Dollar Index (DXY) forecasting the rally after three waves pull back

In this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index DXY , published in members area of the website. As our members know, Dollar is still trading within the cycle from the September’s low. Recently, we saw a 3-wave pullback, followed by a solid rally as expected. In the further text, we are going to explain the wave count.

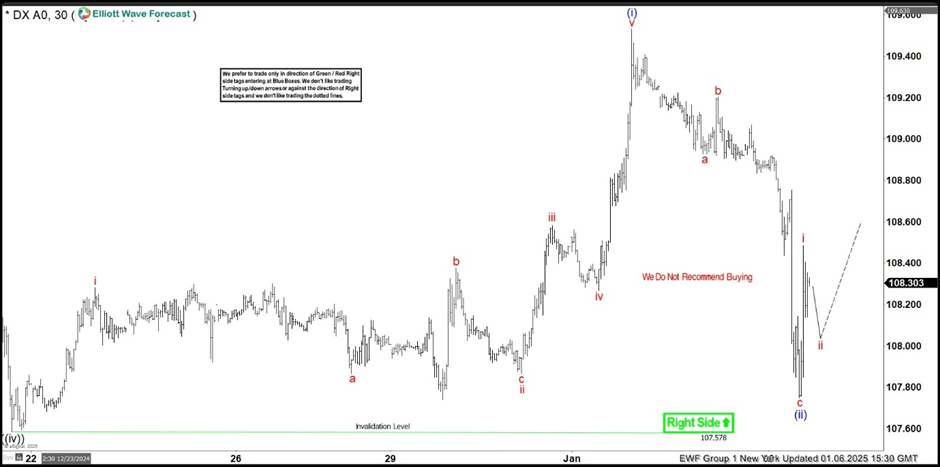

DXY H1 New York 01.06.2025

The current view suggests that the Dollar Index completed a 3-wave pullback from the peak, ending at the 107.751 low and labeled as wave ((ii)) blue. A sharp rally followed from this low, appearing impulsive. We have labeled this short-term cycle as wave i red, indicating the start of a new bullish cycle. A 3-wave pullback in wave ii red is anticipated before the rally resumes. We expect the Dollar Index to continue finding intraday sellers in 3, 7, and 11 swings.

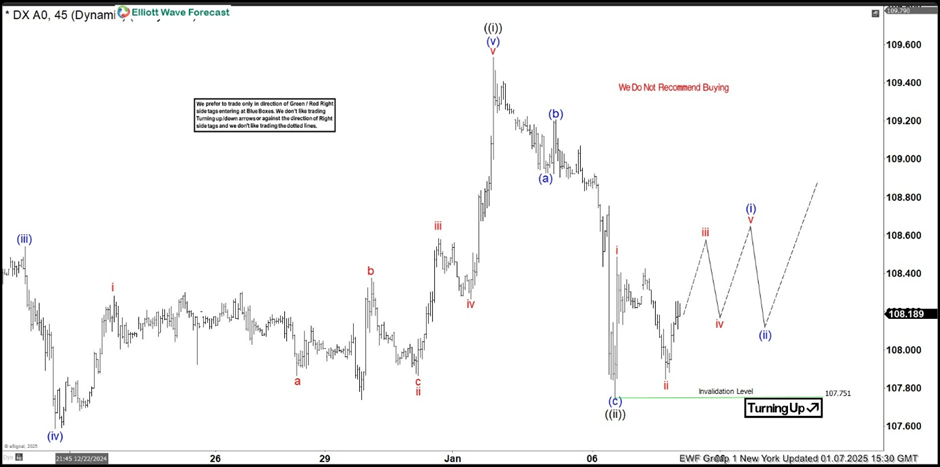

DXY H1 New York update 01.07.2025

We saw a 3-wave pullback in ii red, followed by a move up. The key level is 107.751. While the price stays above it, we expect more rally in the Dollar Index, ideally towards new highs. A break above the previous peak ((i)) black will confirm that wave ((iii)) is in progress.

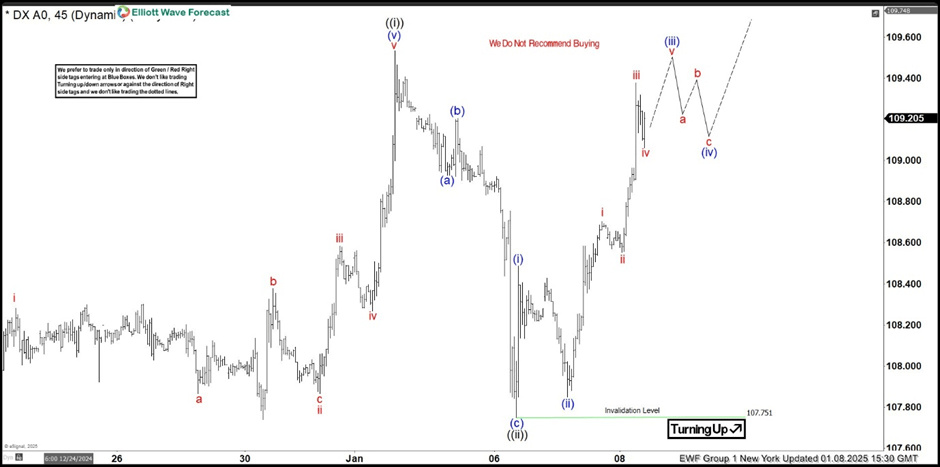

DXY H1 New York update 01.08.2025

The 107.751 low held as expected, and the price moved higher. We got a decent rally in Dollar index. The price is now approaching the previous peak, and we are looking for a break above wave ((i)) black to confirm further strength.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com