DIDI Share Price: DiDi Global Inc extends slide on China stock pullback

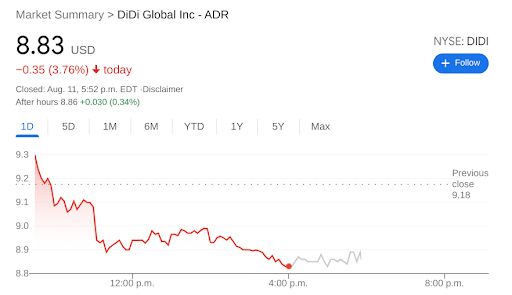

- NYSE:DIDI fell by 3.71% on Wednesday as China weakness continued.

- The ongoing investigation into Didi could result in an executive shuffle.

- Softbank announces it will pull out of investing in China stocks.

NYSE:DIDI fell once again on Wednesday, a sigh that shareholders are getting all too used to unfortunately. The Chinese ride-hailing stock fell below the $9.00 price threshold for the first time since late-July, as the ongoing investigation by the Chinese government has erased any gains that were made since. Shares of Didi fell by a further 3.71% on Wednesday, and closed the trading session at $8.83. It was another session of tech weakness as the Dow Jones and S&P 500 were once again carried to new all-time highs on the strength of cyclical stocks. Blue-chip and value sectors have been showing strength lately on the back of the impending approval of the new infrastructure bill from President Biden.

Stay up to speed with hot stocks' news!

One potential outcome from the investigation into Didi is that high ranking officials within the company may be ousted. The executive shuffle would come as the Chinese government looks into the chain of command and who ultimately gave the green light for the company to IPO on the U.S. markets. Chinese officials have labeled the IPO a ‘deliberate act of deceit’ and Didi awaits the final verdict which could bring historic financial penalties.

NYSE:DIDI news

Softbank, a major stakeholder in Didi, reported its earnings yesterday and net profit fell nearly 40% sequentially from the first quarter. The company’s investments in Chinese companies like Didi and AliBaba (NYSE:BABA) have plummeted during the recent sell-off, and CEO Masayoshi Son reported that the company would scale back investments in China until ‘the situation is clearer’. For Softbank this could mean holding off for another year or two, until the political mess sorts itself out.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet