Dow Jones Industrial Average swamped out by rate cut woes

- The Dow Jones was mired in congestion near 43,000 on Tuesday.

- US ISM PMI figures came in much hotter than expected in December.

- Above-forecast business survey results are reigniting fresh fears of fewer Fed cuts.

The Dow Jones Industrial Average (DJIA) churned on Tuesday as tech stocks pared back recent gains, with investors pushed further off their Goldilocks stance after a hotter-than-expected print in December’s ISM Purchasing Managers Index (PMI) crimped rate cut hopes heading into 2025.

Equity markets hoping to extend last year’s AI-fueled tech bull run into the new year ran into a hard wall on Tuesday, with key darlings of the tech space giving back recent gains. Profit-focused shareholders bluntly want their preferred silicon wafer-punching companies to lean further into demand from the AI tech space, even as the segment of that sector that deals with actually selling AI solutions to consumers and businesses struggle to develop stable methods of generating profit.

ISM’s Services PMI print for December came in well above median market forecasts, clocking in at 54.1 versus the expected 53.3 and rebounding firmly from the previous month’s 52.1. ISM Services Priced Paid survey results also accelerated to a 22-month high of 64.4 in December compared to November’s 58.2.

With business activity outlooks broadly rising faster than expected, as well as prices paid by those businesses appearing to be back on the rise, investors are balking at the prospect of inflation remaining stickier than previously expected. Firm business activity growth plus rising producer prices will make it more difficult for the Federal Reserve (Fed) to deliver as many rate cuts as traders were hoping.

According to the CME’s FedWatch Tool, rate traders now expect the Fed to hold off on any further rate cuts until June. The Fed is expected to stand pat on rates through most of the first half of 2025.

Dow Jones news

A little over half of the companies listed on the Dow Jones are testing into the green on Tuesday, keeping the headline index on balance despite heavier downside in key tech stocks. Nvidia (NVDA) tumbled over 5%, falling back below $142 per share as investor expectations for the chipmaker cool off. The company recently unveiled a new range of chipsets based on its now-familiar Blackwell architecture, but its decision to focus the latest release on a back-to-its-roots pivot to providing hardware for gaming rigs received a delayed tepid response from AI tech investors who initially bid the company up earlier in the week.

Dow Jones price forecast

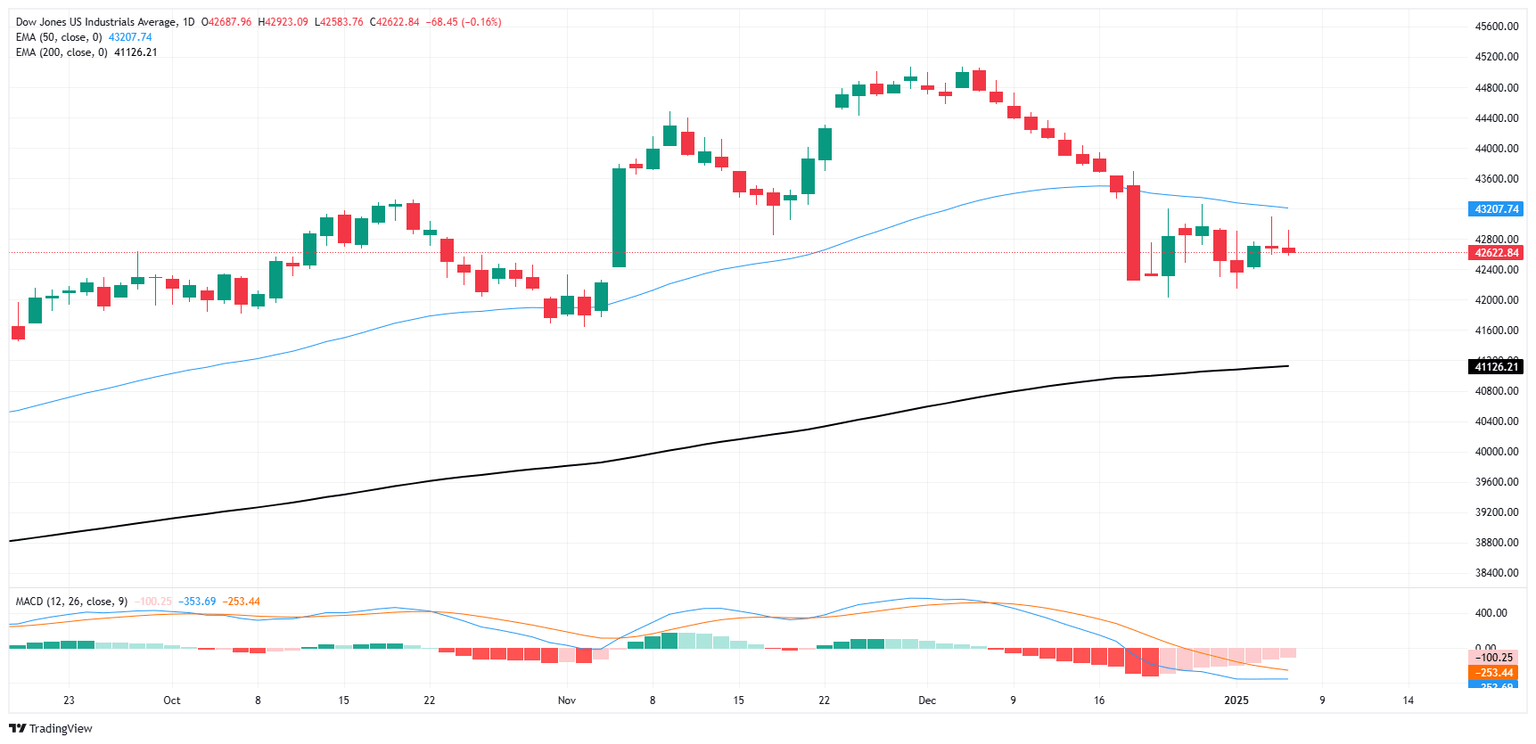

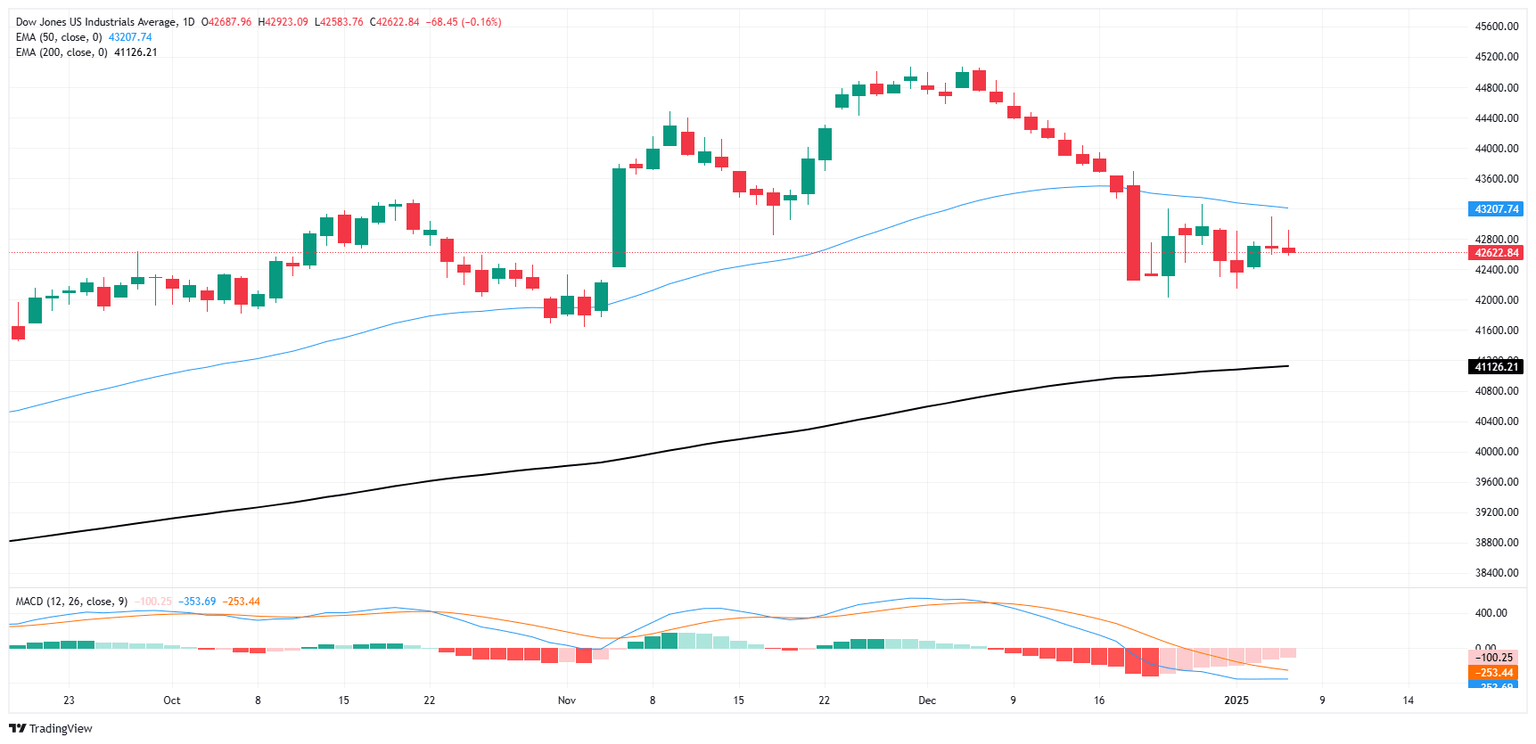

A rough consolidation pattern is cooking into the Dow Jones chart, keeping the major equity index hobbled in a choppy range between 43,000 and 42,000. Short pressure remains unable to push price action firmly into a downside trajectory, and bids remain bolstered into a technical ceiling from the 50-day Exponential Moving Average (EMA) descending through 43,200.

Bulls tired of punching the buy button could run out of gas after keeping the Dow Jones pushed into a one-sided bullish trend. The DJIA has outpaced its own 200-day EMA for 14 straight months, and bidders could be tired of winning, which could see the index pare further gains and fall back to softer chart regions.

Dow Jones daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.