Dow Jones Industrial Average recovers footing after tariff threats turn up empty

- The Dow Jones is hitting a comfortable midrange around 44,450 on Tuesday.

- Threats of nearly-global tariffs have evaporated over 24 hours.

- Trade tensions remain an issue with China, but tariff breaks are priced in.

The Dow Jones Industrial Average (DJIA) is testing the 44,450 region on Tuesday, with equities slowing their recent pace of volatility as United States (US) President Donald Trump walks back nearly all of his recent trade war blustering and kicks his self-imposed tariff can down the road for a third time. US import tariffs on goods from Mexico and Canada have been delayed for up to 30 days, while planned tariffs on China are still on the table and warnings of tariffs on goods from the European Union are also in the pipe.

Despite all the trade war bluster, the Trump administration's three straight walkbacks have left investors with a strong sense that the tariffs were never meant to be an implemented part of the US’ trade strategy. Instead, they were President Trump’s best efforts to work twice as hard to accomplish half as much, strong-arming some of America’s closest trading partners to the negotiating table and obtaining concessions that were largely already agreed to with the previous US federal administration. Tariff threats are likely to be treated less seriously by markets moving forward as investors focus on material issues.

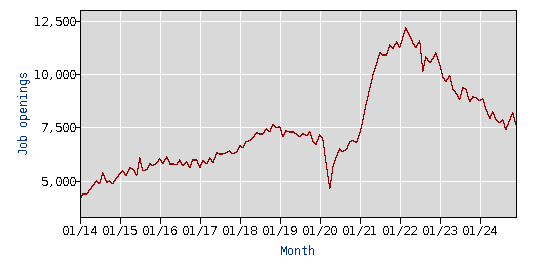

US JOLTS Jobs Openings figures from December printed on Tuesday, showing a slight cooling to 7.6M from 8.09M. JOLTS has an abysmally low respondent rate of around 30%, and December’s print is also a preliminary figure, due for a number of revisions throughout the calendar year. Regardless, the trend in patchy job openings data remains clear as the indicator grinds into two-year lows.

Dow Jones news

Over two-thirds of the Dow Jones equity board is testing into the high side on Tuesday, with investor sentiment brushing off its recent overreaction to trade war gesticulations by the US. Merck & Co tumbled over 10% and fell below $90 per share despite topping Wall Street earnings expectations after the drug supplier softened its forward guidance, warning investors that demand for vaccines in China has not recovered to expected levels and will be pausing further shipments to mainland China to alleviate a supply buildup.

Dow Jones price forecast

A back-and-forth tussle on daily candlesticks has the Dow Jones strung along a near-term midrange, with price action hung up near the 44,500 level. Bids found a technical floor near the 44,000 major price handle this week, but topside momentum remains thin as investors struggle to climb over 45,000. A further cooling period may be required as technical oscillators churn in overbought territory.

Dow Jones daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.