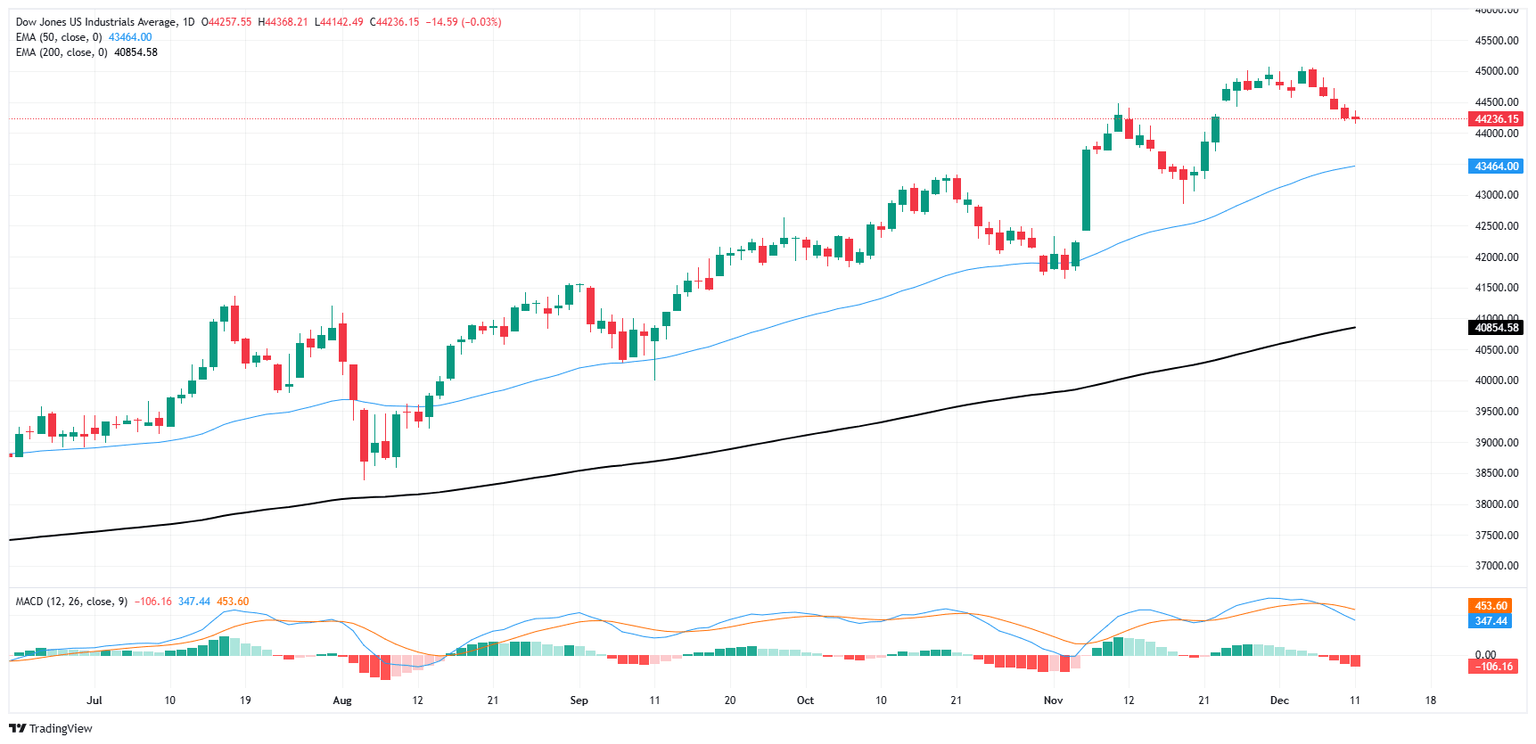

The Dow Jones is holding steady on the low end of a recent downturn. The major equity index peaked just above the 45,000 major handle just last week, and bullish momentum is taking a rare breather and allowing price action to return to some version of normalcy. The index is down 1.8% from all-time highs and treading water just north of 44,000.

Despite a near-term pullback, the Dow Jones is poised for another leg higher if short momentum is able to drag bids back down to the 50-day Exponential Moving Average (EMA) near 43,460. The long-term trend still favors bidders however, with the DJIA still up a stellar 17% and change YTD in 2024.

Dow Jones daily chart

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Dec 11, 2024 13:30

Frequency: Monthly

Actual: 2.7%

Consensus: 2.7%

Previous: 2.6%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.