Dow Jones Industrial Average climbs over 200 points on Monday

- The Dow Jones Industrial Average rose over 150 points in Monday bid.

- Equities continue to recover ground as market sentiment climbs.

- Previous recession fears have eased following upbeat US data.

The Dow Jones Industrial Average (DJIA) climbed over 200 points on Monday after US market indexes broadly gained ground. Investors have rediscovered their risk appetite after a recent broad-based plunge sparked by fresh recession fears off the back of US economic data tilting to the downside faster than many had expected. However, an upturn at the tail end of a recent batch of US figures has soothed investor fears, and markets are broadly climbing once more.

Markets will now pivot to fully focus on upcoming central bank speaking notes as the Jackson Hole Economic Symposium looms ahead later in the week. At the current cut, markets still have a September rate cut fully priced in, according to the CME’s FedWatch Tool. Odds of a double cut for 50 bps have eased to less than 25% this week, down from a two-week high of over 70%, with rate traders piling into bets of a more reasonable 25 bps cut on September 18.

Dow Jones news

Most of the Dow Jones was on the rise on Monday, with over two-thirds of the equity board climbing into the green. McDonald’s Corp. (MCD) climbed 3.4% to $288.00 per share, while Intel Corp. (INTC) followed behind, rising 2.5% to $21.39 per share.

On the low end, Boeing Corp. (BA) fell a full percent to $178.15 per share as the aviation company struggles to return value to investors, with Apple Inc. (AAPL) declining -0.7% to $224.50 per share.

Dow Jones price forecast

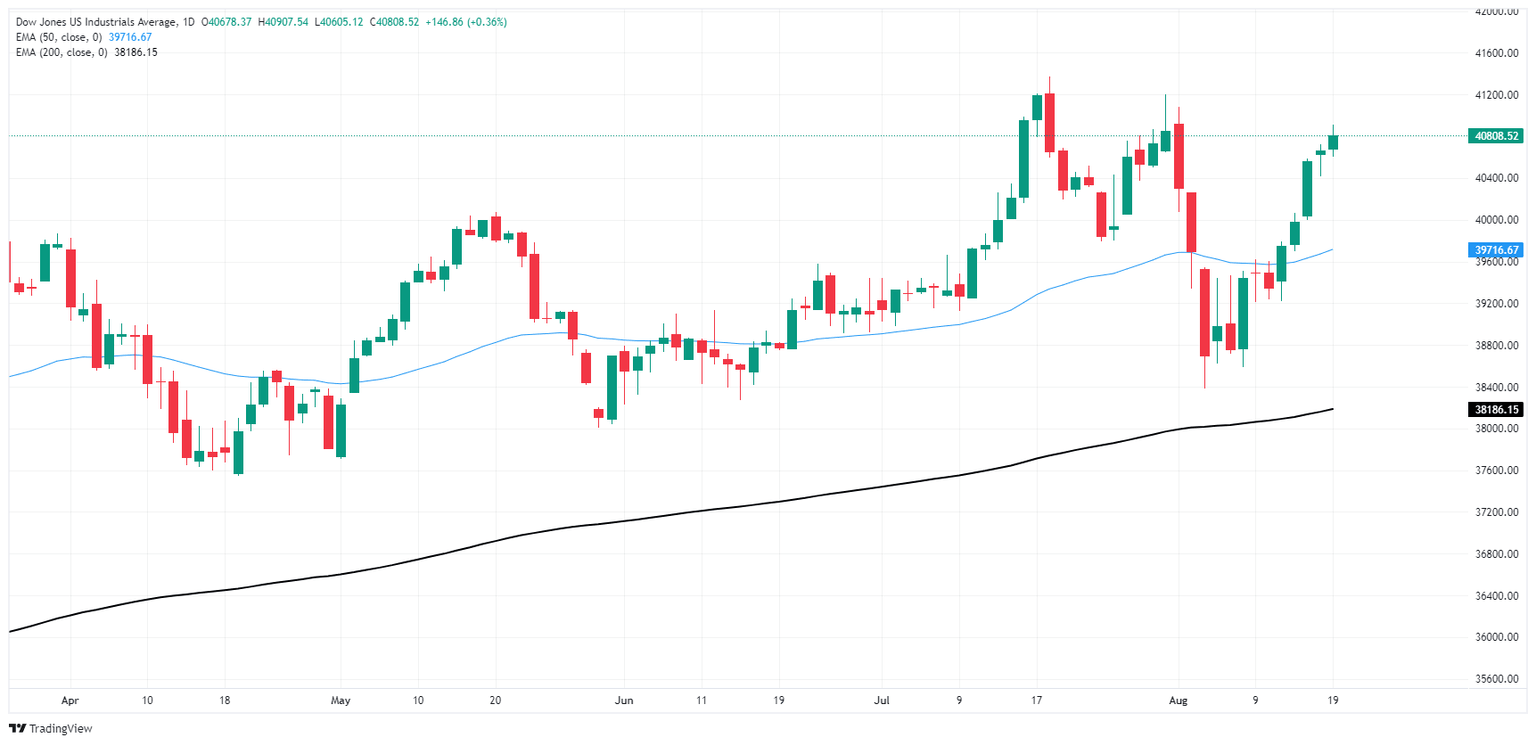

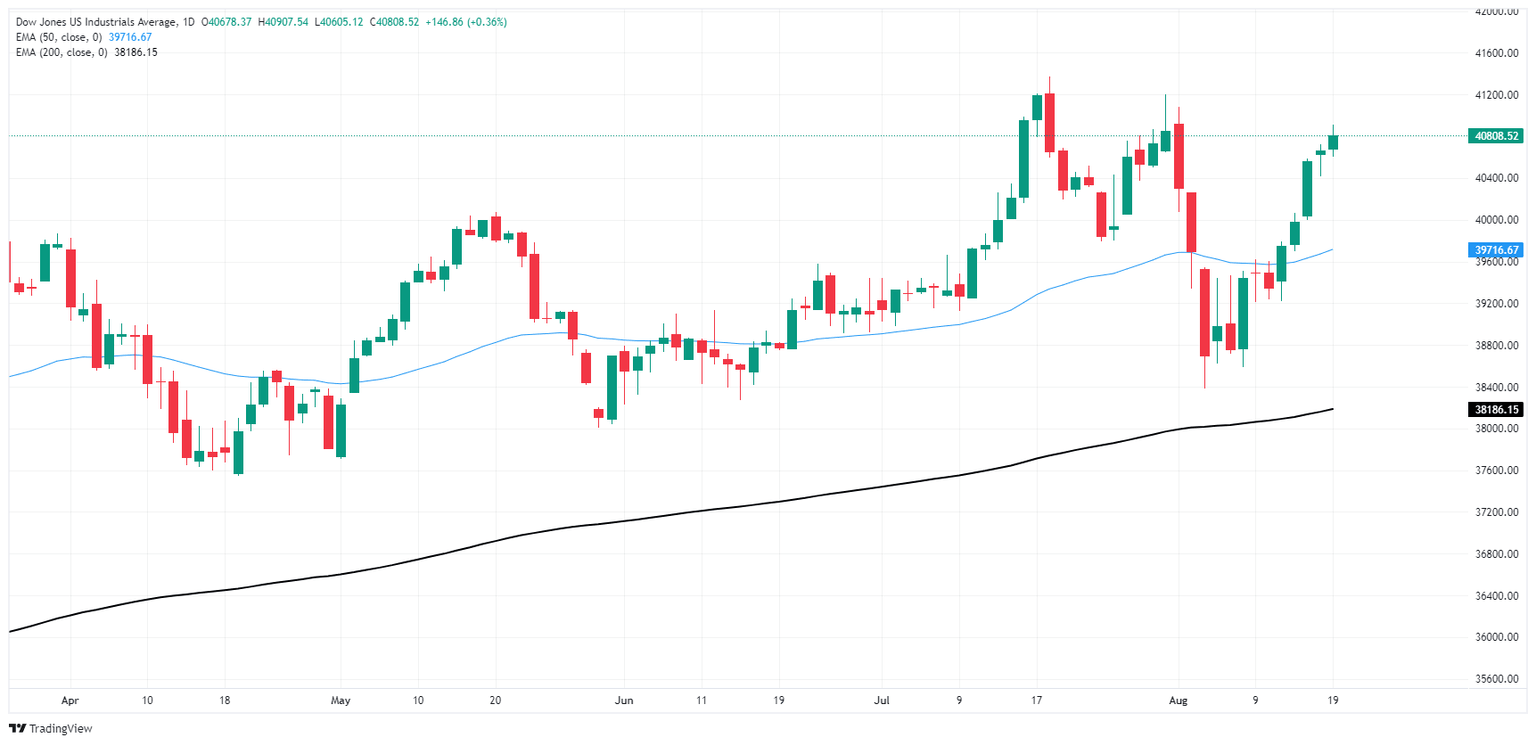

The Dow Jones is on pace to chalk in a fifth straight bullish candle on Monday, tapping an intraday high of 40,907.54 as the major equity index continues to climb after hitting a near-term low of 38,382.90 in recent weeks.

The DJIA is slowly grinding its way back towards all-time highs set in July at 31,371.38, and bullish momentum remains the flavor of the week as investors claw back ground. A technical floor is priced in at the 50-day Exponential Moving Average (EMA) at 39,728.00.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.