Dow Jones Industrial Average falls flat as other indexes gain ground after US data miss

- Dow Jones churns close to flat on Wednesday as index gets left out of bull run.

- Dow Jones struggles as other US equity indexes climb into fresh record highs.

- US data broadly softened, sparking a risk rally on heightened rate cut hopes.

The Dow Jones Industrial Average (DJIA) failed to capitalize on a broad-market uptick in risk appetite on Wednesday. Other US equity indexes climbed into fresh all-time highs, but the DJIA floundered close to the day’s opening bids.

US data broadly softened on Wednesday, sparking a lopsided bull run in market sentiment after easing economic figures helped to bolster rate cut hopes back into the high end. US ADP Employment Change in June fell to 150K compared to the forecast increase to 160K from the previous month’s revised 157K. Looking into the finer details of ADP’s employment report, further softness is found; the overwhelming majority of job gains for the period were in lower-paying leisure and hospitality positions.

US Initial Jobless Claims also ticked higher to 238K for the week ended June 28, rising from the previous 233K and bolstering the four-week average to 238.5K. The June ISM Services Purchasing Managers Index (PMI) activity survey also eased, falling to a multi-year low of 48.8. This is the indicator’s lowest reading since June of 2020, and entirely missed the forecast decline to 52.5 from the previous 55.1.

Read more: FOMC Minutes left the door open to rate hikes if inflation picks up pace

The Federal Reserve (Fed) continues to lean firmly into a cautious tone on monetary policy, and the Federal Open Market Committee’s (FOMC) latest Meeting Minutes showed that the US central bank continues to urge caution on declaring victory over inflation. However, policymakers have nodded the head toward improving price growth figures recently, and the FOMC’s internal discussions noted a slowing in US economic data.

Dow Jones news

The Dow Jones is entirely mixed on Wednesday, with half of the index’s constituent securities in the red on an otherwise risk-on trading day. Losses are being led by Unitedhealth Group Inc. (UNH), which fell below $490.00 per share, declining -1.68%. On the high side, Salesforce Inc. (CRM) is testing $261.00 per share, gaining 1.86% on Wednesday and climbing nearly five points.

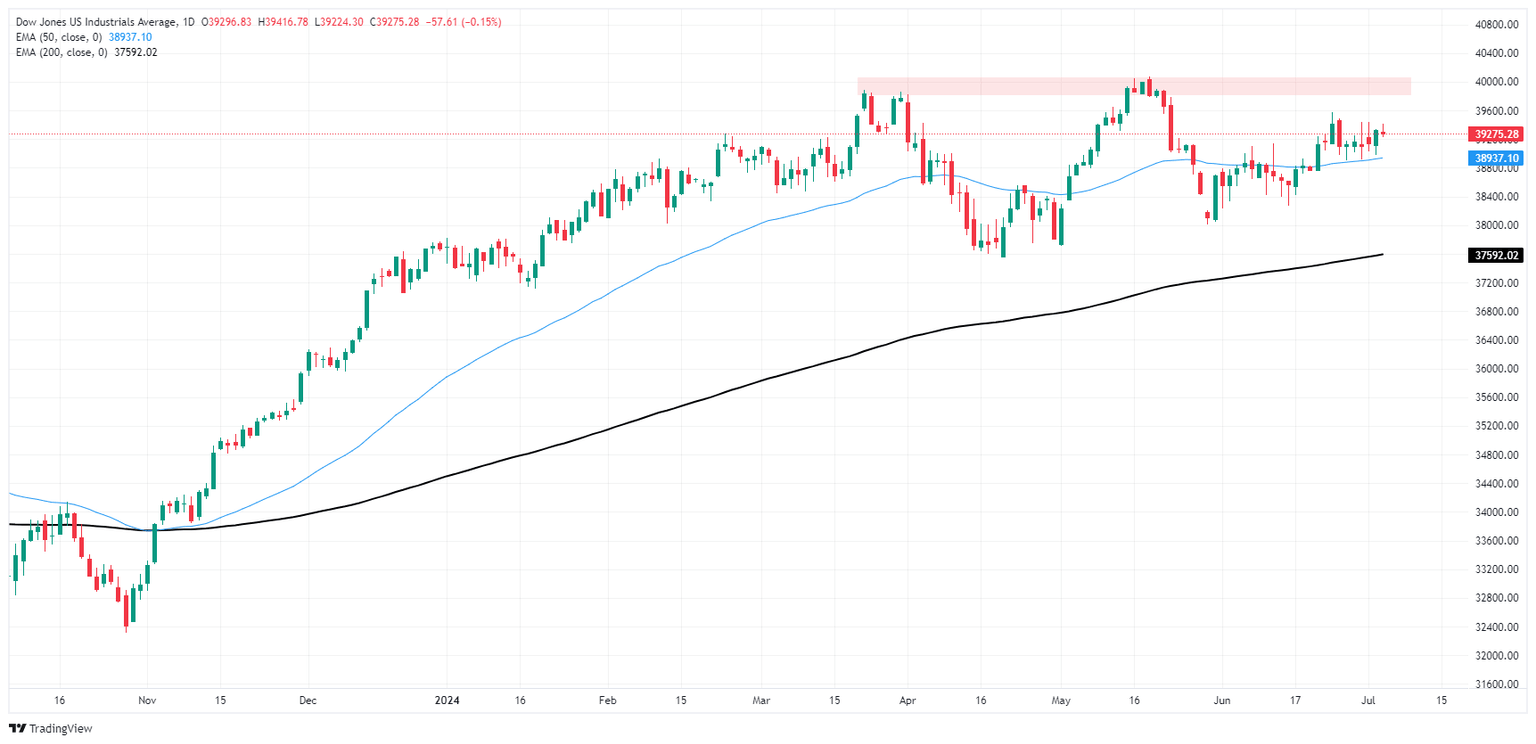

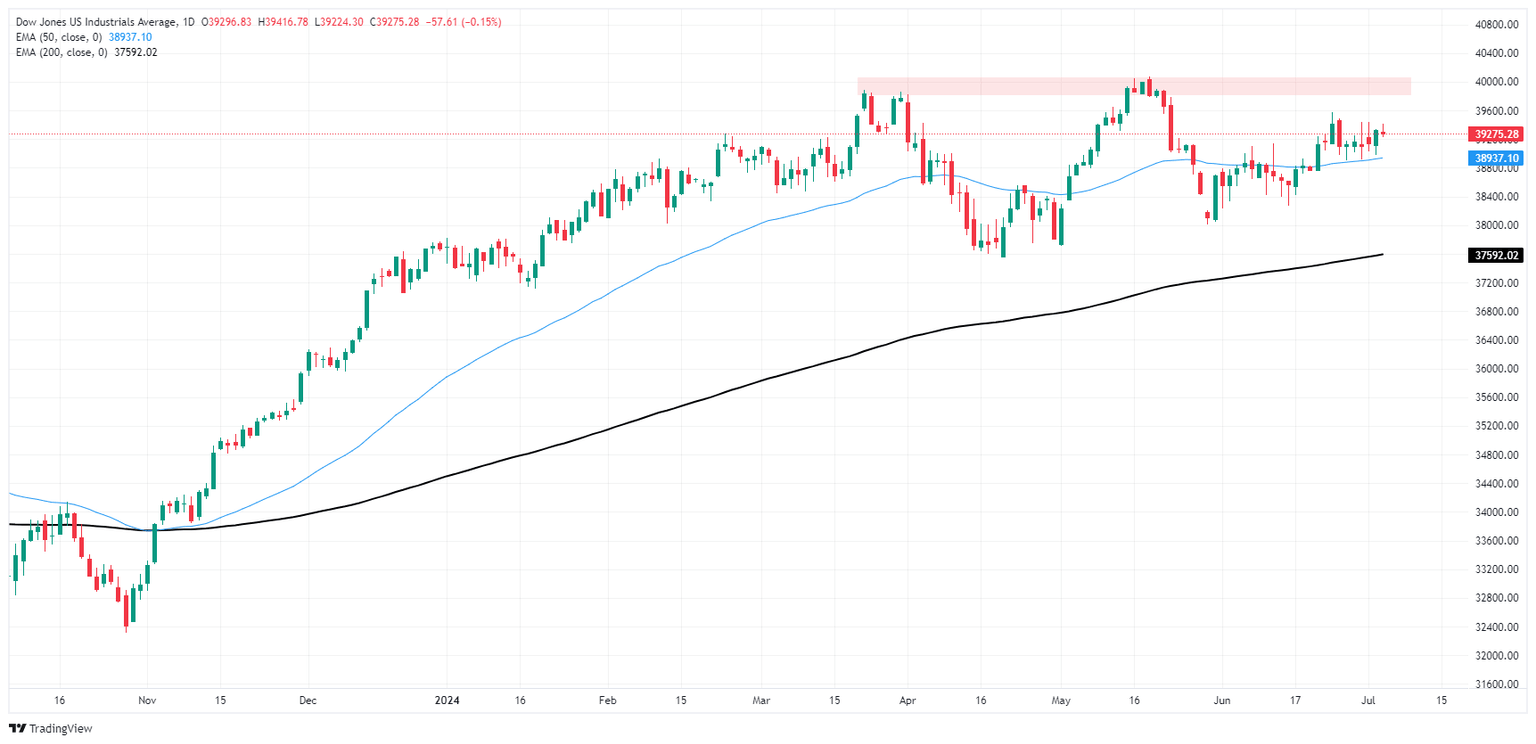

Dow Jones technical outlook

The Dow Jones Industrial Average continues to churn in familiar middle ground, cycling in a rough consolidation range just above 39,000.00. The index briefly recovered into a near-term high above 39,500.00 early last week, but bidders have run out of gas.

Daily candlesticks find technical support from the 50-day Exponential Moving Average (EMA) at 38,936.00, but topside momentum remains thin as the Dow Jones treads water on the high end of a near-term recovery from May’s sharp correction into 38,000.00.

Dow Jones five minute chart

Dow Jones daily chart

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jul 03, 2024 12:15

Frequency: Monthly

Actual: 150K

Consensus: 160K

Previous: 152K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.