Dow Jones Industrial Average backslides on weak tech sector

- The Dow Jones backslid around 150 points on Thursday.

- US equities are higher overall, but losses in key tech stocks are punishing the Dow.

- Earnings brought more downside misses in overvalued silicon companies.

The Dow Jones Industrial Average (DJIA) slid on Thursday, falling around 150 points to retest the 44,750 level. Earnings reports dominated US equities on Thursday, with the tech sector suffering a string of missed revenue and growth expectations.

US economic data was strictly mid-tier, though week-on-week Initial Jobless Claims rose to 219K through the week ended January 31. Median market forecasts expected a print of 213K, and the previous week’s figure was revised slightly to 208K.

Another Nonfarm Payrolls (NFP) jobs data dump looms on Friday. Net job additions are expected to ease to 170K in January, down from December’s print of 256K. Revisions to older data will be closely watched this week. Post-print revisions drifted toward the stronger side during 2024, frustrating market participants hoping for cracks in the US employment landscape to help push the Federal Reserve (Fed) toward more rate cuts.

Dow Jones news

In aggregate terms, the Dow Jones is roughly on-balance on Thursday, with about half of the equity board’s listed securities testing the high side. Nvidia (NVDA) topped the pile, gaining 2.2% and clawing back to $127 per share, followed closely by Caterpillar (CAT), which rose 2% to $366 per share.

Honeywell (HON) tumbled 5.2%, falling to $210 per share after issuing annual forward guidance that fell short of analyst expectations. Salesforce (CRM) also backslid, declining 4.2% to $210 per share as the AI rally sputters out.

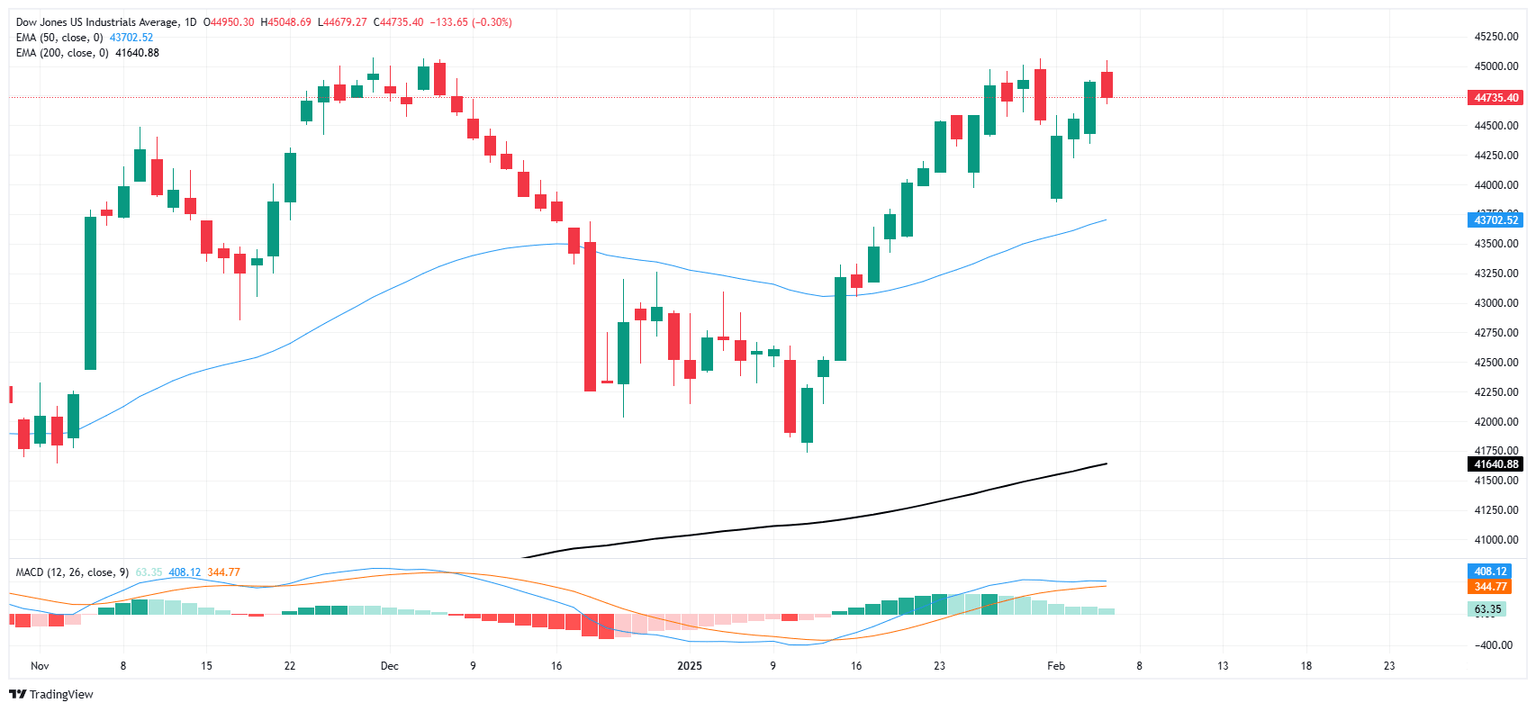

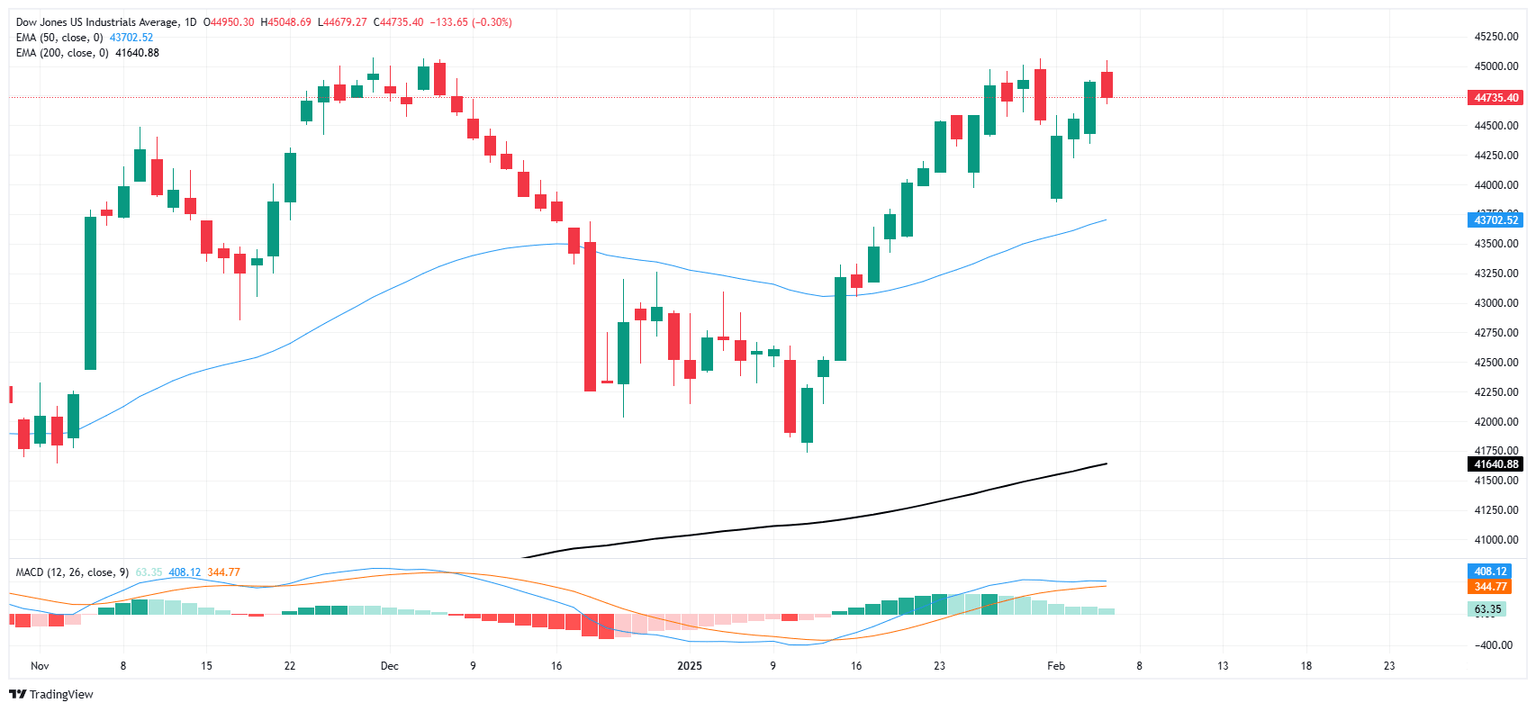

Dow Jones price forecast

The Dow Jones is set to snap a three-day winning streak as the 45,000 handle proves to be too slick of a surface for bulls to get a foothold on. Despite a softer stance on Thursday, the Dow is holding stubbornly in bull country, in the green by 5.2% so far in 2025.

A technical floor is priced in at the 50-day Exponential Moving Average (EMA) near 43,700. On the high side, the immediate target for bidders will be record highs set in December just above 45,065.

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Feb 07, 2025 13:30

Frequency: Monthly

Consensus: 170K

Previous: 256K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.