Dow Jones futures move lower as China CPI soars, yields rise again and oil falls

- Dow Jones futures look lower on Monday as markets digest a further rise in yields.

- China CPI data was higher than expected, raising fears of a slowdown.

- Oil prices slump to $93 on Chinese demand fears.

Dow Jones futures are indicating a lower open from the main stock indices on Monday as concerns mount over the health of the Chinese economy. At the time of writing, Dow Jones futures are trading 100 points lower at 34,517 indicating a loss of 0.3%.

Read more stock market research

Dow Jones futures news: Chinese lockdowns denting stock markets

Overnight losses in Asia look to feed through to the US indices this morning. The news from China is looking especially grim with further covid lockdowns across the country as it seeks to battle the much more contagious variants. China has placed numerous regions on lockdown which has affected manufacturing capacity for some of the world's largest companies. More noteworthy though is how Chinese demand will fare.

China – as is well known – is the world's most populous country and is a major consumer of electronics products, electric cars, etc. Oil prices collapsed this morning because of fears over a slow down in Chinese demand. China is the second-largest crude oil user in the world after the US. The Chinese authority has been loosening monetary policy while the rest of the world has been tightening it. This is an effort to shore up the Chinese economy and boost the construction and real estate sectors. This morning we got much higher than expected PPI and CPI data from China, putting a question mark over the viability of monetary easing. Also out were car sales data sowing an 11.7% drop in Chinese vehicle sales in March.

Chinese equities were hammered overnight and this has fed through to Dow Jones futures this morning. The drop in oil prices though may provide some form of silver lining to equities if interest rate fears calm. Earnings season begins this week with the big banks but next week is the real beginning after this shortened Easter week.

European markets were also mixed this morning as the EU once again mulls a Russian oil embargo and yields remain on the ascent. Money markets now price in nearly 75 bps of rate hikes this year from the ECB.

Dow Jones futures forecast: Choppy trading range

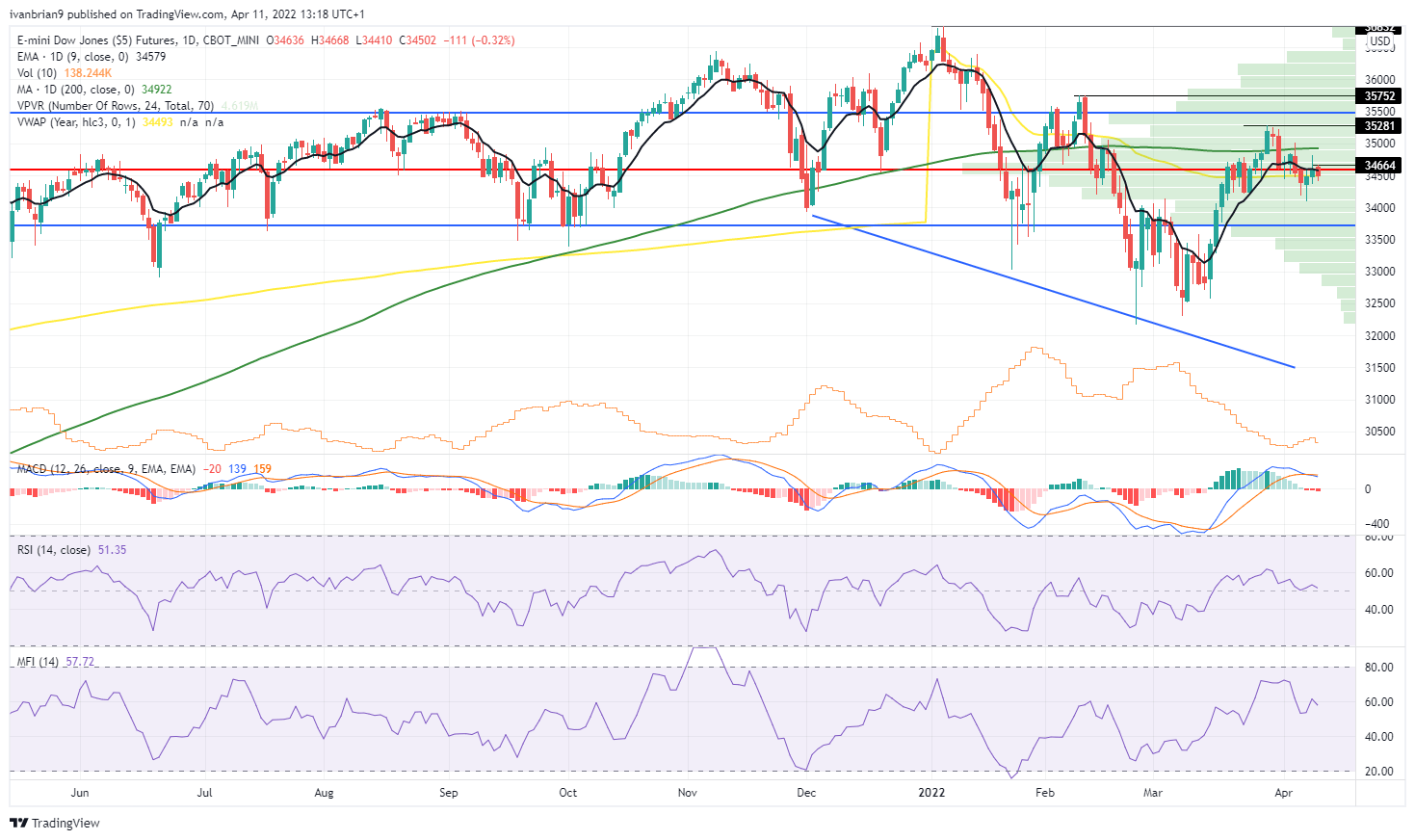

There is not much change here. The Dow Jones futures remain in the downtrend we had identified. 35,281 remains the DJIA futures most recent high and so our pivot point. 34,500 is the point of control since last Jun and so is a massive equilibrium point for Dow Jones futures, with a huge volume profile bar (green, right of chart).

Markets move from points of equilibrium to points of instability so which way will this one go? Below the aforementioned 35,281 and the 200-day at 34,922 puts the money slightly on another move lower. However, this is earnings season so that will be the more important factor going forward. Earnings may finally help to establish a trend, up or down, and take Dow Jones futures out of this choppy trading range.

Dow Jones futures chart, daily

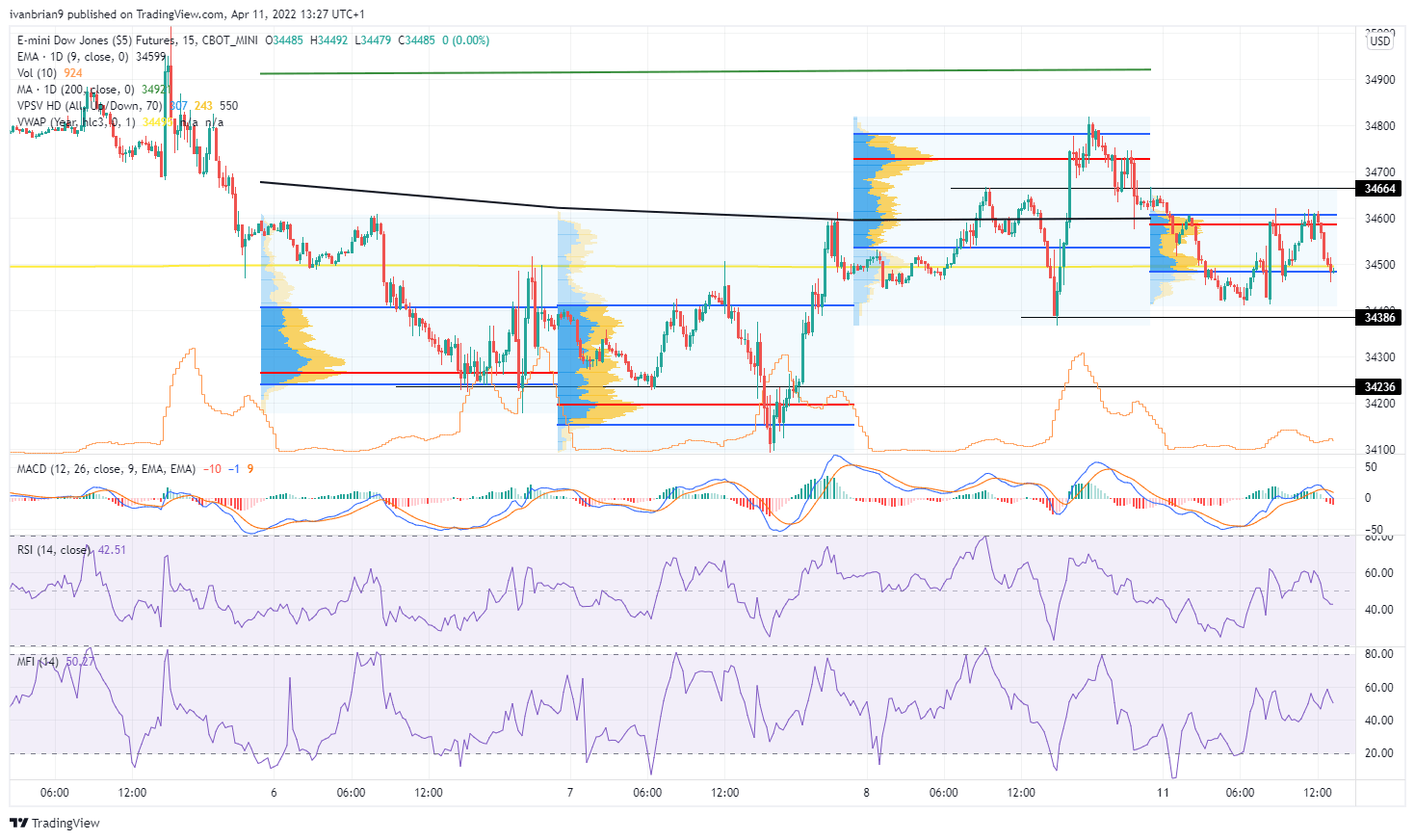

The intraday pivot is 34,386, a DJIA futures break below and a quick move to 34,236 is likely.

Dow Jones futures chart, 15 minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.