DiDi Global Inc (DIDI) Stock News: Drops nearly 20% premarket as China crackdown hits

- DIDI under regulatory spotlight, the company only launched in New York IPO last week.

- China's Cyberspace Administration begins investigation into DIDI and others.

- Investors and backers of DIDI include Softbank (SFTBF), UBER and Tencent (TCEHY).

Update: Shares in DIDI are down nearly 20% in Tuesdays premarket session as investors react to the weekend news of Chinese regulatory investigations into the company. China has been increasingly observant of its burgeoning tech companies as many of htose have pursued Nasdaq listings. China appears to want to keep some elemnt of stability over its regulation of Chinese tech companies and this foloows on from concerns China had over Alibaba (BABA) and the proposed IPO of ANT Group. Either way investors are likely to take an increasingly cautious view of Chinese shares going forward until more clarity is available. Markets generally hate uncertainty more than bad news. At the time of writing shares in DIDI are down over 18% at $12.68. The shares had dropped as much as 25% earlier in the premarket.

DIDI launched to much fanfare on the New York stock exchange last week, raising nearly $5 billion in the process, and has a $75 billion market cap. However, the company has now been the subject of an investigation by China's Cyberspace Administration.

Didi Global Inc is a Chinese company engaged in the business of ride-hailing and taxi services. According to its own website, "DiDi Global Inc. (NYSE: DIDI) is the world’s leading mobility technology platform. It offers a wide range of app-based services across Asia Pacific, Latin America and Africa, as well as in Central Asia and Russia, including ride-hailing, taxi-hailing, chauffeur, hitch and other forms of shared mobility as well as auto solutions, food delivery, intra-city freight and financial services."

As part of its operations, DIDI collects large amounts of data on mobility and traffic analysis, but the company has stated that it follows strict procedures in relation to this data. China has reportedly become concerned by the vast amounts of information that online firms can collect and has begun a crackdown on DIDI and widened the investigation to include other tech firms.

The Cyberspace Administration of China (CAC) has ordered app stores to stop offering Didi's app. In response, DIDI released a statement saying the app takedown may have an adverse impact on Chinese revenue:

Once the "DiDi Chuxing" app is taken down from app stores in China, the app can no longer be downloaded in China, although existing users who had previously downloaded and installed the app on their phones prior to the takedown may continue using it. The company will strive to rectify any problems, improve its risk prevention awareness and technological capabilities, protect users' privacy and data security, and continue to provide secure and convenient services to its users. The company expects that the app takedown may have an adverse impact on its revenue in China

Reuters reports that the Chinese cyber investigation is now including Kanzhun Ltd (BZ.O) owner of online recruiting company Zhipin.com, truck haling apps Huochebang and Yunmanman, part of Full Truck Alliance (YMM). The Chinese Cyberspace Administration has said that the business should halt new user registrations.

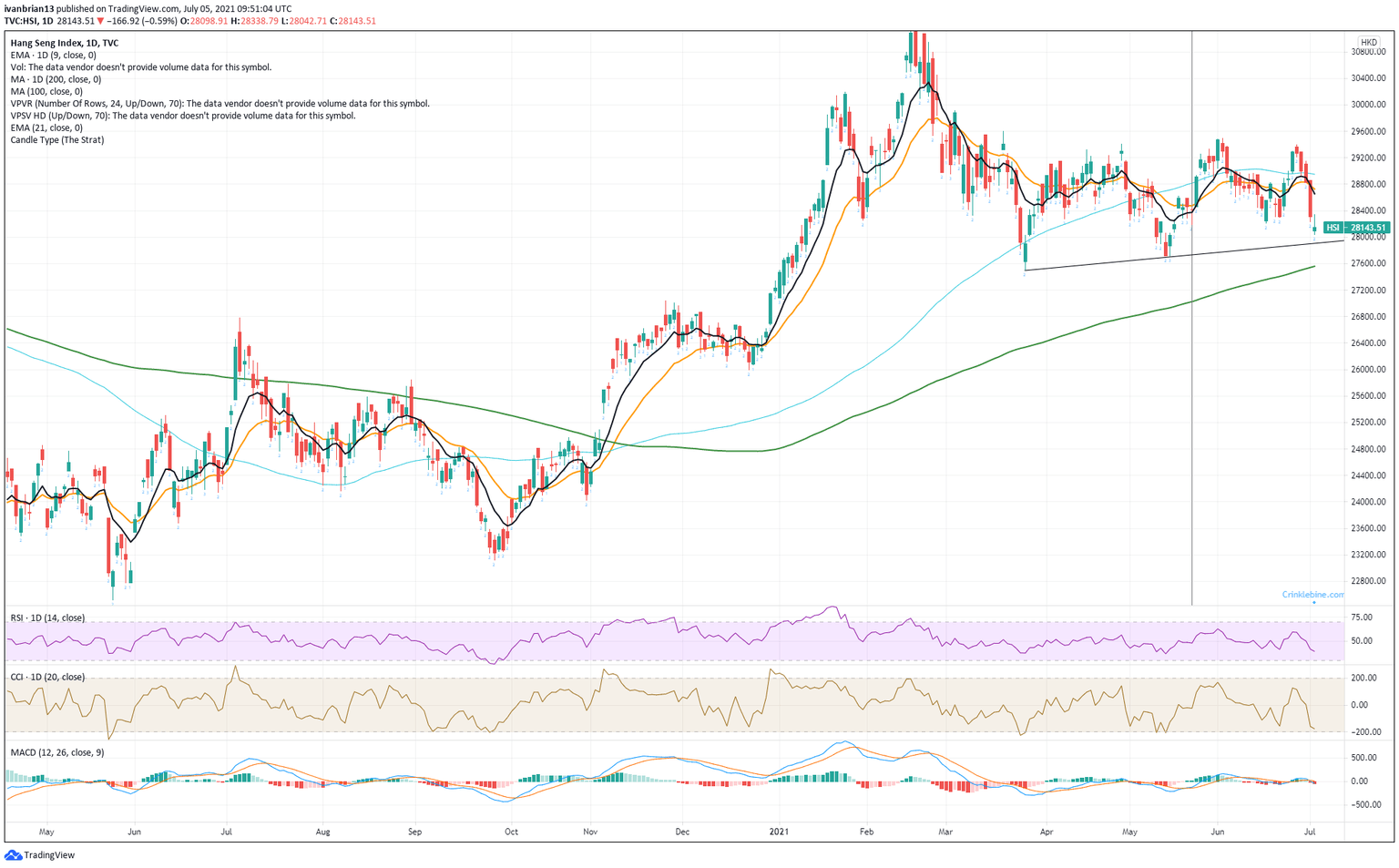

This is a new turn in the regulatory crackdown that engulfed Jack Ma and Alibaba (BABA) group at the end of 2020. Jack Ma had been seen as too critical of the Chinese hierarchy and stepped completely back from the limelight. This brings renewed emphasis back on the long-term stability of investments in Chinese tech companies and shares of most are down sharply in Asian trading (US markets closed for July 4 holiday). Tencent (TCEHY) is down 4%, BABA is down 3% and others are also dragging down the Hang Seng Index.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.