- DIDI back in the headlines for the wrong reasons on Thursday.

- The data company has been the subject of increased scrutiny from Chinese authorities.

- Bloomberg reporting that China is considering an "unprecedented penalty".

DIDI is back in the headlines on Thursday and again it does not look too promising. The company has been facing heightened scrutiny after China aired concerns over data handling.

Didi Global Inc is a Chinese company, considered the Uber of China. It is engaged in the business of ride-hailing and taxi services. According to its own website, "DiDi Global Inc. (NYSE: DIDI) is the world’s leading mobility technology platform. It offers a wide range of app-based services across Asia-Pacific, Latin America and Africa, as well as in Central Asia and Russia, including ride-hailing, taxi-hailing, chauffeur, hitch and other forms of shared mobility as well as auto solutions, food delivery, intra-city freight and financial services."

As part of its operations, DIDI collects large amounts of data on mobility and traffic analysis, but the company has stated that it follows strict procedures in relation to this data. China has reportedly become concerned by the vast amounts of information that online firms can collect and has begun a crackdown on DIDI and widened the investigation to include other tech firms.

The Cyberspace Administration of China (CAC) has ordered app stores to stop offering Didi's app. In response, DIDI released a statement saying the app takedown may have an adverse impact on Chinese revenue:

Once the "DiDi Chuxing" app is taken down from app stores in China, the app can no longer be downloaded in China, although existing users who had previously downloaded and installed the app on their phones prior to the takedown may continue using it. The company will strive to rectify any problems, improve its risk prevention awareness and technological capabilities, protect users' privacy and data security, and continue to provide secure and convenient services to its users. The company expects that the app takedown may have an adverse impact on its revenue in China

DIDI had only recently launched a successful IPO in the US and the shares took a significant hammering once this news broke. Further woes hit the stock last week as the Cyberspace Administration of China (CAC) said it had sent people from up to seven departments to DIDI's offices to carry out a cybersecurity review of DIDI.

China has become increasingly concerned over the large amounts of data that tech firms handle and in September of this year is to launch a data security law that will require companies to conduct risk assessments and submit reports, according to Reuters. Companies handling data that affect China's national security will have to submit to annual reviews.

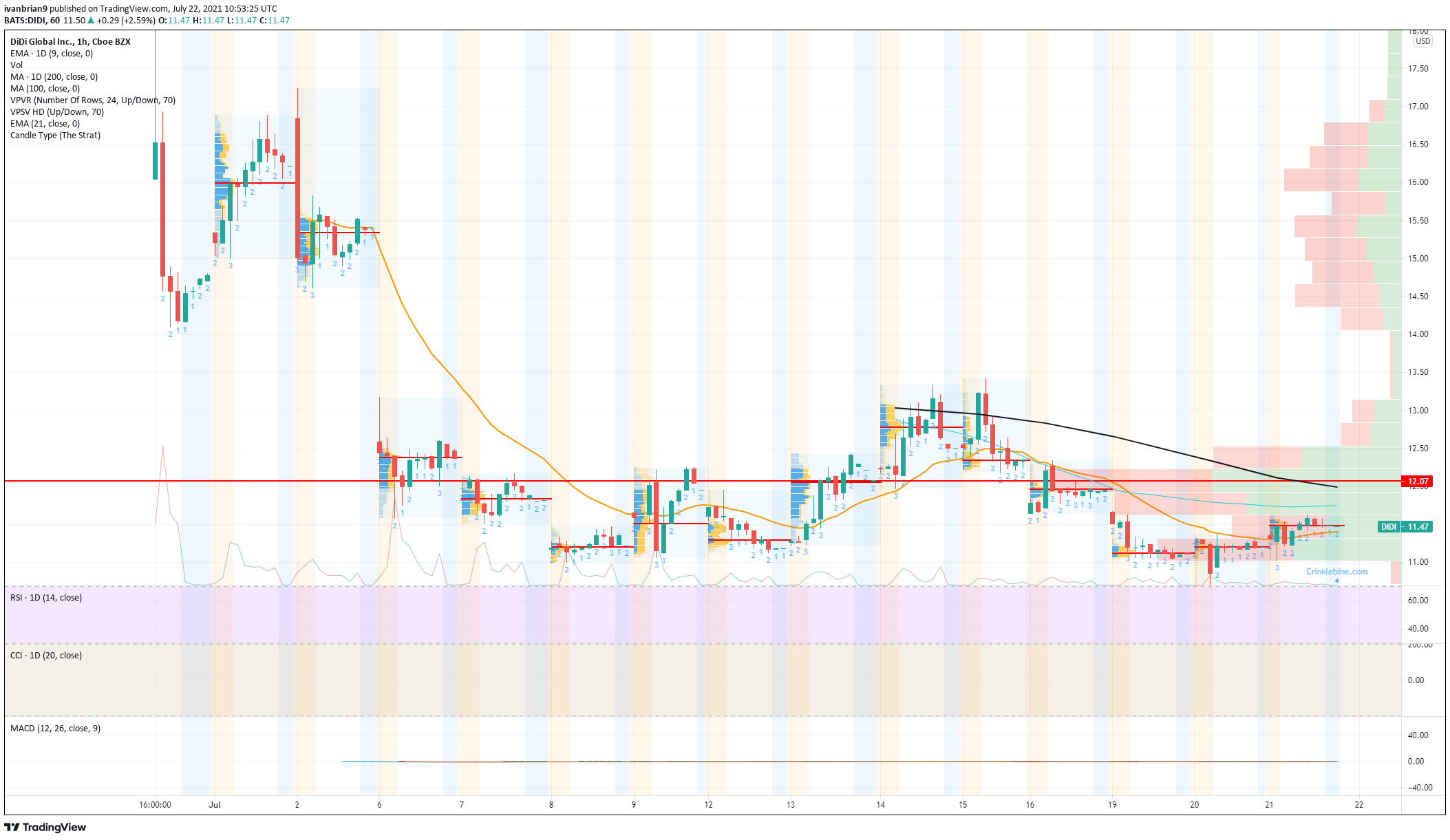

The news this morning reported by Bloomberg contains the rather alarming headline that China is to consider an unprecedented penalty. This is obviously unknown but is sure to scare investors further. The stock is currently falling in the premarket. At the time of writing, it is down 3% at $11.14.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.