Dow Jones Industrial Average trims recent gains as tariff tensions set in

- The Dow Jones backslid on Thursday, falling back below 40,000.

- Equities are souring as investors hunker down for messy, prolonged trade frictions.

- US CPI inflation ticked lower in a welcome reprieve, but tariff effects still loom ahead.

The Dow Jones Industrial Average (DJIA) eased lower on Thursday, backsliding below the 40,000 handle as investors rethink this week’s record-setting surge after the Trump administration announced yet another last-minute pivot away from its own confusing tariffs. Despite delaying the majority of President Trump’s “reciprocal” tariffs, an across-the-board 10% import levy is still in effect during the 90–day ‘grace period’, and a 145% tariff on all Chinese imports is still in effect.

On top of the eye-watering 145% tariff on Chinese goods, China has slapped its own 84% retaliatory tariff on all imports from the US, which will overwhelmingly impact US agriculture and energy, two darlings of the Trump administration. Additionally, the 10% interim tariff also applies to all goods from Canada and Mexico and promises to cause pricing problems for US consumers, who remain notably sensitive to upside price pressures.

Read more stock news: US stocks slide after historic Wednesday rally, NASDAQ down 5.7% on Thursday

US Consumer Price Index (CPI) inflation came in well below expectations in March. Core CPI eased to 2.8% YoY, reaching a four-year low after stubbornly holding above 3.0% for nearly eight months. Headline CPI inflation also eased to 2.4% YoY, and investment markets will be devastated if tariffs undo years’ worth of work by the Federal Reserve (Fed) to bring inflation to heel.

This week will wrap up with University of Michigan (UoM) Consumer Sentiment Index survey results on Friday. The UoM Consumer Sentiment Index is expected to contract yet again in April as consumers continue to buckle under the weight of the Trump administration’s tariff and trade “strategy”, and is expected to sink to a nearly three-year low of 54.5. Consumer Inflation Expectations are also on the cards for Friday. UoM 1-year and 5-year Consumer Inflation Expectations last clocked in at 5% and 4.1%, respectively.

Dow Jones price forecast

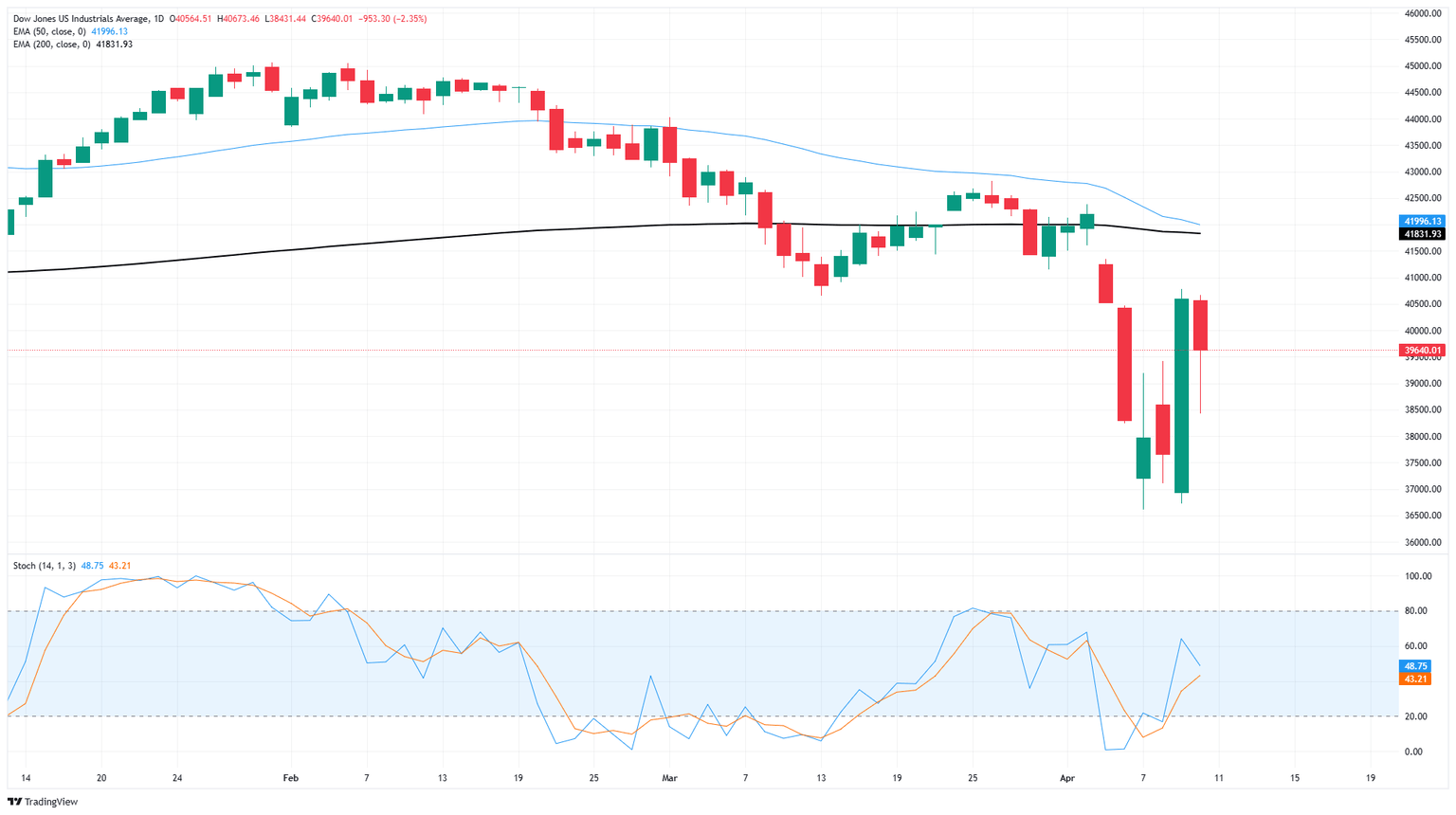

Despite a wild mid-week recovery, the Dow Jones still found some room on the low side on Thursday, paring away some of the index’s near-term gains and keeping the 40,000 major price handle in play. The Dow Jones is trading in a wide, choppy range on the low side of the 200-day Exponential Moving Average (EMA) near 41,900.

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Apr 10, 2025 12:30

Frequency: Monthly

Actual: 2.8%

Consensus: 3%

Previous: 3.1%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.