The Transportation sector dived during Covid Pandemic. Since the low on 03.2020, the recovery has been very anemic compared to the rest of the Indices and Stocks around the World. Delta has been one of the more substantial companies within the airline industry and will soon provide another chance to buy the trend. The Grand Super Cycle shows a lovely impulse, as shown in the following chart

Delta monthly Elliott Wave chart

The Idea is a five-wave impulse and a three-wave pullback in the form of a FLAT, which ended in 2020. Since then, the stock has rallied. We believe the advance was in five waves and now should be correcting the cycle from 03.2020 lows.

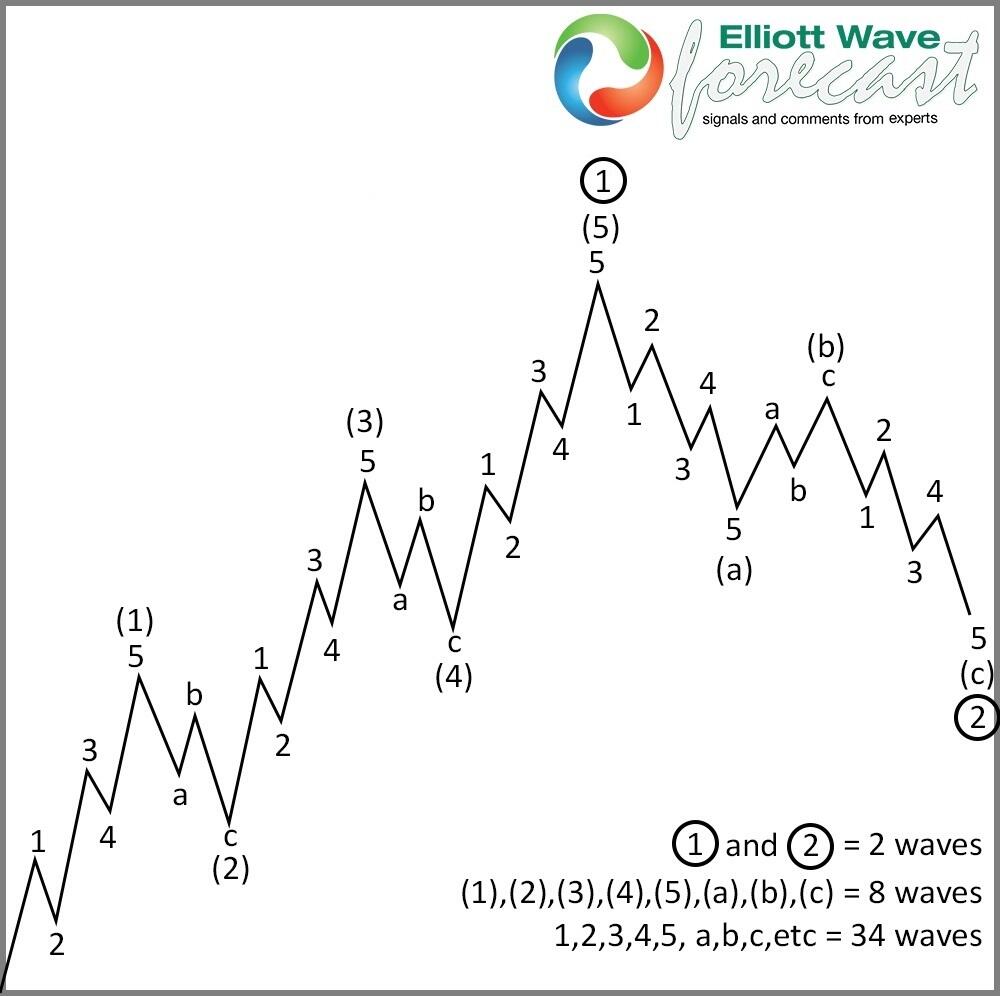

The Elliott Wave Theory, as explained in the following article https://elliottwave-forecast.com/elliott- wave-theory/, states that after five waves advance, there is always a three waves pullback before the continuation of the previous cycle. The Five waves advance looks like the following chart:

5 waves impulse followed with 3 waves pullback

At this moment, Delta should be at the beginning of a new process and as far as it stays above 03.2020. Otherwise, a break lower should see the 100% extension since the peak at 07.01.2019 but will be a buying opportunity within the alternate view.

The Elliott Wave Theory is a repetition of patterns, which comes from the microsecond cycles to the Grand Supercycle. The Theory helps many trades to stay on the right side. At EWF, we have added new tools to improve the Theory. The five waves advance and three waves pullback remain the main pattern of the Theory. As of right now, we will concentrate on the cycle since the low at 03.2020 which unfolded as an impulse. The stock is doing ABC correction since the peak at 03.01.2021. The following chart is the Daily view

Delta Airlines (DAL) daily Elliott Wave chart

The daily chart above shows the five waves’ advance and the corrective pullback. The chart also shows target to enter the market at $18.5 – $23.78.

In conclusion, Delta still can drop more, but nobody can deny the two impulses from all-time low and 03.2020. The area of $23.92-$18.55 might offer a good next opportunity to buy the symbol.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.