Dead cat bounce or new high? [Video]

![Dead cat bounce or new high? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/music-board_XtraLarge.jpg)

Watch the free-preview video extracted from the WLGC session before the market open on 23 Apr 2024 below to find out the following:

-

The 2 telltale signs to anticipate and confirm the current correction

-

How to confirm the technical rebound and the target for the S&P 500

-

Why this market correction is different from Aug-Oct 2023?

-

The 2 key levels in the S&P 500 you must be aware of.

-

And a lot more…

The relief rally was anticipated 1 day before the live session as posted in the 20s market update post on 22 Apr 2024 (check out the post below if you haven’t)

Market environment

The bullish vs. bearish setup is 143 to 125 from the screenshot of my stock screener below.

Together with the slight improvement in the market breadth, buying the outperformers while riding the relief rally is a better option than late short-selling.

Market comment

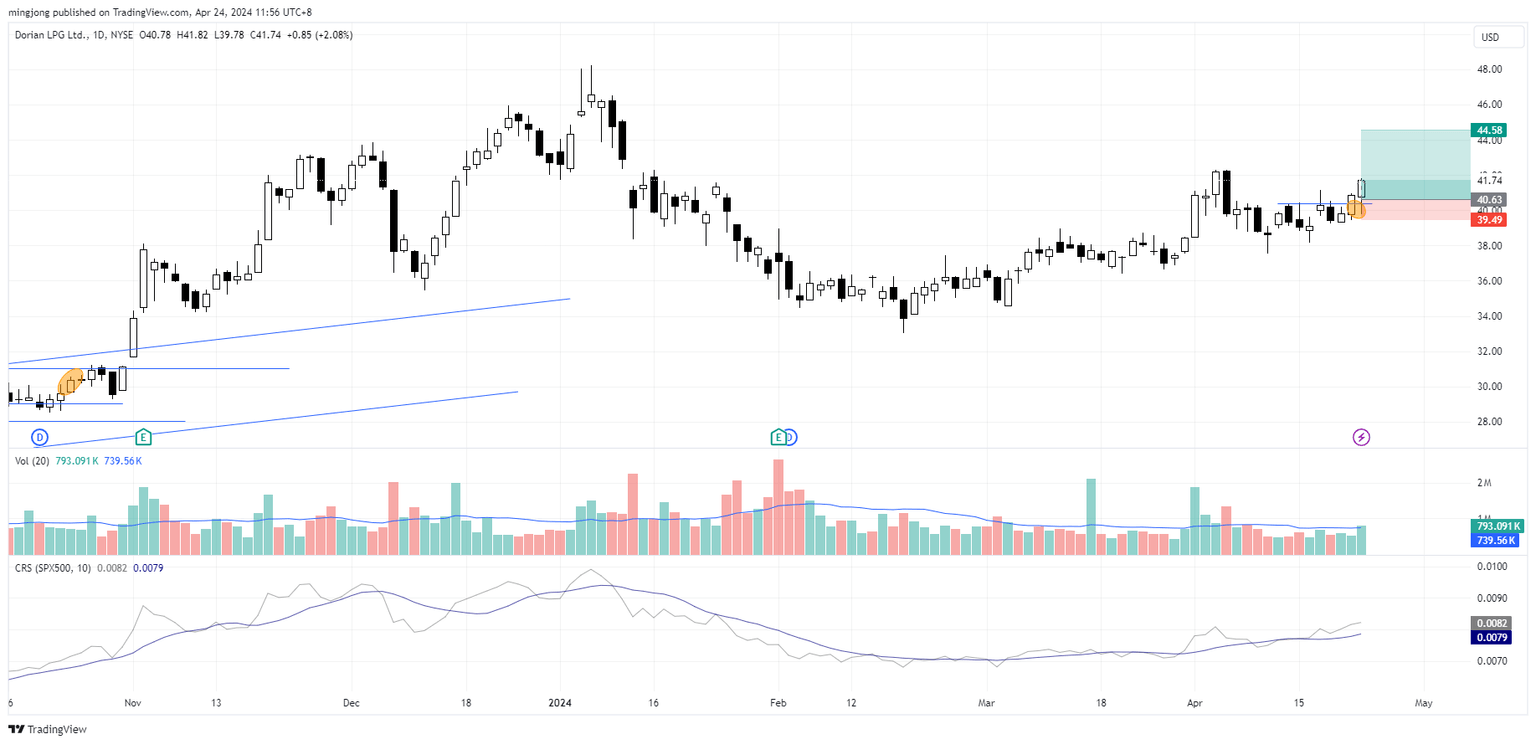

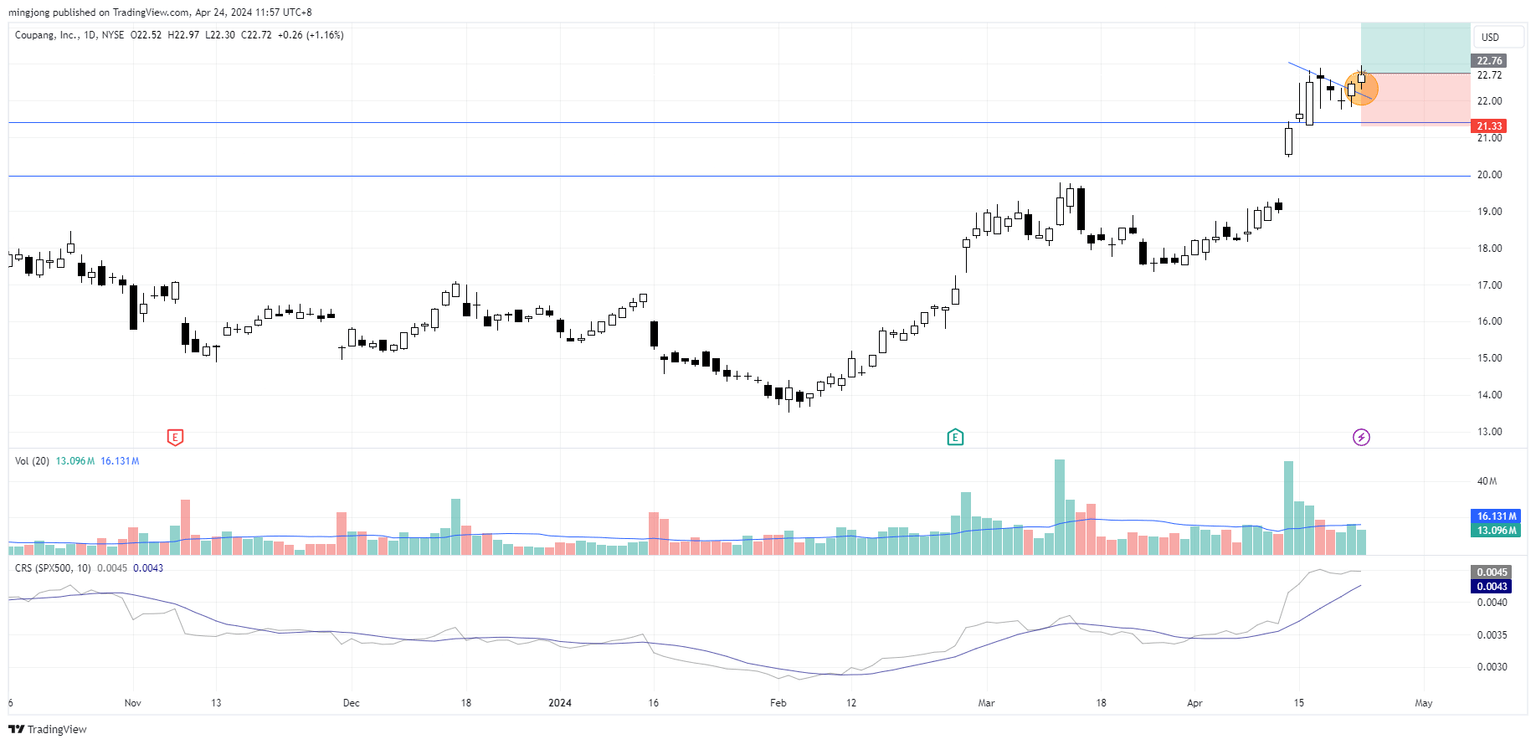

4 “low-hanging fruits” KLG, LPG trade entries setup + 7 actionable setups CPNG and 5 “wait and hold” candidates were discussed during the live session before the market open (BMO).

KLG

LPG

CPNG

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.