Dagang NeXchange Bhd (DNeX) opened at 0.91, up 6.55% following the news that Foxconn (or Hon Hai), the main assembler of Apple's iPhones, has acquired 120 million shares (or a 5.03%) in DNeX.

Tell-tale signs for bullish characteristics have been spotted while DNeX was trading below the resistance level at 0.835, as shown in the video below:

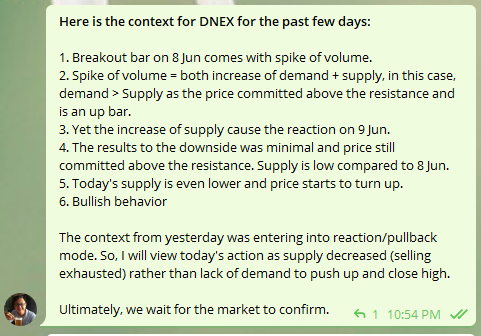

Inside the Telegram Group, Ming Jong Tey has discussed the context for DNEX after the breakout happened on 8 Jun and how to derive the directional bias based on the interpretation of the supply and demand using the volume spread analysis together with the price action. Refer to the screenshort below:

DNeX Price Action Update

As shown in the daily chart above, DNeX had jumped at the market open followed by an attempt to push up to test the resistance zone at 0.95-1. Profit-taking activity was observed with spike of volume. It is crucial to monitor the today's close to judge the price movement characters for DNeX next week.

As supply has emerged, it is expected to see a reaction or at least a consolidation for DNeX to absorb the supply before the next rally under a bullish scenario. A drop below the resistance-turned-support at 0.835 might negate the bullish case.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0550 despite soft German inflation data

EUR/USD fluctuates in a narrow range near 1.0550 in the American session on Thursday. Soft inflation data from Germany makes it difficult for the Euro to gather strength, limiting the pair's upside, while US markets remain closed in observance of the Thanksgiving Day holiday.

GBP/USD trades below 1.2700 on modest USD recovery

GBP/USD struggles to gain traction and moves sideways below 1.2700 on Thursday. The US Dollar corrects higher following Wednesday's sharp decline, not allowing the pair to gain traction. The market action is likely to remain subdued in the American session.

Gold at risk of falling

Gold extends its shallow recovery from Tuesday’s lows as it trades in the $2,640s on Thursday. The yellow metal is seeing gains on the back of cementing market bets that the Fed will go ahead and cut US interest rates at its December meeting.

Fantom bulls eye yearly high as BTC rebounds

Fantom (FTM) continued its rally and rallied 8% until Thursday, trading above $1.09 after 43% gains in the previous week. Like FTM, most altcoins have continued the rally as Bitcoin (BTC) recovers from its recent pullback this week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.