Dow Jones Industrial Average taps all-time highs on Wednesday near 39,550.00 post-Fed

- Dow Jones rallied after Fed rate call sparks risk-on market bids.

- FOMC Interest Rate Projections eased looking forward, despite long-term uptick.

- Powell's press conference reveal Fed shrugs off recent inflation misses.

The Dow Jones Industrial Average (DJIA) is up nearly a full percent on Wednesday and etching in fresh all-time peaks after investors found the buy button following the Federal Reserve's (Fed) latest rate call, which saw the US central bank hold rates at 5.5% as investors had broadly expected.

Despite the rate hold, the Fed is leaning toward the dovish side. Fed Chairman Jerome Powell effectively shrugged off recent inflation misses to focus on expectations that price growth will continue to slow to the Fed's 2% target. The Federal Open Market Committee (FOMC) shifted near-term Interest Rate Projections slightly lower on the Dot Plot of rate forecasts, seeing one-year inflation landing somewhere around 3.9% compared to the previous 4.6%. Despite the shift in forecasts, the Fed still only sees around three rate cuts in 2024, totalling about 75 basis points through the end of the year.

Read more: Jerome Powell speaks on policy outlook after leaving interest rate unchanged

Dow Jones news

Of the 30 securities listed on the Dow Jones, only three remain trapped in the red on Wednesday after the Fed's latest rate call, with Chevron Corp. (CVX) stuck on the downside, falling around 1.25% on the day. The day's largest DJIA gainer is Boeing Co. (BA), rising nearly 4% and trading into $188.00 per share as the hammered stock sees a much-needed recovery.

US stocks have tilted broadly into the high side as risk appetite surges on hopes of Fed rate cuts, with the Consumer Discretionary Sector climbing over 1.3%, closely followed by a rebound in telecoms with the Communications Sector climbing 1.2%. The Health Sector remains underweight, shedding around a third of a percent on Wednesday.

Dow Jones Industrial Average technical outlook

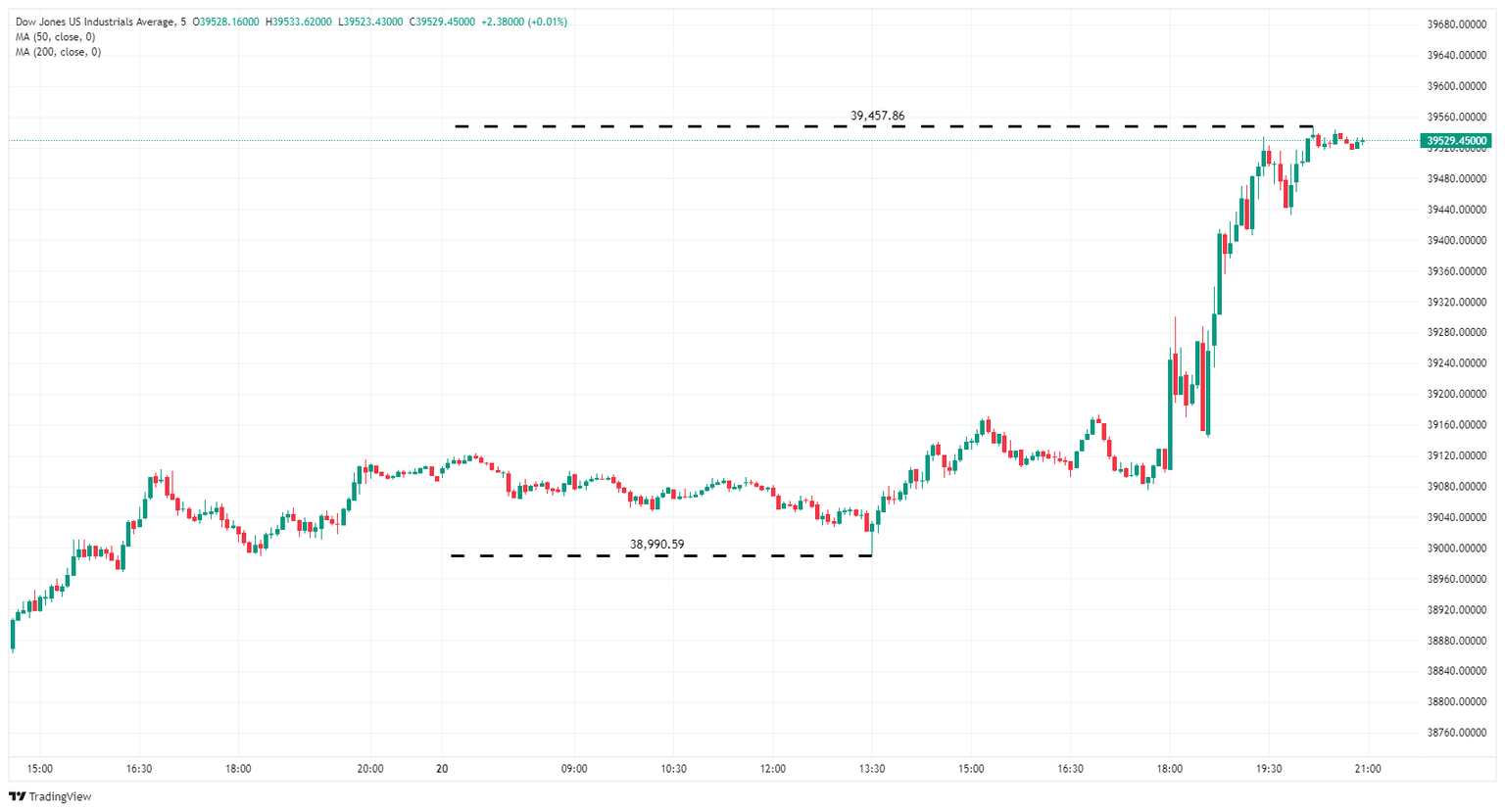

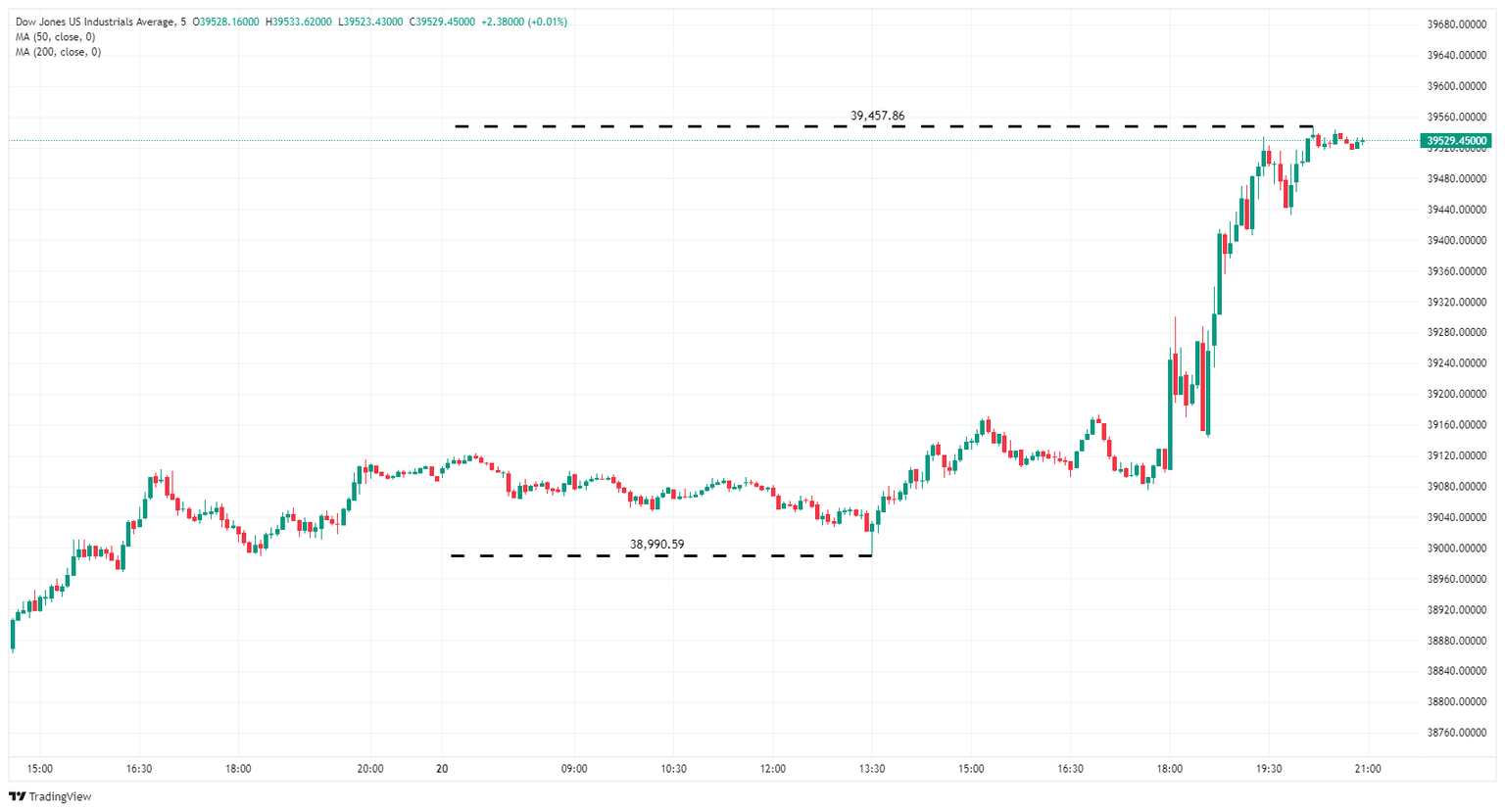

The Dow Jones drifted into an early low near 39,000.00 on Wednesday before recovering into 39,160.00. Bids initally pulled back into the day’s opening prices near 39,100.00 as investors waited for the Fed, and the major equity index rallied into a fresh all-time high just above 39,525.00 after Fed chair Jerome Powell shrugged off recent hotter-than-expected inflation prints.

The DJIA cracked through recent near-term consolidation to break record bids, and the US equity index is up over 2% from the last swing low into 38,600.00.

Dow Jones Industrial Average 5-minute chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.