- DWAC stock surges 8% on Thursday to close at $48.06.

- Digital World Acquisition stock ignites as President Trump returns to Truth Social.

- DWAC shares gained 13% in the after-hours market on Thursday.

Guess who's back-back tell a friend, Shady's back-back! Well, not quite, but he who must-not-be-named for Democrats is back online. Ok, that's enough vague and obscure song and movie references which probably are way too old for most of you anyway.

Twitter (TWTR) and Tesla (TSLA) have been stealing all the social media limelight these past few weeks but as promised President Trump has returned to Truth Social and sent its proposed SPAC partner DWAC stock soaring. Truth Social was launched by Trump Media and Technology Group (TMTG) and DWAC is the SPAC vehicle that is proposing to take TMTG public.

DWAC stock news: Trump is back online

The Donald's return to social media is the perfect antidote to DWAC stock struggles and a knock to Twitter and Elon Musk. While nothing had ever been confirmed it was assumed that Elon Musk's advocacy for free speech would see Donald Trump's Twitter account restored. Elon Musk had after all said he favors suspension rather than outright bans from Twitter, but last week former US President Trump said he would not be returning to Twitter and instead promised to return to Truth Social. So promise kept as he posted on Thursday evening: "I'm Back! COVFEFE".

Ok, let's dig this one up again because there might be some of you who have no idea what COVFEFE means. The origin apparently dates back to a tweet President Trump sent in May 2017, "Despite the constant negative press covfefe". It was widely assumed to be a misspelling for coverage but quickly went viral. President Trump though did not admit it was a misspelling and instead posted later "Who can figure out the true meaning of 'covfefe' ??? Enjoy!"

According to Wikipedia "U.S. Representative Mike Quigley (D-IL 5) introduced H.R.2884, "The Communications Over Various Feeds Electronically for Engagement Act (COVFEFE Act)" on June 12, 2017. It would require the National Archives to preserve and store social media posts by the President of the United States. The bill was referred to the House Committee on Oversight and Government Reform on the same day but saw no further congressional action."

Excellent I'm glad we cleared that up and we are all up to speed on what COVFEFE means then! So, one tweet (oops see what I did there), sorry one truth, has generated a significant market cap gain of about $200 million for DWAC stock. Now imagine if President Trump tweeted (oops), truthed all the time. Truthed, is that even a verb? Maybe it will catch on, after all how weird did tweet first sound.

However, before getting too excited please be aware that DWAC has been struggling to get the SPAC deal with Truth Social over the finish line. The deal has been beset with delays and executive resignations which raises some concerns. Indeed Kerrisdale Capital recently opined that “with each passing day, the truth becomes harder to deny; a merger between two sketchy companies that is already taking too long is likely headed for collapse. We value DWAC at the cash held in trust: $10 (-80%).”

Kerrisdale did say they are short DWAC. We have no visibility on Kerrisdale and are merely reporting the story, we do not vouch for its accuracy or otherwise.

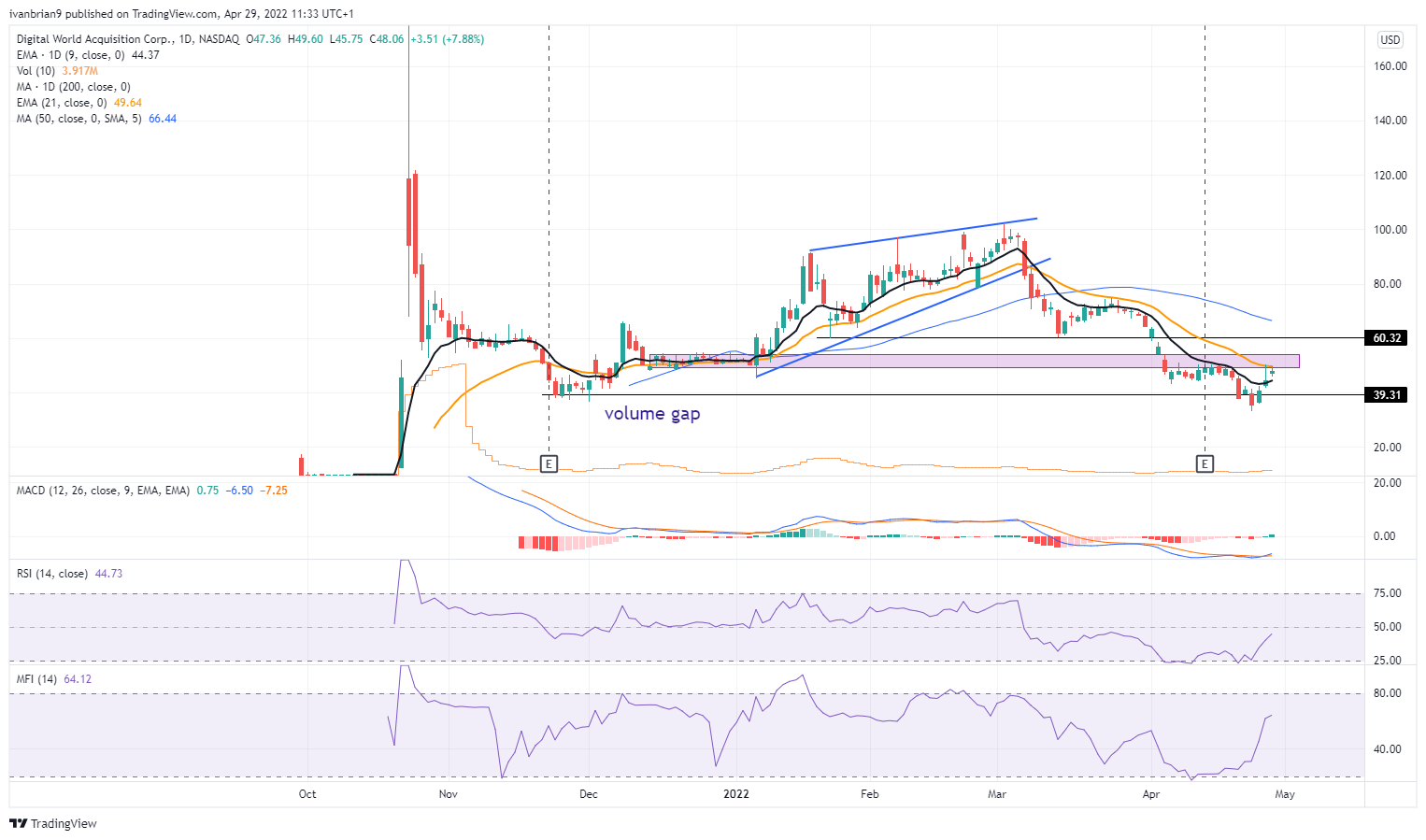

DWAC stock forecast: Long-term downtrend remains

DWAC stock is still in a clear and long-term downtrend. It is much too speculative at these levels for us, but if you do want to play it it does exhibit huge volatility and momentum. None better than former President Trump to stir up momentum in something, but please use careful risk management, we think this is way too high for the medium-to-long term.

DWAC stock chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD touches two-week high near 0.6350 after RBA meeting minutes

AUD/USD attracts buyers for the fifth straight day on Tuesday and climbs to a nearly two-week low near 0.6350 following the release of RBA minutes, which indicated that the May meeting would be an opportune time to reconsider reacting to potential risks. This, along with a positive risk tone, acts as a tailwind for the Aussie.

USD/JPY trades with positive bias above 143.00; upside potential seems limited

USD/JPY gains some positive traction on Tuesday and now seems to have snapped a three day losing streak to a multi-month low touched last week. The upbeat market mood undermines the safe-haven JPY and lends support amid a modest USD uptick.

Gold looks north amid US tariffs uncertainty

Gold price is bouncing back toward the record highs of $3,246 set on Monday as buyers fight back control despite a sense of calm across the financial markets early Tuesday.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested the $85,000.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.